5 Factors To Consider For Your Buy-to-let Property Investment

Table of Contents

With the various property cooling measures in place, the market has inevitably stabilised. Property speculation has been slowed down tremendously.

According to the managing director of PA International Property Consultants (KL) Sdn Bhd on The Star, Jerome Hong, “A lot of the speculators have been removed with the various cooling measures and stringent banking requirements. Prior to this, developers took care of their own marketing and do not need the services of marketing agents.”

However, property investment is not dead. Even though property prices do not seem to be going down anytime soon, investors are still at large. The difference between an investor and a speculator is, investors buy to let, while speculator buy to flip.

Unlike speculators who look solely for capital growth, buy-to-let investors look for both good rental yield and capital growth.

If you are considering investing in property or improving your returns on a buy-to-let you already own — it’s important to do things right.

1. Choosing the right property

Should you buy a landed property or a high rise apartment? Is a low-cost apartment better than a high-end condominium when it comes to rental yield? How about capital gain?

Different types of property can help you achieve different goals. So, first you have to decide which objective takes precedent — is it high rental yield or is it capital gain that you are looking for?

Rental yield per annum is the percentage return based on rental income from the

property after deducting the expenses incurred to maintain the property versus the total purchase price of the property. Capital gain on the other hand is the gain or loss incurred after selling the property.

To decide on the property to get for buy-to-let, you need to find out everything about the location, target market and the property type to determine the best return for your money.

Search online to find out the rental demand and the market rental rate for that area and also the types of property that are in the rental market.

The general rule of thumb is that a high-rise usually will yield better rental, while a landed property has a higher rate of capital gain.

2. Do your math

Once you have done your research and have made a decision on what property to buy and where, then you need to ensure that you will get the rental yield that makes the investment worthwhile.

For example, if you are buying a 965-square-feet condominium unit in Cyberjaya, selling at RM455,000, the market rate for rental is RM1,800 for a partially furnished unit.

Some of the cost that may be incurred in a year are the maintenance fee (RM0.25 per square foot), assessment tax, quit rent and mortgage insurance. Let’s assume that the cost of maintaining a unit in Cyberjaya runs up to RM3,000 a year.

The net rental yield for this property is calculated as such:

Net rental yield

= ([(RM1,800 x 12) – RM3,000] ÷ RM455,000) x 100

= 4.08% per annum

However if you have to get the property with a home loan (like most people), it is important to include the annual interest incurred in the calculation as well. For example, you get a fixed rate loan for 35 years at 4.39% with a 90% margin of finance. Your interest for the first year is around RM19,356.

Net leveraged rental yield

= (RM21,600 – RM3,000 – RM19,356)/RM45,500 x 100

= 1.66% per annum

The above rental yield is not really promising. The monthly repayment for the home loan is already RM1,910. That’s RM110 more than the rental received. If you put your money into a fixed deposit account with an interest rate of 4.15%, you can probably get higher return than putting it into a property.

Calculate the rental yield before taking the plunge to ensure your money is working as hard as it should in the investment.

3. Manage your investments

Property investment is not something that you can just dump your money into and leave alone. There’s a lot of work involved, especially bearing in mind that it is a relatively illiquid investment.

If you decide to manage the property on your own you must be prepared to set aside time for it. From the beginning, you will have to bring your potential tenants to view the property, and then prepare the tenancy agreement, collect rental, pay maintenance fee and taxes, as well as any repairs that need to be done during the tenancy period.

