The Hefty Price We Have To Pay For The Declining Health In Malaysia

Table of Contents

A coronary angioplasty done in a private hospital costs RM29,070 on average, while a mastectomy costs RM10,160. Five-figure price tags for some of these medical procedures is now the new normal.

These procedures are increasingly common as coronary heart disease, stroke and cancer stay in the top five causes of death in Malaysia. The rise of these diseases is probably contributed by the prevalent smoking habit, high blood pressure and cholesterol, lack of exercise and obesity.

With five million smokers in Malaysia and also being the most obese country in the region, the list of top causes of death is really not that surprising. What’s more surprising is probably the lack of concern or backup plan when the illness befalls us or someone close to us.

With Malaysians living longer – the average life expectancy of a Malaysian resident has risen to 74.7 years in 2016 from 72.2 years in 2000 – the cases of diseases and illnesses will only rise.

However, with the advancement of medical technology and pharmaceutical solutions, cure is not impossible. So the science isn’t the barrier, the cost however…

Grappling with the high cost of medical treatment in Malaysia

According to the latest research by Mercer Marsh Benefits, Malaysia has one of the highest medical cost increases in Asia at 17.3%.

If medical inflation continues on this trajectory, a coronary angioplasty will cost a heart-stopping RM706,976.98 in 2037 – 20 years later!

You may be fine and healthy now, but nobody can guarantee that you will still be in the pink of health 20 years later. Without a plan to deal with these illnesses financially, many Malaysians are left struggling to pay for the treatment they need.

Based on the latest data from Credit Counselling and Debt Management Agency (AKPK), 11.5% of those who enrolled into their Debt Management Programme fell into debt due to high medical expenses.

This is further supported by Employees Provident Fund’s (EPF) data, where 5,692 health withdrawal applications were approved amounting to RM51,766,353 withdrawn in 2015 for medical reasons. This shows a 14.55% increment in the number of cases compared to 2014, and 12.4% increment in the amount.

Going into debt or facing the prospect of retiring broke just to pay for your medical expenses is akin to rubbing salt to wounds – instead of focusing on recovery, you find yourself worrying about medical costs while lying on the hospital bed.

Planning for uncertainties

You can’t plan your illnesses but you can plan for it financially. This goes beyond having a sizeable emergency fund (with current medical costs, that’ll get wiped out fast!). This calls for adequate insurance planning.

The financial risks a sickness may pose can be mitigated with the right insurance plan at the right coverage. But how much is adequate? It can be a challenge figuring out in advance how much you would need if you do get sick.

If you have employer-sponsored insurance, you may think that the high medical inflation does not matter to you because someone else is paying the bill. You are wrong.

The truth is, insurance plans provided by employers generally have relatively lower annual limits and lifetime limits, and the same goes to the hospital room and board limits. In the event that you need to be hospitalised long-term for treatment, you will find yourself co-paying the hefty medical cost to make up for the low medical claim limit.

Furthermore, not many people can guarantee their job. If you suddenly find yourself jobless, you will also find yourself uncovered. If this happens later in life, you are not likely to secure a medical plan due to previous illnesses, or existing medical ailments.

Certain illnesses may require long-term treatments, and working may not be possible. Quitting your job will cancel your health insurance from the company, and if you do not have a personal insurance plan, you will find yourself knee-deep in debts.

What do you need?

Based on the frightening medical inflation, one of the first things you need to consider when you are looking for a health insurance plan is the annual limit.

Treatment for stroke costs between RM35,000 and RM75,000 in 2015, but 20 years later, the cost will likely spike up to between RM851,194 and RM1,823,986. For sicknesses that require long-term treatment such as kidney failure or cancer, you are looking at an even higher cost of treatment.

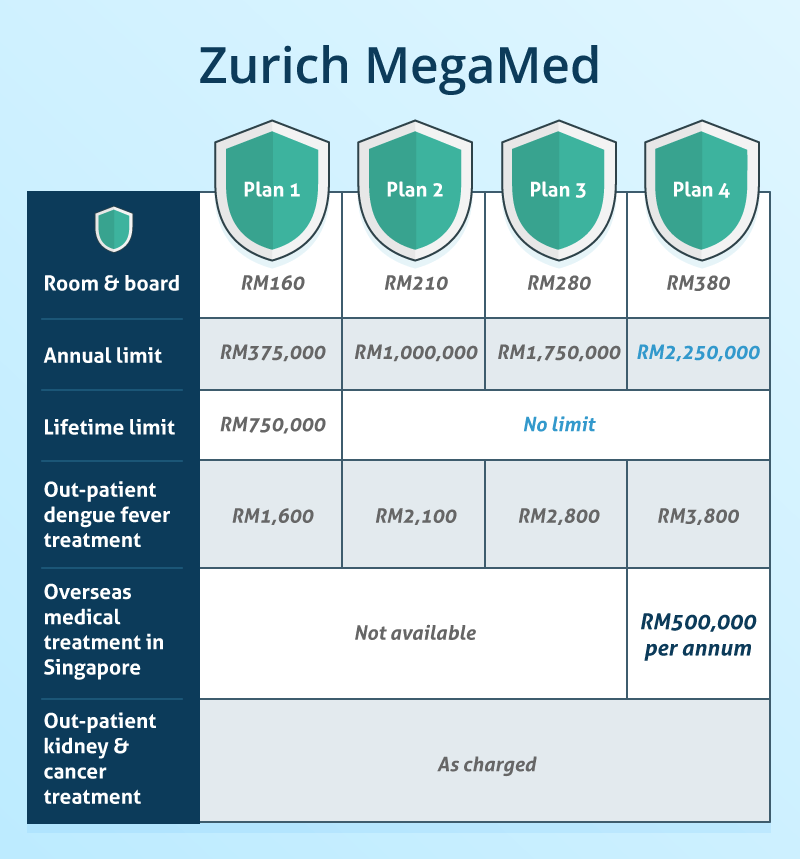

This is why getting a plan with a high annual limit is extremely important today. The Zurich MegaMed, a medical rider that is attachable to a basic regular premium investment-linked plan, is a solution that considers all your medical concerns for the long-term.

The high annual limits for medical claims will give you the peace of mind to focus on getting better, instead of worrying about hospital bills. From the second plan onwards, there is no lifetime limit, a benefit for those who may be diagnosed with lifelong or recurring ailments that require long-term treatments.

For the highest plan, a RM500,000 coverage per year is available for overseas medical treatment in Singapore. This opens up more medical options to seek treatment overseas if there is inadequate expertise available locally to treat a specific medical condition.

With the cost of everything including medical treatment going up, this will be the worst time to rest on our laurels. Even if you have minimal medical coverage at work, it shouldn’t be your only source of insurance. Plus, you need to remember that you’re not planning for the costs today, you’re planning for it in the future where you can expect costs to be much greater.

During the stressful time of dealing with an illness, the last thing you want is to leave your loved ones with more financial strain due to your huge medical cost. It’s time take action and get the medical coverage that will protect your wallet if you get sick.

Stop worrying about the cost of your health. Get a quotation for Zurich MegaMed now and take control of your health & finances. For more information and details click here.