ATTENTION: Use Your Credit Card To Beat GST

Table of Contents

Are you planning to buy yourself a Prada bag? The difference between buying a RM6,000 bag now and after April is RM360.

The implementation of the 6% Goods and Services Tax (GST) in Malaysia means you will be paying more for certain things. You may not notice the difference with a can of Coke, but it can be painful if you are buying an expensive item, like a designer bag.

So, how can we beat GST using credit cards?

If you have cash, you can just walk into a mall and grab the bag, interest-free, without a worry. However, if you don’t and you are reluctant (who wouldn’t) to fork out a few hundred more a few months later, this is what you can do:

If you have cash, you can just walk into a mall and grab the bag, interest-free, without a worry. However, if you don’t and you are reluctant (who wouldn’t) to fork out a few hundred more a few months later, this is what you can do:

Regular credit card payment

Yes, it’s true. A credit card allows you to pay for something that you do not have the cash to pay for at the moment. However, if by the time your due date comes around and you still do not have to money to pay for it, you can expect to pay more than you initially planned to (much more).

Charging RM6,000 on your credit card and just planning to pay minimum payment every month is a shortcut to financial hell. Here’s why:

Easy payment plan

Easy payment plan

However, if you take advantage of the Maybank Easy Pay Plan to pay for it, you need not pay any interest payment at all.

Balance transfer

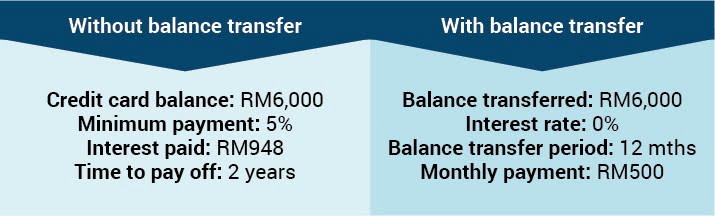

Even if you did not use the easy payment plan (if it wasn’t available), you can still save on interest by using the balance transfer facility.

Maybank 2 Cards offers attractive balance transfer rate of 0% for 12months. Find out how you can save on interest with balance transfer.

The implementation of GST is unavoidable. The only way to beat it is to be smarter in our money management.

By taking of advantage of credit card repayment plans like easy payment plan and balance transfer, we can very well be on the way to make some savings. However, be reminded to make such credit card purchases with understanding the repayment responsibility and capacity. Do not let yourself fall into the debt trap while trying to combat GST — you may end up paying more!