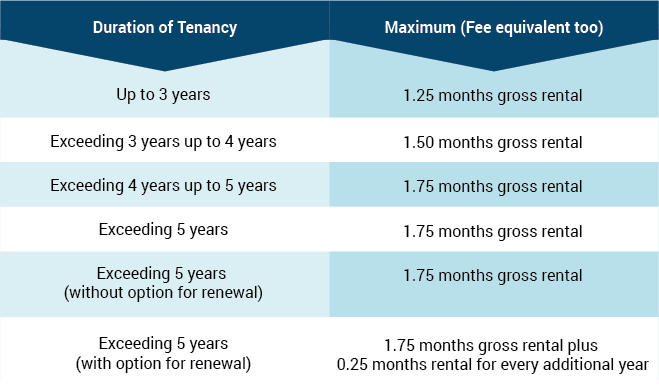

However, if you don’t have the time to manage this, it may seem more worthwhile to get a real estate agent to do it for you. The fees charged by an agent are as follows:

If you decide to go with an agent, this cost may affect your rental yield slightly.

4. Know your target market

Identifying your target market will help you decide the kind of property you should be buying and the locations you should consider. Should you target single expatriates, expatriates with family, students, young professionals or corporate tenants?

If you are planning to engage a real estate agent, ask for their opinion. They can probably advise you on the best location to go for based on your target market, as they understand the market and may already have a database of potential tenants who are looking for property to rent in the area.

Most first time property investors make the mistake of imagining whether they would like to live in the investment property, instead of putting themselves in the shoes of the target tenant.

If you are targeting student tenants, you should look at properties near campus, have convenient public transportation, and a low rental. However, if you are targeting family, you should get a bigger property with at least three bedrooms.

For local families, they would prefer properties that are empty, as they usually have their own furniture and would like to decorate it according to their preference. However, expatriate families may prefer a bigger property that is fully furnished and near international schools.

Deciding on your target market can help you narrow down your investment and fine tune your strategy.

5. Tax implications

Being a buy-to-let property owner will bring new tax implications and you should make sure you fully understand them by seeking the appropriate professional advice. Here are some personal taxes that you need to be aware of:

Property tax

Property owners have to pay for assessment tax on residential property based on the annual rental value of the property, as assessed by the local authorities. It is generally levied at a flat rate of 6% for residential properties and payable in two instalments.

On top of that, quit rent is also payable once a year if you own a landed property. It is charged annually at a rate of RM0.035 per square foot per annum. If you own a 2,500-square-foot terrace house, you will have to pay RM87.50 in quit rent every year.

Income tax

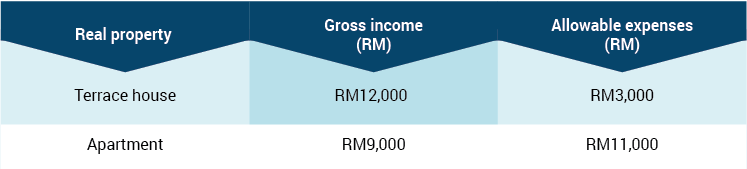

Rental income is taxable in Malaysia. If you find that your total income for the tax year exceeds RM5,000, you may have to pay tax. However, the costs associated with the buy-to-let property, such as mortgage interest payments, property management costs and the cost of repairs can be offset against your rental income in order to reduce your tax payment to the minimum.

According to Public Ruling No. 4/2011, the allowable expenses for residential property investments are as follows:

Capital gains tax

Also known as the Real Property Gains Tax (RPGT), the capital gains tax was last increased in 2014.

Should you decide to sell the property, you may be liable to pay capital gains tax on any profit you make. However, property investors who are buying to let may not be affected much as they would probably hold on to the properties for a few years.

This does make property investment more illiquid than before, as it is not as easy to dispose of a property at a profit with the new ruling.

Whichever property you decide to get for your buy-to-let investment, the decision should be made based on a long-term view. Make sure you have enough money put away to cope with any unforeseen repairs and maintenance costs that may arise.

If you decide to go for variable home loan, make sure your finances will be able to cope should the rate increase. Your finances should also take into consideration periods when your property is untenanted. Without the rental income, you will have to fork out the monthly repayment from your own pocket.

With the right choice of property, in the right location and managed right, a future in buy-to-let can be extremely rewarding.