Here Are The Key Investment Trends To Look Out For This Year

Table of Contents

- 1. Markets might still be unstable in the short-term

- 2. Global economic recovery expected

- 3. Positive outlook for Asian markets

- 4. Malaysia equities are undervalued

- 5. Sukuk and bonds continue to be attractive

- How can you take advantage of these trends?

- Diversify your retirement portfolio with Principal through EPF i-Invest and PRS

![]()

Last year was a strange time for markets. Who would have foreseen a global pandemic that would take such a toll on our lives and the economy, and send markets crashing and then rising almost immediately after?

But with vaccinations rolling out, and economies starting to recover, 2021 ought to be less volatile. What does that mean for your portfolios? Here are some investing insights from experts at Principal Asset Management Berhad (Principal) on trends you should look out for.

1. Markets might still be unstable in the short-term

Fears of inflation tend to cause bond yields to rise. On top of that, stocks and bond yields generally have an inverse relationship – when bond yields go up, stocks may go down, and vice versa.

Patrick Chang, Chief Investment Officer of ASEAN Equities at Principal, said there has been a rise in bond yields due to higher inflation expectations. This has caused the recent global market correction (i.e. when the stock market drops from a recent high).

While this may lead to markets being unstable in the short-term, it may only be temporary. “There are no real signs from the data that real inflation is rising,” said Chang. Bond yields are actually rising as there are better growth prospects due to economic recovery, not due to real inflation.

2. Global economic recovery expected

Jesse Liew, Chief Investment Officer of ASEAN Fixed Income at Principal, notes that global economic recovery may come below expectations in the first quarter of the year, as there are still lockdowns being carried out across the globe. However, he added that the recovery should improve in the second quarter onwards with more vaccinations rolled out.

Besides that, Chang said that equity markets recorded positive returns year-to-date, led by strong inflows, improving economic data and lower number of COVID-19 cases globally. We’ve also reached a milestone where global vaccinations have exceeded the number of confirmed cases. “This leads us to having more confidence that developed and emerging countries are moving towards a recovery, revitalize and renewal [sic] environment,” he said.

Mass vaccinations are still in progress and new variants of the virus could pose threats – but on the upside, resurgence of cases could be contained by better awareness, testing and contact tracing and the availability of vaccines. According to Principal, the global economy should continue to recover over the next twelve months.

3. Positive outlook for Asian markets

“The investment environment for Asian equities continues to remain favorable,” said Chang. With the rollout of vaccines, continued monetary and fiscal support, Principal foresees an economic recovery taking place.

“In ASEAN, we are taking a contrarian positive view that these markets should do well this year,” Chang added. This is because most ASEAN markets were undervalued in 2020, and therefore have “deep value opportunities”. There are opportunities for those who are looking for long-term value in tourism, e-commerce and commodities, which Principal thinks will do well this year.

Principal also views China positively. “US-China relations could be less thorny and volatile going forward,” said Chang. “Washington has just reaffirmed its one-China policy on Taiwan. This is a promising start before dialogue on other issues like trade and investment restrictions [take place].”

4. Malaysia equities are undervalued

“As we look towards reopening of the economy post-MCO with the vaccine roll-out, the [Malaysian] economy will start to recover,” said Chang. This will lead to a rebound in corporate earnings. Besides that, Malaysian equities are cheap, as foreign selling has been overdone.

Domestically, Principal’s sectors in focus are the consumer and retail, technology, telco and commodity-related sectors. On the other hand, it is underweighting healthcare and plantation sectors.

5. Sukuk and bonds continue to be attractive

The sukuk asset class (an Islamic equivalent of bonds) performed well in 2020. The Principal Islamic Lifetime Sukuk Fund delivered returns of 5.11% last year, while Malaysian equities delivered returns of 2.4%.

Mohd Fadzil Mohamed, Chief Investment Officer of Principal Islamic Asset Management, shared that the global sukuk market has remained resilient this year, supported by rising oil prices. “Since November last year, oil prices have surged by more than 60% following positive COVID-19 vaccine developments. This benefitted Middle Eastern oil-producing countries, driving up demand for their bonds and sukuk,” he said.

“The outlook for global sukuk remains positive as a result of continued fund inflows into emerging market assets, which offers higher yields relative to developed markets,” he said. In addition, expectations of slower global growth will support demand for fixed income assets.

Principal’s ASEAN Fixed Income Chief Investment Officer, Liew also shared that with bond yields rising, new bonds issued by corporations will likely carry higher yields and drive returns for bond portfolios. “We continue to advocate a bond allocation in your portfolio, as its low volatility is a crucial component of your portfolio’s asset allocation mix,” he said.

How can you take advantage of these trends?

As an investor, keeping up to date with investment trends is useful – but how do you actually take advantage of them? You could invest in international stocks, bonds, commodities, and other assets. But investing in individual investments on your own may require a lot of time and research.

