5 Ways This New Budgeting App Will Help You Win Your Financial Game

Table of Contents

![]()

The current economic climate (read: lowest Ringgit value in 17 years) has been draining for everyone, both economically and mentally. If you are the proactive type, you had probably already drawn up a budget, and are now struggling to stick to it. We don’t blame you, it can be a difficult task.

The toughest part of budgeting is probably balancing spending and saving. Tracking expenses, controlling spending urges, and meeting saving goals can be overwhelming. Especially if you’re trying to do this all mentally. Even if you have a budget sheet at home, you may tend to forget certain transactions that happened by the time you get to your sheet!

One of the best inventions of this digital age are smartphones, and with them come a myriad of apps that can make our lives easier. The most useful app when it comes to money is probably a budgeting or money management app.

Understanding the importance of a money management app that is relatable to Malaysians, and also is Syariah-compliant, Bank Rakyat has gone ahead and come up with its own budgeting app called TouchStyle.

It’s especially useful since most budgeting apps come out of the US or another country and the categories don’t always match what we have here.

TouchStyle, available on both iOS and Android platforms, covers all aspects of money management in just one app.

Here are 5 ways how using just one app, you can reign in your finances to achieve your financial goals:

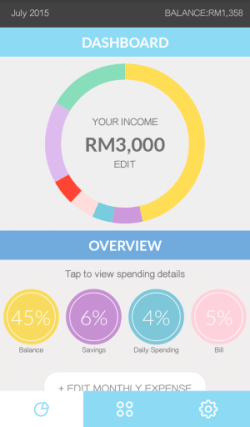

1. Assess your financial situation

Before you can come up with a realistic budget, you need to know and understand your financial situation. The first step of using TouchStyle is to key in your net income (minus EPF and income tax deductions), and then input your set monthly financial commitments such as existing financing, transports, rent, and insurance. This way you’ll get a quick and clear view of where you stand financially on a month to month basis. This first step is the most impactful, as you’ll find that you don’t actually have as much to spend as you may have previously thought.

When you first download the app, you will need to register for an account, where you will link your TouchStyle account to your email, and also protect your privacy by setting the password during registration. Upon registration, you will be prompted to set your net income, and your monthly savings amount.

To ensure your budget is realistic, the app automatically calculates how much of your income is left for your daily expenses after putting aside the savings amount and monthly expenses. This allows you to see the balance of your monthly income after deducting all your set monthly expenses.

Make sure your balance left to spend is sufficient to sustain your daily expenses.

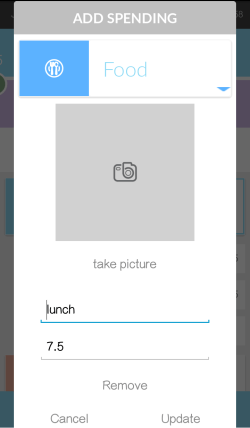

2. Tracking your spending

Traditionally, those who are serious about sticking to their budget will note down every single cent going in and out of their pocket (and bank accounts) all the time. Like most money management apps, TouchStyle allows you to track your daily expenses too. Being on your smartphone, this allows you to quickly key in your expenses right after they happen so you never miss out while budgeting.

This section of the app shows you the total of your monthly budget (what’s left of your income after deducting your financial commitments and monthly savings). In this example, you still have RM1,480 for the month to play around with. Divided by 31 days, you will have an average of RM47 a day to spend.

However, rigid budgets usually fail. This figure aims to give you an idea on how to stay within your budget. If you exceed the daily budget amount, you just have to ensure you cut back on other days.

3. Keeping your goals in mind

Having contingency savings stashed can be a life saver. It will come in handy when your car breaks down and needs a major overhaul, or for a renovation or repair works at home that are unavoidable.

However, what about short to medium-term savings for wedding or buying a home?

You can set your saving goals using the app, which will track your progress. Perhaps you are saving up for the down payment of your first home, and you will need RM30,000. You can set your goal either by the deadline, or by how much you are able to save every month.

In this example, the saving progress is set by the deadline on January 2018. Currently, the user has already saved RM2,000 for this purpose, and he or she will need to put aside RM1,034 every month to achieve this goal by the deadline.

How much you save for your goal can be adjusted by extending the deadline.

This feature is very useful if you’re eyeing even smaller goals like a phone or small appliance. It’ll help you stay on track and reach your goal earlier!

4. Monitoring your progress

The best way to keep yourself motivated is by looking at how far you’ve come, what you’ve achieved, and what good progress you’ve made.

This can be easily viewed whenever you need a little boost of motivation through the Insight function.

You will be able to monitor if your spending has gone up over the month, or even by year. A graphical overview will allow you to pinpoint when and where you’ve strayed from your budget and will help you reign in your spending immediately.

You know how sometimes you look at your balance and you go “Hey! Where’d all my money go” then you wrack your head trying to remember when you made a large enough transaction to cause it? This saves you that trouble. Plus on occasion it’s a culmination of smaller very frequent transactions that we often overlook. So having this tool on hand will really help you see where your money went.

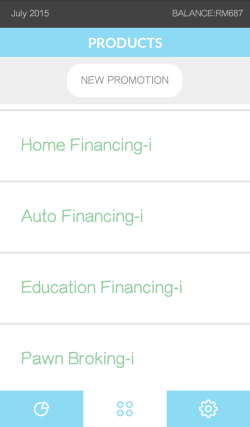

5. Leveraging on financial products

It’s undeniable, we need banking products like savings, current and fixed deposit accounts, as well as other financing products to help us manage our finances optimally. However, lack of financial literacy and an easy method to help us look at the big picture at all times makes it hard for us to leverage on these products to ace our finances.

TouchStyle allows you keep all this information at your fingertips. If you need financing, the app comes with a calculator with the latest interest rates to calculate the monthly repayment.

This will save you the trouble of going to the bank, listening to the rates and tabulating in your mind whether you can or cannot afford it, since you can easily check what products are available and how much it will cost you a month right from TouchStyle.

You are also able to check for latest promotions available from Bank Rakyat, and the nearest bank branch and ATM to you but the app is completely usable and this is really just a plus for existing Bank Rakyat customers.

There are plenty of budgeting apps available for smartphones, but it can be difficult to find the right app for you especially one that’s made with Malaysians in mind. With a relatively small file size (10.41MB for Android), TouchStyle offers you all the important features you need to stay ahead of your financial game.

We’ve tried it, tested it, and we are definitely keeping it on our smartphone.

This app is an example of how your smartphone does more than launch Clash of Clans! It’ll also help you keep your finances organised, and finding ways to save and control your finances are essential to keeping your life organised. In between games of Clash of Clans anyway.

First step to sound money management is to ensure you have the right tools. Find out if the credit cards in your wallet are right for you.