Is It Too Easy To Buy A Car In Malaysia?

Table of Contents

All you need is some basic documentation, a low down payment, an approved hire purchase loan – and voila, you are a proud owner of a car. It is that simple to own a car in Malaysia.

Although car prices are considered expensive in Malaysia due to the high taxes and excise duties charged on foreign made cars, this has not deterred Malaysians from continuing to buy cars at all. Especially with significantly cheaper alternatives offered by Perodua and Proton, most people start driving at the tender age of 18.

Singapore across the Straits of Tebrau, has one of the highest entry requirements to owning a vehicle. You are required to pay a minimum down payment of 50% of the car’s total value. In terms of documentation, you are required to have obtain Certificate of Entitlement (COE), Vehicle Quota System (VQS), and Electronic Road Pricing (ERP) which all cost a lot of money before you actually earn the eligibility to own a car.

So, which is actually better for us in terms of the ease of owning a car?

Pros of low entry requirement

1. Increases car ownership

With lack of reliable public transportation in most parts of Malaysia, having a car has become a necessity more than a luxury. With lower requirements to own a car, it makes it very easy to own a car, although it may still incur a large cost on you at the end of the day. This can clearly be seen as most households today have at least one car.

Owning a car is easy, sometimes you don’t even have to save up for down payment with those zero down payment promotions, but is owning a car really affordable? You may be paying a few hundred bucks here and there every month, and you get the convenience of zipping in and out of town. But if you really sit down and tabulate all the money you pour into your car, you will be shell-shocked!

Being eligible for a car loan doesn’t mean you can afford one. Monthly instalments are just the tip of the iceberg of car ownership. If you’re paying more than 15% of your monthly salary on your car then you’re already doing it wrong!

2. Higher government revenue

If requirement to owning a vehicle was stricter like in Singapore, the majority will be discouraged from owning a car. If many opt out from purchasing cars, this can affect the Government’s tax revenue. For example, foreign cars are charged up to 105% of the car’s value in excise duties. The Government could lose up to RM8 billion in yearly revenue if this happens.

Cons of low entry requirement

1. Increases congestion and carbon pollution

With lower entry requirements, more Malaysians have access to owning a car. This definitely increases the number of cars on the road, which leads to increased traffic and pollution due to the carbon smoke emitted from the exhaust. This is one of primary reasons why Singapore imposes stricter regulation for car ownership and encourage Singaporeans to instead use public transportation.

2. Decreases household disposable income

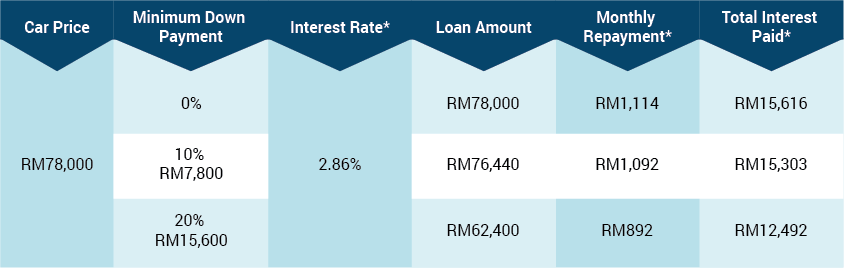

As banks offer low or zero down payment for car purchases, this practice can discourage Malaysians from the habit of saving. Especially since cars are already quite expensive. By paying a lower down payment, households will need to acquire a larger loan amount and longer loan tenure, which results in higher interest payments. This can burden car owners with higher monthly repayments, among the other costs they already need to bear.

*Loan tenure: 7 years

Based on the example above, we can see that by paying a higher down payment at 20%, we save RM3,124 in interest compared to the zero down payment plan.

Most incidents of bankruptcy in Malaysia are due to hire purchase loans, making up 26.54% of the total cases from 2007 to 2014. This happens primarily because it is so easy to own a car, most of them fail to evaluate getting one based on their affordability instead. So, how do you know if a car is affordable for you? The math is simple.

Financial experts recommend that your total debt obligations should not exceed 36% of your gross income. Here’s an example of how to calculate your true affordability to buy a car:

Gross monthly income: RM4,000

36% of your gross monthly income: RM1,440

Total debt commitments: RM1,000

How much can you afford to pay for your car repayment?

RM1,440 – RM1,000 = RM440

3. Increased depreciation

When making your down payment, do consider the depreciation of the car’s value. Having a low or zero down payment immediately decreases your car’s value once interest is factored in. If your car is stolen or involved in an accident during the early part of your loan tenure, your insurance company will typically pay what the car is worth, leaving you with little to nothing after your car loan is settled. This will pose a challenge when you want to get another car, as you will need to repeat the same purchase process and pay another down payment.

Let’s say you take up a five-year loan last year to buy a new car. Naturally, you insured your car at around the same time. If your car is stolen tomorrow and not recovered, or is damaged beyond repair, the amount your insurance company pays could be insufficient to pay off your auto loan, as the sum insured is based on the market price, and not the amount you owe the bank. And the rest must be forked out from your own pocket.

If your car is involved in an accident, your insurance company has the option of either declaring it a total loss or repairing it. Your insurer will declare total loss if the cost of repair is higher than the car’s value. If your insurer totals your car, it’ll pay the bank the actual cash value of the car, minus any deductible on your coverage.

Basically, the insurance company uses the depreciated market value of the car just before it was totalled. This figure may be substantially less than what you still owe on your loan. During the first two or three years you own your car, your vehicle typically depreciates in value much faster than your loan balance declines, especially if you made a very small down payment on your car.

While having a low entry requirement can be good in some ways, but the cons as seen above, outweigh the good in the long run. Perhaps when the public transportation in Malaysia has improved significantly, more Malaysians can opt not to be dragged down by a hire purchase loan they can’t afford. If this does happen, then Malaysians may reduce their dependency on their cars and greatly increase their disposable income and savings. All their expenses spent on the car may be channeled for appreciative items such as property and investment.