Investment Guide: Understanding The Prospectus

Table of Contents

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

The Securities Commission Malaysia (SC) has always advocated that investors should conduct their own due diligence by researching, evaluating risks and returns and understanding the potential investment before making a decision.

To do this, one of the most powerful documents you should get your hands on is the prospectus. By reading the prospectus, you will know exactly what the investment intends to do with your money.

What You Should Pay Attention To

A prospectus contains forward looking statements, consisting of predictions about future business conditions. While no one can predict the future, management is often in the best position to see new trends that may be occurring and to speak about what the company has planned. Fortunately, you don’t need to be able to predict the future when reviewing the prospectus. Instead, just focus your attention on these key sections:

1. Investment objective

This section covers the primary goal(s). For example, some funds will aim to achieve short-term growth while others may focus on long-term stability.

Investment objectives will vary from one investment to another. Certain investments may attempt to generate income for their investors, while others focus on reaping tax benefits or are geared towards capital appreciation or preservation.

Ensure that the investment’s objectives match your personal investment objectives. For example, a fund with an objective of capital growth would not be a good fit for a 60-year-old retiree who needs regular income from investments to cover his day-to-day expenses. On the opposite end, a young investor with time on his side would not feel too worried when faced with higher risks or inconsistent returns in trying to achieve his investment objectives.

2. Investment strategy

How does the fund plan to accomplish its objective? When designing its strategy, the fund will strongly take into consideration its asset allocation and investment restrictions (i.e. investing only in a specific industry). For example, if its objective is to generate income, it would most probably adopt a strategy of investing in fixed income securities such as bonds.

The prospectus usually doesn’t specifically indicate what stocks or bonds it will invest in, but simply describes the types of assets to be purchased, such as corporate bonds or small cap stocks. This will give you an idea of the types of assets that they will be buying into.

A fund’s investment strategy should be in sync with your personal investment style. Although a small cap fund and a large cap fund both aim for long-term capital appreciation, they each use very different strategies to attain this goal. Before choosing one type of investment over another, make sure that you are comfortable with the investing style and are confident with the perceived performance.

3. Fees and expenses

Funds charge their investors a variety of fees and expenses, all of which are documented in a detailed breakdown in the prospectus. This should make it easy for you to compare fees and expenses across other investment schemes. Remember, fees and expenses can eat into your total investment return from the fund, so remember to compare the fees and expenses for all the investment funds that you are interested in (Before you invest, take the time to understand all the costs and charges associated with your investment and how it can impact the value of your investment portfolio.).

4. Risks

This is one of the most important sections in the prospectus as it describes the level of risk that the investment is exposed to. It details the specific risks associated with a particular investment, such as credit risk, interest rate risk and/or market risk. if a fund invests a large portion of its assets into foreign securities, take note that this may pose a significant foreign exchange risk, country risk as well as political, economic or social instability risk.

As investors have varying degrees of risk tolerance, this information can help you decide the level of risk you that you can cope with in your investment portfolio.

To get the most out of this section, you should familiarise yourself with different kinds of risk, why they are associated with a particular investment, and how they would fit into your overall portfolio (How much are you willing to lose? You should always consider the different types of investment risks to determine which will work best for you.).

5. Performance

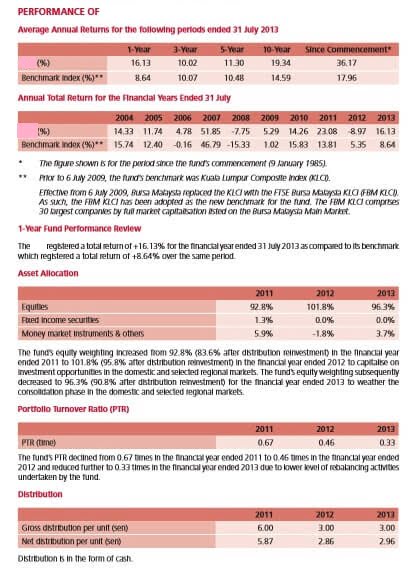

This section indicates the fund’s performance over the last one year, five years or ten years (depending on how long the investment has been around).

While historical performance is not necessarily an indicator of future results, you need to know how the fund performed in the past before you can make a calculated and informed investment decision. Depending on the age of the fund, its average annual returns will be provided, including a comparison with its benchmark index over the same period.

You can judge how well the investment has performed compared to its index. Other useful information such as the investment’s volatility, dividend payments, and turnover is also indicated here.

In addition, keep in mind that many of the returns presented in historical data do not account for tax, while some funds present data based on an after-tax return. As an investor, read the fine print to see whether the taxes have been taken into account.

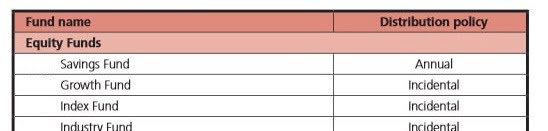

6. Distribution policy

Should a fund prove successful or profitable, it may choose to reward investors in the form of realised gains, dividends, or interest (subject to what is indicated in its distribution policy). Some funds may distribute returns directly to investors, while others would reinvest the distributions back into the investment.

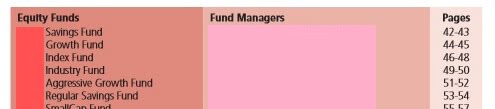

7. Management

This is your opportunity to find out more about the people in charge of your money.

Additionally, you can find out about his or her experience and qualifications. From this, you can try to make sense of his or her past strategies and results and use it as a guide to make an informed investment decision.

Conclusion

Reading a prospectus will require your effort, time and concentration but the rewards will be worth it. And although it may seem like a difficult task, reading a prospectus is all about knowing exactly what to look out for.

You can obtain the prospectus directly from the investment company or fund by requesting it via mail or email. Alternatively, you may acquire a copy from a certified financial planner or advisor. Many fund companies also provide PDF versions of their prospectus on their websites.

After reading (and understanding) the prospectus, you will then have a better idea of how the investment fund functions, the risks it may pose, its historic performance, fees, strategy and many more. Most importantly, you will be able to determine if the potential investment is indeed the right choice for you.

*Screenshots taken from an actual Prospectus.

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.

[sc:leadform-fa]