Are Your Car Expenses Too High?

Table of Contents

The popularity of cars in Malaysia is immense with many Malaysian families having more than one car. Therefore it is no surprise to see that a lot more roads are clogged during the dreaded peak hours, especially in larger cities. However, this is understandable as with the scarcity of public transportation in most areas, having your own car becomes more of a necessity than a luxury.

According to the latest statistical data released by the Government, the average household income in Malaysia was RM5,900 for 2014. Most financial planners recommend spending only 15% of your income for transportation related matters. Which means, with an average annual income of RM70,800, you should only be spending an average of RM10,620 on your car yearly.

But, are we spending way more than 15%?

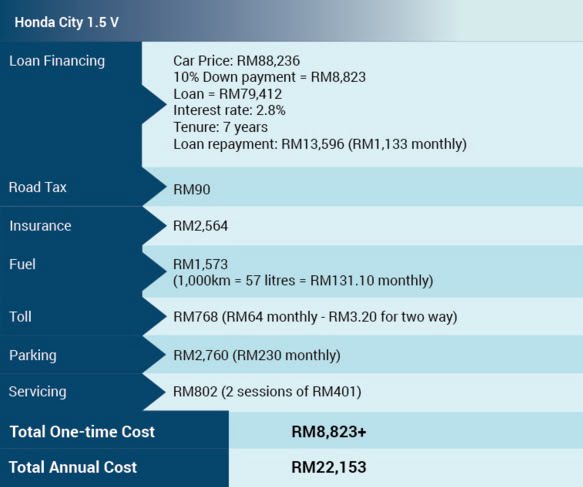

For that, let us compare the difference in annual expenses for a Myvi SE and a Honda City. Both these cars have 1.5L engine. Myvi SE 1.5 offers fuel consumption efficiency of 12.8 km per litre while Honda City offers 17.6 km per litre.

According to this calculation, the Myvi SE driver who is earning RM5,900 a month is spending 23% of his income on his car, that’s RM5,813 more that what he should spend in a year.

However, we can see that we are spending RM11,533 in excess or 31% of your income if you drove a Honda City.

If the family has two or three cars, this amount will double or triple. It’s no wonder the household debt in Malaysia is showing no signs of declining.

Pay a higher down payment

By saving up and paying a higher down payment, you will be able to service a lower loan repayment for a shorter tenure. This means you will be paying less in interest.

Since car loans charge fixed interest rate, repayment and total interest to be paid is all calculated up-front. This allows you to be aware of the financial impact and be able to plan your finances ahead. For the same reason, getting a smaller loan will have a significant impact on your finances. This is quite opposite to home loans as it charges variable interest rate. Therefore, repayments change according to the changes in interest rate. In the case of a home loan, getting a smaller loan may not impact you as significantly as car loans.

Housing loan interest is calculated based on the declining loan principal and the interest rate varies. Quite the opposite, car loan interest is calculated based on the loan amount and the interest is fixed. Hence, even if you are able to do full settlement, you won’t be saving much in interest for a car loan.

For example, if you paid RM15,000 down payment for your Myvi SE, your monthly repayment would be RM555 instead. This means in a year you would be paying RM6,660 for your loan repayment, in which would save you RM1,680 a year. For the Honda City with the same amount of down payment, your monthly repayment would be RM1,070 instead. This means in a year you would be paying RM12,840 for your loan repayment, in which you can save RM756 a year.

Therefore, the higher the down payment, the less you pay in the long run. However, do remember that you will need to keep some money stashed away for other car expenses and emergency purposes.

Carpool with others

If you and your spouse work nearby or one of your office is on the way, you could perhaps travel together in one car. Or if you have a colleague that lives nearby or a neighbour that works near your office, perhaps you could take turns to carpool with each other. This can help you save on petrol and toll – as there is only one car involved.

Look for a cheaper parking facility

Look for a cheaper parking facility even if it means you need to walk to “Timbuktu”. If you arrive early, you may be able to grab free parking space that may be available. However, do keep in mind of your safety to ensure the parking place is not too isolated or dark. Perhaps if you carpooled, this expense can be eliminated altogether or at least halved.

Use alternative route to avoid toll

In order to avoid or minimise toll, you can also use alternative route that doesn’t charge you toll. That will save RM768 a year. This is of course given the alternative route doesn’t cost you that amount in petrol!

Leave early to avoid jam

Getting stuck in a jam means your car will burn more fuel than usual. While the after-work jam is sometimes unavoidable, you can still beat the morning jam by starting off early to work.

By making these little adjustments to your finances and driving habits, you could be saving or minimising some of these expenses to reach the target ratio of 15%. Manage your car finances today to avoid unnecessary stressful hair-tugging moments in the future!