Is Akaun Emas The Answer To Your Long-Term Care?

Table of Contents

No matter which way you cut it, you can never have too much protection to safeguard your finances in old age. You never know when you will need that money. When it comes to your long-term care, the idiom ‘better safe than sorry’ stays true.

Hence, when the Employees Provident Fund launched the Akaun Emas in November 2016, it was welcomed news indeed and another step in the right direction to address Malaysia’s ageing needs. The Akaun Emas, effective this January, aims to help EPF members save a second source of funds to serve their needs when they retire.

While it is a good initiative, will it last till the time we need long-term care in our old age? With the average life expectancy of Malaysians having gone up to 75 years of age, Malaysia is 13 years away from being classified as an ‘ageing society’ – with the senior population reaching 15% by 2030.

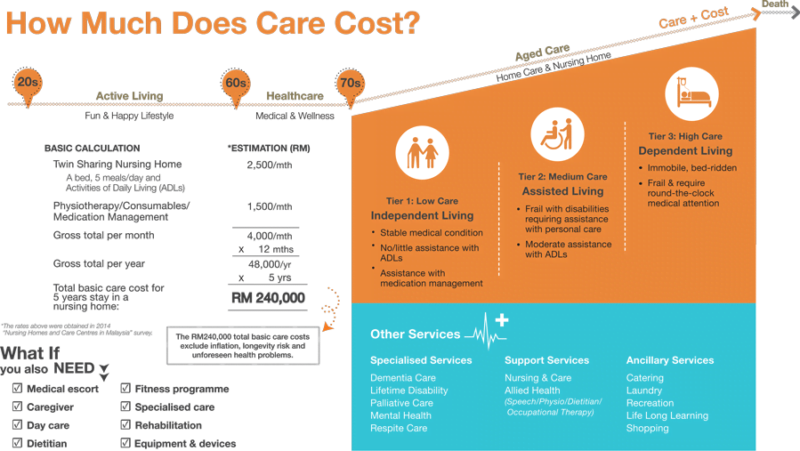

So what does this mean for our long-term care needs in our financial planning and retirement? First let’s look at the anticipated cost of care.

Source from www.managedcare.com.my

Is Akaun Emas sufficient for your long term-care?

As depicted in the infographic, the cost for basic care for 5 years – while remaining relatively active with low care needs – is roughly RM 240,000, excluding factors of inflation and other external factors. Furthermore, according to the Malaysia Health Insurance organisation, the cost of healthcare increases at an average of 15% annually.

The Akaun Emas is a good initiative, but without additional options, the money accumulated won’t be enough when we need long-term care during our senior years.

Stacked on top of other investment options, you may have enough. However, investment incomes from interest rate-driven instruments have dropped.

Though it should be noted, the EPF has a reliable track record of fund managing, having been able to give an average dividend of 6% in the past 5 years. Despite that, returns for the coming years are expected to be lower.

Age: 55

Average monthly income: RM6,000

Balance from Account 1 and 2: RM30,000

Projected balance at age 60: RM158,100 (Assuming average dividend rate of 6% p.a.)

* Calculated using EPF Savings Calculator.

Your Akaun Emas savings only covers the basic cost of care for about three years, should you dedicate the whole sum to long term-care.

Stocking up ammunition for our twilight years

The positive note is the Akaun Emas certainly provide some much needed support for retirement. The more money you have for long-term care, the better off you are and three years coverage of basic care is better than nothing.

However, the advent of the Akaun Emas signifies an important message.

We need options that cater to our twilight years in retirement and our long-term care is a big part of it. As such, it is imperative to discuss these needs with a financial advisor and arm ourselves with greater awareness of the available investment and insurance offerings that can help in this endeavour.

Among the offerings available, you could rely on these products to cover long-term care expenses:

- Private Retirement Scheme (PRS)

- Dividend-paying stocks

- Real Estate Investment Trusts (REITs)

- Unit trust funds

- Exchange Traded Funds (ETFs)

- Insurance plans

Another option to accommodate this niche is a living trust. Currently, the only available option that has a care-specific focus is a CareTRUSTTM. Its specific purpose is for you to set aside money to ensure you have access to continuum care that is financial sustainability. A trustee is also assigned who will only act on your instructions to pay for your care needs.

It also comes with the Care Administration service – whereby a Care Manager assigned to you will coordinate a variety of care services that you may require – as part of the package. A Care Manager’s job is to ensure the quality of care you receive is in sync with the appropriate healthcare and long-term care – which are based on your care needs and financial affordability.

This service is convenient when you need immediate access to quality care from reputable providers, saving time on vetting through them yourself.

An infrastructure in its youth

Despite its benefits, the Akaun Emas is an instrument for retirement. It is not specifically tied to paying for care, as is the case for many investment products currently available in Malaysia. Many would likely spend their Akaun Emas savings on various needs, leaving the leftover (if there is any) insufficient to pay for long-term care when it is needed.

Insurance may cover some medical costs such as surgery, hospitalisation and perhaps a set amount of recovery days in a nursing home. However, Malaysia’s aged care infrastructure is still young. Our insurance structure has yet to incorporate sufficient coverage for long-term care which includes assisted daily living devices, services and supplies.

Furthermore, with various factors that include the ringgit’s falling value, inflation, longevity risks, unforeseen health problems and behavioural spending habits, statistics from EPF have shown many having exhausted their regular EPF Account 1 and 2 within five years.

Depending on adult children to pay for our care when the money runs out is not always a reliable option. They too will need to save for their aged care while supporting their own families.

Hence, the best course of action is to be prepared for the latter years of our long-term care now with care-specific goals in mind. Doing so early on would not only give us peace of mind, but also help ensure the financial burden of care does not pass from us to our children.

Without careful planning, discipline and other mechanisms to fund our care, our Akaun Emas savings would meet the same end.

Image from Wisconsin Watch

Disclaimer

Aged Care Group (ACG) is an organisation engaged in the business of elevating and providing aged care services in Malaysia. ACG is driven with a strong vision to advocate innovation and transformation in ageing by offering continuum care as a premium choice for enriched living. We operate in an ecosystem that provides integrated care services and products through meaningful partnerships with individuals, government, organisations and corporations. ACG seeks to be the forerunner in all things related to aged care, building on the years of knowledge and experience of its shared holders and management team. A detailed profile of who we are can be obtained at www.agedcare.com.my.