Save Up To 33% On Your Car Financing With This Subscription Service

Table of Contents

Technology has made it a lot easier to access our favourite products and services. With a few taps on your phone, you can get groceries delivered to your home, or watch thousands of movies online for the price of a cinema ticket. Want to upgrade to the latest phone every year? Your telco has an option for that. Want to try out different fitness classes, without being tied to a single gym? There’s an app for that too.

So why is getting a car still so much of a hassle? Conventionally, to buy a car, you’d need to pay a hefty down payment, get tied down to the same vehicle for years, and deal with things like insurance, road tax and maintenance.

But what if there was a more convenient and financially accessible way to buy a car – one that allows you to save up to 33% on your car financing in the first year? Here’s where a Flux car subscription comes in.

What is a Flux car subscription?

A Flux car subscription gives you access to a range of new and pre-owned cars for a simple monthly fee, via an online platform. Flux is an all-inclusive service that covers the financial costs (and administrative hassle) of ownership, such as insurance, road tax and even servicing and maintenance.

Under Flux’s Subscribe to Own option, you can choose to buy your car at the end of your subscription. Your monthly fee contributes towards the purchase of the car. In addition, with Subscribe to Own you only have to pay a fraction of a down payment upfront.

In other words, it’s an alternative way of buying a car that offers more convenience and financial accessibility, compared to a car loan.

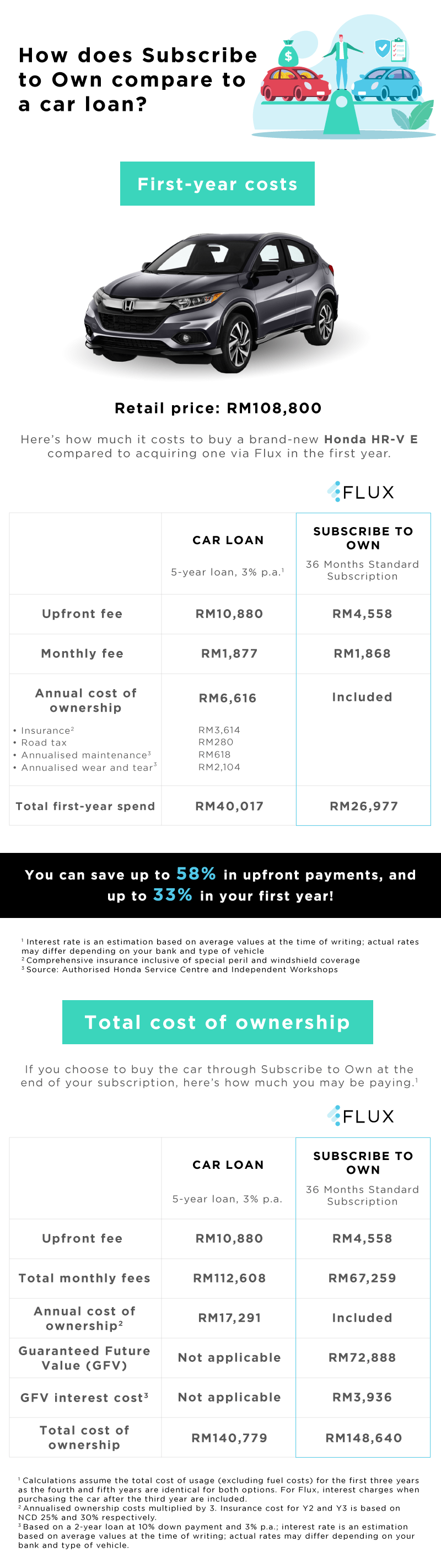

Subscribe to Own vs. car loan

So how exactly does a car subscription financially compare to a car loan? Here’s how the numbers work out.

When should you consider Subscribe to Own?

While you pay a small premium when it comes to the total cost of ownership with Flux, you enjoy certain benefits that don’t come with a conventional purchase. Buying a car through Subscribe to Own can be beneficial to you if:

a) You want to minimise your upfront costs

A car loan requires you to pay at least 10% down payment, which can be a hefty amount.

But with Flux, you just pay a small start fee. As illustrated above, buying a brand-new Honda HR-V E through Subscribe to Own can save you up to 58% in upfront payments. After including other costs of ownership, you could save 33%, or RM13,040, compared to a car loan, in the first year.

If you don’t have the 10% down payment saved up for a car loan, Flux can be a good way to kick-start your car ownership journey without the high barrier of entry.

Alternatively, you could use those savings for the down payment of a home, or towards your investment portfolio. For instance, if you invested RM13,040 at an annual interest rate of 7%, it would grow to RM50,461 by the end of 20 years.

b) You want more financial flexibility

Buying a car is often seen as a huge financial commitment, but it doesn’t have to be.

With Flux, you’re not tied down to the same monthly payment for years. If you need more breathing room in your budget, you can swap your car for one with a lower monthly fee at any time during your subscription. If you change your mind, you can even cancel your subscription.

And unlike taking up a loan, Flux’s subscription does not affect your credit score. This means being able to use your credit resources for other purposes, such as a home loan or a credit card application.

c) You want to leave maintenance and repairs to someone else

If you aren’t familiar with cars, getting your car serviced can be stressful. Unscrupulous workshops could use replacement parts that aren’t genuine, convince you to get repairs that you don’t need or charge you for repairs that weren’t done correctly.

However, Flux’s concierge service takes care of mechanic pick-ups, deliveries and administrative matters for you. They come in between you and the workshop to ensure quality servicing, and that your car will only receive repairs or replacements that are essential.

Even if you are confident in your automotive knowledge, having someone else handling these matters can free up a lot of time and energy – allowing you to focus on other things in life.

How to sign up with Flux

With Flux, getting a car is financially accessible, flexible and convenient. Signing up is quick and easy. Here’s how to do it:

- Visit driveflux.com and create an account.

- Verify your email address and mobile number.

- Provide your basic information and supporting documents:

- Contact information (home and billing address)

- Upload a copy of your valid driving licence

- Upload a copy of your MyKad or passport

- Provide a valid payment method (credit card or debit card).