All You Need To Know About Getting Medical Insurance In Malaysia

Table of Contents

With medical inflation climbing steadily, it is undeniable that private medical treatment is fast becoming a luxury that not many of us can afford.

Due to increasing lifestyle diseases, such as diabetes and chronic heart disease, access to fast and quality treatment become a priority. With diabetes, high cholesterol, hypertension, and obesity affecting more than 5% of adult Malaysians today, the spotlight has shifted to medical insurance in recent years.

However, with household debt showing no signs of reducing, it becomes crucial to find the “best value” medical insurance for you and your family. Best value is not solely defined by the premium, but also what you get in return for the premium. It should also depend on your needs — why pay more than what you need?

Here are some of the most important factors to help you identify the best medical and health insurance (MHI) plan to suit your needs.

Types of insurance

There are generally three types of MHI policies in Malaysia: Hospitalisation and surgical insurance, dread disease or critical illness insurance, and long-term care insurance.

For the best coverage, it is always recommended to have all the three areas listed above covered by your MHI plan. However, if you are looking to reduce the premium, you can opt for ONLY the medical card which covers the hospitalisation and surgical insurance, including for emergency.

When comparing benefits offered by the medical card, pay close attention to the room and board limit, daily allowance, pre-hospitalisation, annual limit and lifetime limit.

For those who have dependents like aging parents, a spouse with no income, and young children, it is important to ensure your life insurance comes with disability (provides an annual income stream) and dread disease (compensates you in a lump sum) in the event of total permanent disability (TPD) and when you are hospitalised. In the event of loss of income, this will help your family financially.

The premium

Most people make the mistake of buying a medical insurance solely based on the premium. While the premium is important, it should not dictate the insurance policy we should get.

It is more important to get the coverage that you need within the premium that you can afford.

Insurance coverage should be considered beyond its premium, as what you need that’s most important when deciding on a medical insurance. This applies to over-insuring as well. In this case, just because you can afford the premium does not mean you need that much coverage.

Want to find out what your maximum insurance premium should be? Use our medical insurance calculator.

The coverage

Once you have an idea of what type of MHI you need, and roughly how much you can afford in premium, you can start shopping for a health insurance policy.

Some of the things you should look out for are the room and board limit, annual limit, and lifetime limit.

When deciding on your annual and lifetime limits, be future ready. With medical inflation at 12% a year, the quantum of health cover that appears adequate today will be inadequate to cover your healthcare expenses in the next few of years.

Some MHI plans come with a rider plan that lets you waive the annual limit, so you don’t have to worry while you are down and out.

It’s also important to consider coverage of outpatient treatments before and after hospitalisation, as these can come up to a significant amount. Consultation by a specialist can easily cost several hundred ringgit per session, and medications can set you back by another few hundred. Without pre- or post-hospitalisation outpatient coverage, you will have to fork out the money from your pocket.

The ASEAN Costs in Oncology (ACTION) study by the George Institute for Global Health found that 45% of cancer patients in Malaysia suffered from financial catastrophe one year after diagnosis, and they could not pay for medication (39%) and medical consultation fees or tests (35%).

With cancer, early detection and treatment can save or prolong the lives of these cancer patients.

In this case, don’t be penny-wise – it might cost you dearly in future.

Panel hospitals and reimbursements

Having a high claimable limit means nothing if the network of hospitals under your insurer is not easily accessible to you. This is one of the most important factors to consider when choosing your MHI insurer.

If your insurer has a direct tie-up with a hospital, you can opt for the cashless treatment facility (depending on your plan). The transaction will be painless and you don’t have to worry about payment and documentation when you are recovering on the hospital bed.

In other words, you will not have to fork out any money (depending on your plan) and the claim will be directly settled by your insurance company – saving you the hassle of filing for reimbursement.

Look for an insurance company that offers cashless facility at a good number of quality hospitals – especially within your geographical proximity. If you have your preferred doctor or specialist, check to see if they are in the insurer’s network.

Other factors

It’s a no brainer that one should study and understand the terms and conditions before committing to any financial decision, especially on something as important as your insurance.

However, most people do not have the time or the expertise to understand the confusing terms and jargon we often encounter in an insurance policy. To simplify the matter, here are some of the important points that you should look out for in your policy. To make it even easier, you can ask your insurance agent to point these out for you.

- Co-insurance

Co-insurance refers to the percentage of the cost of your medical care that you have to pay. For example:

To opt for lower premium, consider plans with co-insurance. Co-insurance requires you to share at least 10% of the cost with the insurer. If you have a clean bill of health, you can consider knocking down your premium by opting for a plan with co-insurance.

- Deductibles

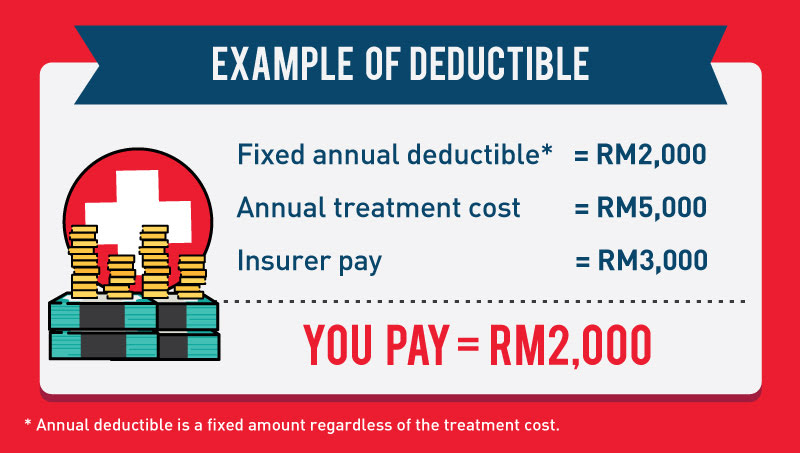

Unlike co-insurance or co-payment, an annual deductible is not based on a percentage of the payment by the insured. It is based on a set minimum amount that must be paid for all covered treatments before the insurer will begin to cover all subsequent expenses for treatment.

- Guaranteed renewal

It is advisable to opt for a MHI policy that provides guaranteed renewal, especially when you are older (above 50 years old). Though guaranteed renewal is subject to the terms and conditions specified in the policy, it ensures protection is available throughout despite recent diagnosis of illness. However, the renewal premiums payable is not guaranteed or fixed.

For older policyholders, look out for the age of renewal and age of entry. Certain insurers only cover up to 60 years of age.

The key to choosing the best value MHI is not just about the premium you are paying but what you are getting out of it. Ideally, you should get an insurance policy that is not only adequate but also promptly delivers on your healthcare requirements as and when the need arises.

Spend some time to compare and choose your best value medical and health insurance so you won’t have to worry later and just focus on your recovery.