What Are Contracts For Difference (CFD) And How Do You Invest In It?

Table of Contents

Have you tried speculative investments where you do not have to actually own the asset?

This type of investment is based on using leverage. What ‘leverage’ means is that you are using a small percentage of deposit (also known as required margin or ‘Initial Margin’) of the full contract value to trade CFD, so you do not have to commit a huge amount of money into a single investment.

This approach is useful to diversify your investment portfolio. One way that investors can now get into this speculative investment arena is through CFD trading.

A CFD allows investors to participate in the price movement of an underlying asset without owning the asset. One of the key features of a CFD is it is a leverage investment product; you are required to pay only a small percentage of the full contract value to trade the product.

How does CFD trading work?

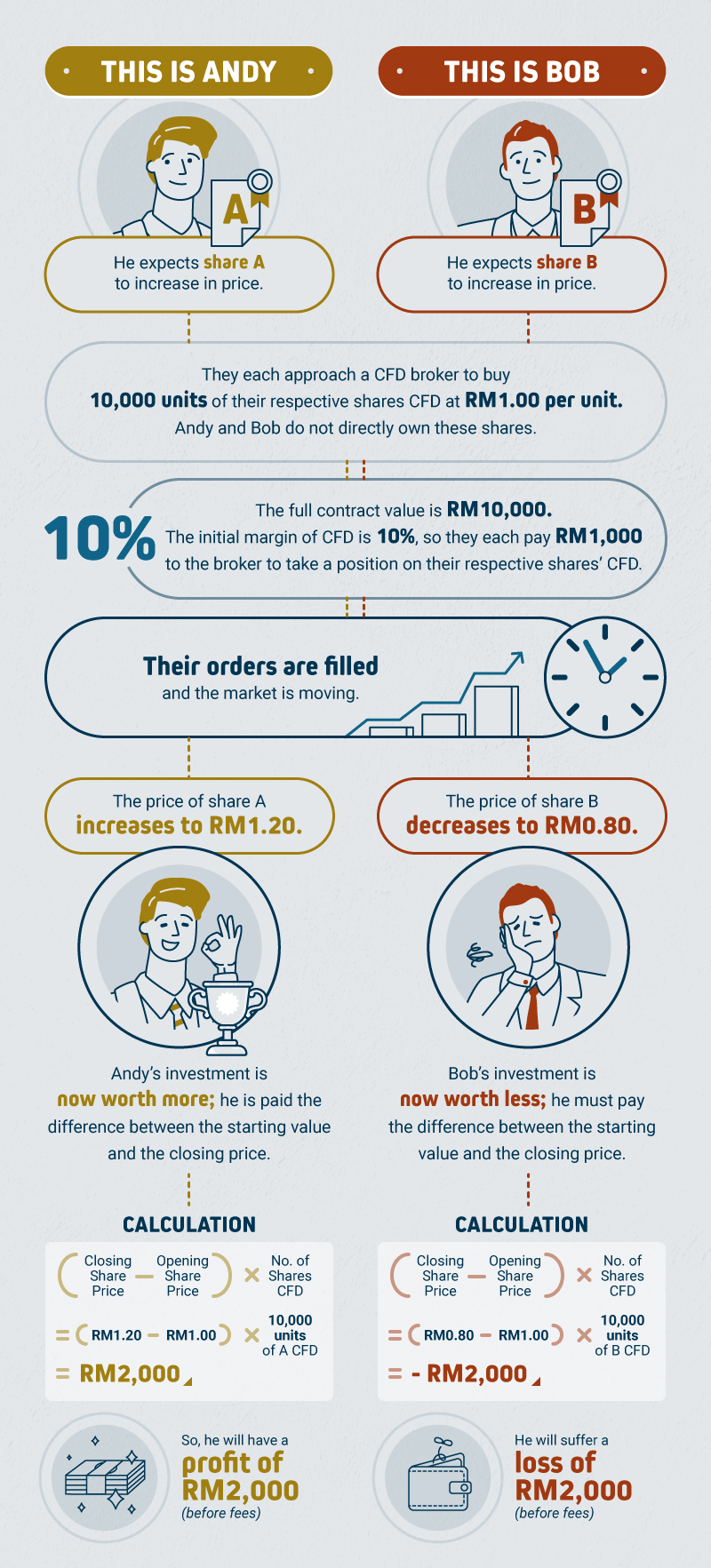

A CFD is a contract made between two parties- an investor and a CFD broker- to exchange the difference in the value of a financial product (shares or derivatives) between the time the contract opens and closes. A CFD investor never actually owns the underlying asset but instead receives revenue or incurs loss based on the price change of that asset.

An investor can either be a buyer or a seller! The buyer speculates the asset’s value will increase; an opening BUY (long) position can be placed. While the seller expects the asset’s value will decline, an opening SELL (short) position can be placed. In order to close the opening position, the investor must purchase an offsetting trade. The net difference of the gain and loss is cash-settled through their trading account.

Step by step example of a CFD investment

Still confused about how CFD works? Here’s a simple example to illustrate how this works.

What is going ‘long’ or ‘short’ in CFD trading?

These two terms will come up if you are trading in CFD.

For regular investors, the aim is to buy low and sell high. After all, it is an easy concept to understand and provides the most straightforward way of profiting from an investment. Buying at a certain price thinking that the market value will rise is called a ‘long exposure’ or ‘going long’.

However, investors can also try to profit from a decrease in price. This generally happens by selling shares or derivatives on the promise to buy them back at a later date in the expectation that the price declines in the future. This investment move is known as a ‘short exposure’ or ‘going short’.

A CFD can be opened for either ‘long’ or ‘short’ exposures. The more the market moves in the direction you took a position on (market direction favors you), the more profit you make. (provided if the market direction favors you).

Speculating on these future movements in the market price without directly investing in it can provide a lot of opportunities for investors who do not need to actually come up with the full amount of cash to buy the asset.

How do you start investing in CFD?

Phillip Futures offers an easy entry into the world of CFD investment in Malaysia. This ease of access extends not only to high value shares, but also foreign share markets which may be difficult for local investors to reach due to regulations or simply because of extra fees.

Phillip Futures is the first futures broking company in Malaysia to provide online trading on local and foreign Specified Exchanges. They are also one of the first brokers in Malaysia to offer CFD trading.

With Phillip Futures, you can:

- start trading with margins from as low as 10%*

- trade using leverage without owning the actual asset

- trade Malaysia and US shares CFD in one single platform

- trade foreign shares CFD without opening trading account with offshore brokers

*varies depending on selected shares CFD

What’s more, CFDs traded by investors on Phillip Futures are 100% identical with the actual exchange prices by using a direct market access model (DMA).

This advertisement has not been reviewed by Securities Commission Malaysia and is for general information only and does not constitute a recommendation, offer or solicitation to buy or sell any investment product. It does not have regard to your specific investment objectives, financial situation or particular needs. Trading in CFDs carry a certain degree of risk and may not be suitable to all investors You must acknowledge that trading in CFDs involves trading on the outcome of the price of a financial instrument (e.g. equity) or of an index and you will not be entitled to delivery of, or be required to deliver, the underlying instrument nor ownership thereof or any other interest therein. You may wish to seek advice from a registered representative, pursuant to a separate engagement, and to read the governing Terms and Conditions and the Risk Disclosure Statement carefully before making a decision whether or not to invest in such products.

For full disclaimer, please visit https://www.phillipfutures.com.my/phillip-futures-cfd-risk-disclaimer/