This Is How The New EPF Minimum Savings Of RM228,000 Affect You

Table of Contents

Retirement should be painted as the ultimate dream of finally leaving our hectic work life behind, and kicking back and enjoying glorious days of fun and relaxation that we’ve been working hard for. However, this vision is far from the truth for many Malaysians.

Statistics illustrate the dire situation facing millions of Malaysians. Most employees at 55 years old only saved up one-third of their financial salary (34%), which would likely last them a maximum of five years in retirement.

For those who decide to retire and start withdrawing their retirement fund at age 55, they will find themselves broke by the time they turn 60.

To try to avert a retirement crisis, the Employees Provident Fund (EPF) has increased the minimum savings of its members at age 55 from RM196,800 to RM228,000. The minimum savings have been adjusted every three years to reflect the rising inflation. The new quantum is benchmarked against the minimum pension for public sector employees.

In the current minimum savings threshold of RM196,800, the replacement income of a retiree is a modest RM820 a month over 20 years of retirement (age 55 to 75). That’s slightly above the national poverty line, which is made worse if shared between a couple.

Is RM228,000 enough for retirement?

The new minimum savings of RM228,000 will increase the monthly amount to RM950 over the same period. That’s only RM130 more every month compared with the current threshold.

To answer the question, if you are making RM4,000 a month, a monthly retirement income of RM950 only replaces 24% of your last drawn income.

This is below the national replacement income ratio of 30%, and way below the 57% average for Organisation of Economic Corporation and Development (OECD) countries. The replacement income ratio refers to a person’s gross income after retirement, divided by his or her last drawn income before retirement.

For example, if you earn RM48,000 per year before retirement, your ideal replacement income according to OECD’s average should be RM27,360 (RM48,000 x 57%) in retirement. Assuming 20 years of retirement, your retirement fund should be at least RM547,200 (RM27,360 x 20 years), without taking inflation into consideration.

In a nutshell, whether RM228,000 is adequate for one’s retirement really depends on your lifestyle and income. Based on the rule of thumb, it would not be enough to maintain your current standard of living if you are earning above RM1,600 a month.

So, how does this affect EPF contributors?

The more immediate impact this revision will have on EPF members is their eligibility to withdraw for the EPF Members Investment Scheme (EPF-MIS).

The EPF-MIS allows EPF members to withdraw a certain amount of money from Account 1 and invest into EPF-approved unit trusts, provided the Basic Savings in Account 1 is met.