Alternatively, you could invest in unit trust funds that invest globally and in Malaysia. This allows you to instantly diversify your investments, take advantage of current trends and leverage the expertise of professional fund managers. For example, Principal has a range of mixed-fund investment opportunities available through EPF i-Invest and/or Private Retirement Scheme (PRS):

| Fund names: | Risk | Region | Fund objective |

|---|---|---|---|

| Principal Greater China Equity Fund | Aggressive | China, Hong Kong, and Taiwan | Strategically invests in the Greater China region, where you’ll have the chance to be part of China’s economic growth. |

| Principal Asia Pacific Dynamic Income Fund | Aggressive | Asia Pacific ex-Japan | Aims to provide regular income by investing primary in the Asia Pacific ex Japan region. At the same time, aims to achieve capital appreciation over the medium to long-term. |

| Principal Islamic Asia Pacific Dynamic Equity Fund | Aggressive | Asia Pacific ex-Japan | A Shariah-compliant fund that invests in emerging and developed markets. |

| Principal DALI Equity Growth Fund | Moderate | Malaysia | Potentially aims to achieve consistent capital growth over the medium- to long-term. |

| Principal Islamic Lifetime Sukuk Fund | Moderate Conservative | Malaysia | Potentially aims to gain higher than average income over the medium to long-term by investing in a diversified portfolio consisting mainly of sukuk, certificates of deposit, short-term money market instruments, and other investments according to Shariah principles. |

Diversify your retirement portfolio with Principal through EPF i-Invest and PRS

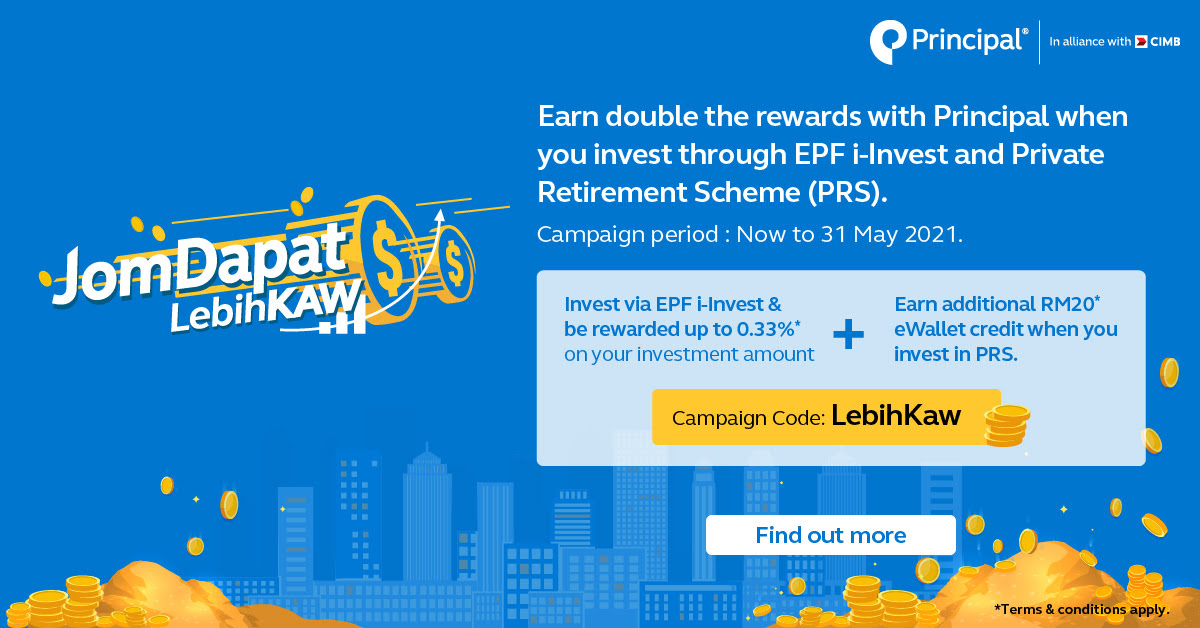

Here’s how you can get rewarded when you invest with Principal through the Jom Dapat Lebih Kaw promotion:

1. Invest with Principal through EPF i-Invest

Channel your EPF savings to over 30 approved mixed fund opportunities that could potentially grow your retirement funds at a greater rate. You’ll earn up to 0.33% in Touch ‘n Go eWallet Reload PIN from your total net investment amount.

2. Boost your retirement funds with Principal through PRS

Invest in PRS-approved unit trust funds and receive an additional RM20 Touch ‘n Go eWallet Reload PIN with a minimum investment of RM2,000. You’ll also get a PRS tax relief (available until the assessment year 2025) of up to RM3,000.

With Principal, there’s never been a better time to take advantage of investment trends and start diversifying your retirement portfolio.