Here’s Your Free Ticket To A Kwik Getaway

Table of Contents

As it’s nearing the end of the year, everyone is starting to wind down and think about a year-end holiday to bring the year to a close. Unfortunately, with today’s cost of living, going for a holiday is a luxury that not many people can afford.

Therefore, a free flight to the well-deserved vacation is very much welcomed, especially if it’s easy to get, and you don’t have to get out of your way to earn it.

With the latest promotion by CIMB Bank for the Kwik Account, it is that easy! In collaboration with AirAsia BIG Loyalty Programme, you can accumulate BIG Points easily and quickly using your Kwik.

Here’s how you can ‘kwikly’ earn your free ticket to various destinations!

Step 1: How many points do you need to have?

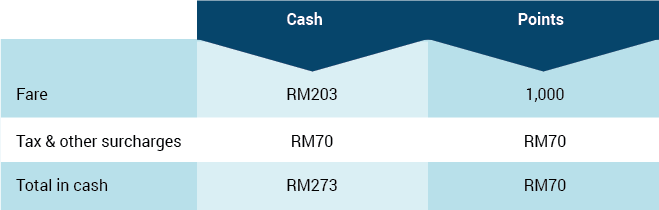

Firstly, check the best time to go on a vacation. If your timing is flexible, let the price help you decide on when to go on a holiday. A flight to Siam Reap (one-way) for one adult cost about RM207 to as high as RM273. Here’s how you can shave off even more from the flight ticket.

Completely get away from paying for the flight fare, by accumulating enough BIG Points to redeem a flight. However, the thing about redeeming miles points, it is only redeemable for the fare, but not the airport taxes and fees. Therefore, you will still need to pay for the minimal fees, even when you are redeeming the flight with points.

Using your BIG Points to redeem the fare, you will be saving RM203 for a one-way ticket to Siam Reap.

Step 2: What’s the easiest way to earn BIG Points?

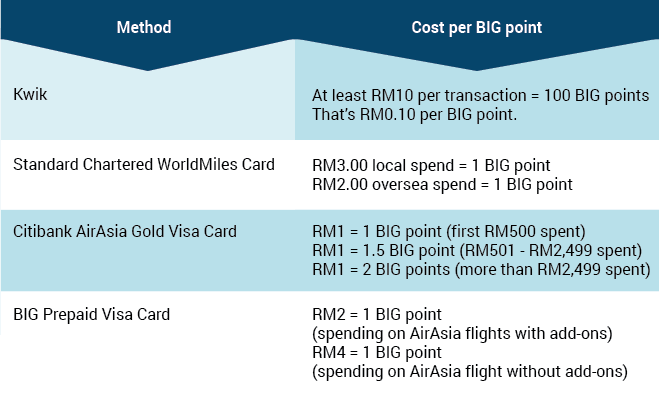

Unlike using credit cards to accumulate BIG Points, the CIMB’s Kwik account allows its users to earn BIG Points for every spending, easily.

Most cards allows its holder to accumulate points according to the amount spent, but Kwik allows its users to earn BIG Points based on minimal transactions.

With a cap of 500 BIG Points each month, here’s how you can easily earn points by just using your KWIK account.

By basing the accumulation based on the number of transactions, instead of the amount you spend per transaction, it becomes so much more affordable to accumulate the points.

To get Kwik users started, CIMB is giving away 1000 BIG Points for free. All the user need to do is to open a Kwik account between before 30 November, 2014 and maintain a Daily Average Balance of RM50.

Sign up for a Kwik account and you will be able to redeem for a free flight to Siam Reap immediately. You can also keep spending with your Kwik account and earn up to 1,500 AirAsia BIG Points which will be valid for three years, giving you plenty of time to plan before you decide on your dream destination for a vacation!

Step 3: How much you need to spend to accrue BIG Points?

Other than using a Kwik account to accumulate BIG Points, one can also earn points via credit card spending. However, the conversion rate from spending amount to points largely depend on the individual credit card.

Another way of earning BIG Point is through the BIG Prepaid Visa Card. With this card, you earn one BIG Point for every RM4 spent on AirAsia flights with no add-ons (premium seats, baggage, meal, AirAsia travel insurance, sports equipment and comfort kit), while you earn one BIG Point for every RM2 spent on AirAsia flights with add-ons.

Kwik by far, provides the easiest and cheapest way to accumulate BIG points, compared to other methods:

Kwik account offers you the cheapest way to earn BIG points. To earn the maximum of 500 BIG Points a month, you just need to spend at least RM30 in three transactions. That’s the cheapest way to earn 500 BIG Points. Even with the BIG Prepaid Visa Card, you need to spend at least RM125 to earn 500 BIG Points.

CIMB Bank Kwik Account offers real convenience where you can simply open an account online, at the comfort of your home, without going to a bank branch. It gives you access to the account immediately to perform transfers out and receive funds as well as making transactions.

The account works the same as the usual bank account, where a Kwik Card is issued to you. The card enables you the same features as a credit/debit card, with the same promotions, privileges and benefits. But the only difference is that you don’t actually need the card to do online transactions as you can get all your card details from CIMB Clicks which lets you transact instantly.

It is the perfect banking tool for added security as it is not linked to your savings account, as it is an dedicated account for all your online transactions.