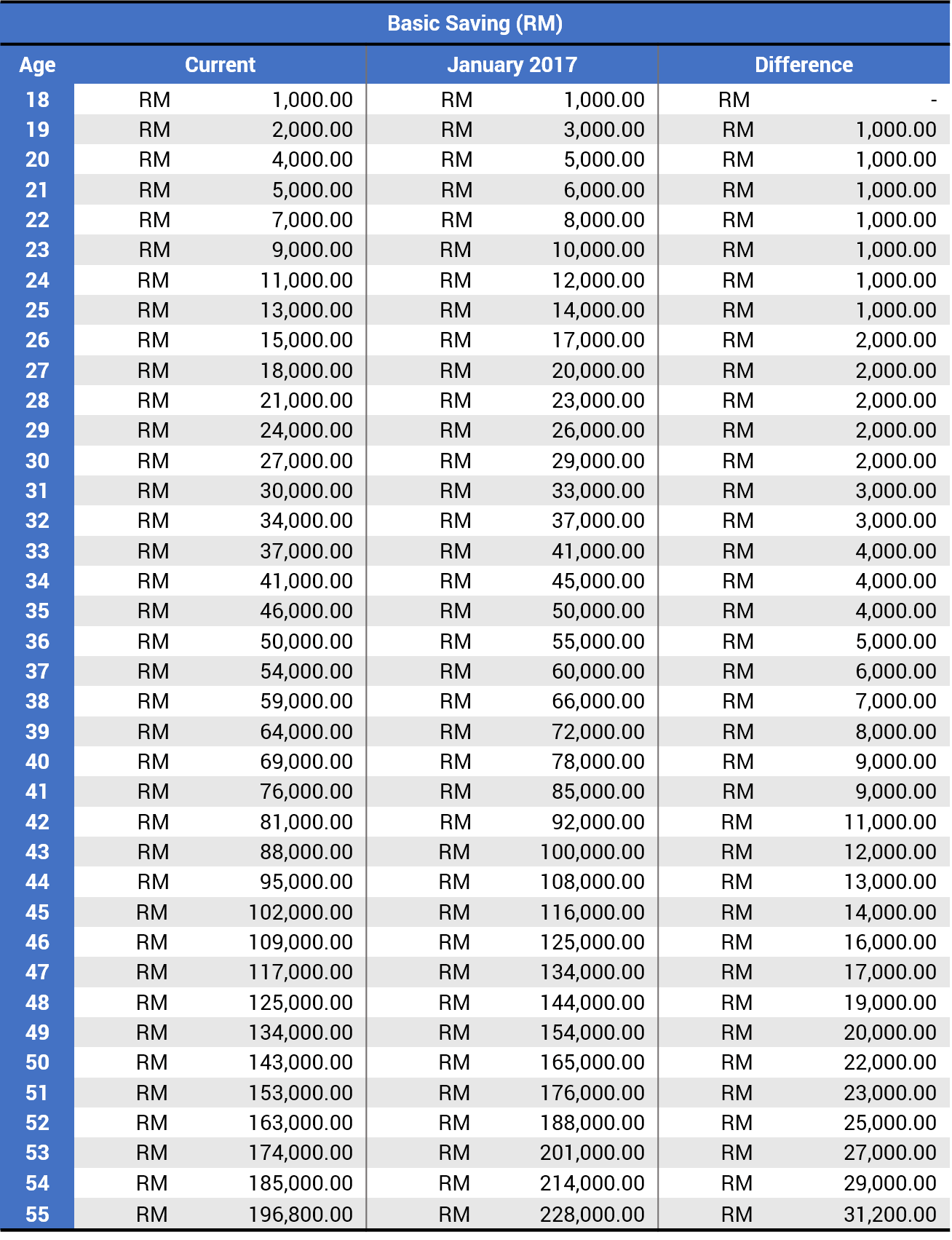

The Basic Savings in Account 1 is tabulated based on the minimum savings amount to ensure that the member will still be able to save up the minimum amount by the time he or she reaches age 55.

Here is the current Basic Savings schedule compared to the new schedule effective January 2017.

Currently, the EPF-MIS allows the EPF members to withdraw not more than 20% of their total amount in excess of their Basic Savings in Account 1. Effective January 1 next year, members will see an increase in the eligible amount allowed to invest under the EPF-MIS from 20% to 30% in excess of their Basic Savings from Account 1.

For the 2016-2017 list of EPF-approved funds, go here.

Here’s an example of how you may be affected by the increased in Basic Savings:

| Age (years) | ||

| Assuming Total Savings in Account 1 | ||

| Basic Savings | ||

| Total Allowable Withdrawal Amount for EPF-MIS (Total Savings – Basic Savings) x (% of excess) | ||

| Latest NAV Price* | ||

| Total Units (Withdrawal Amount ÷ NAV Price) | ||

Despite the higher Basic Savings, EPF members can now withdraw more to boost their retirement savings by investing in approved unit trust funds. With the increased percentage of 30%, the eligible amount is higher than previously allowed.

As shown in the example above, the number of units you will be able to purchase is about 25% more based on the new Basic Savings.

Protecting your nest eggs

With cost of living heading one way (read: up), we need to do everything we can to protect our retirement fund. This includes being extra cautious about how we use our retirement fund pre-maturely.

Though we are allowed to withdraw our EPF savings for purposes such as education, medical and housing, the onus is really on us to weigh the pros and cons of withdrawal in such situations before going through with it, especially with the smaller amount left for withdrawal.

Those cashing out their retirement savings will not only risk living in poverty in their golden years, but lose out the growth on their savings and will need to power save later if they wish to maintain the same standard of living in their retirement.

Retirement savings is crucial to everyone, especially with an aging population. The government’s move is definitely praiseworthy, it will put additional financial stress on the lower-income group, who are already struggling with their daily expenses.

Perhaps, a better way to help Malaysians is to raise the minimum wage, and also wages in general, and educate them to put away savings for their retirement.

In the meantime, one way to stretch your retirement savings is to delay withdrawing your retirement savings for as long as possible, and avoid withdrawing in cash-lump sum. This will ensure that your savings continue to compound even when you have stopped working.