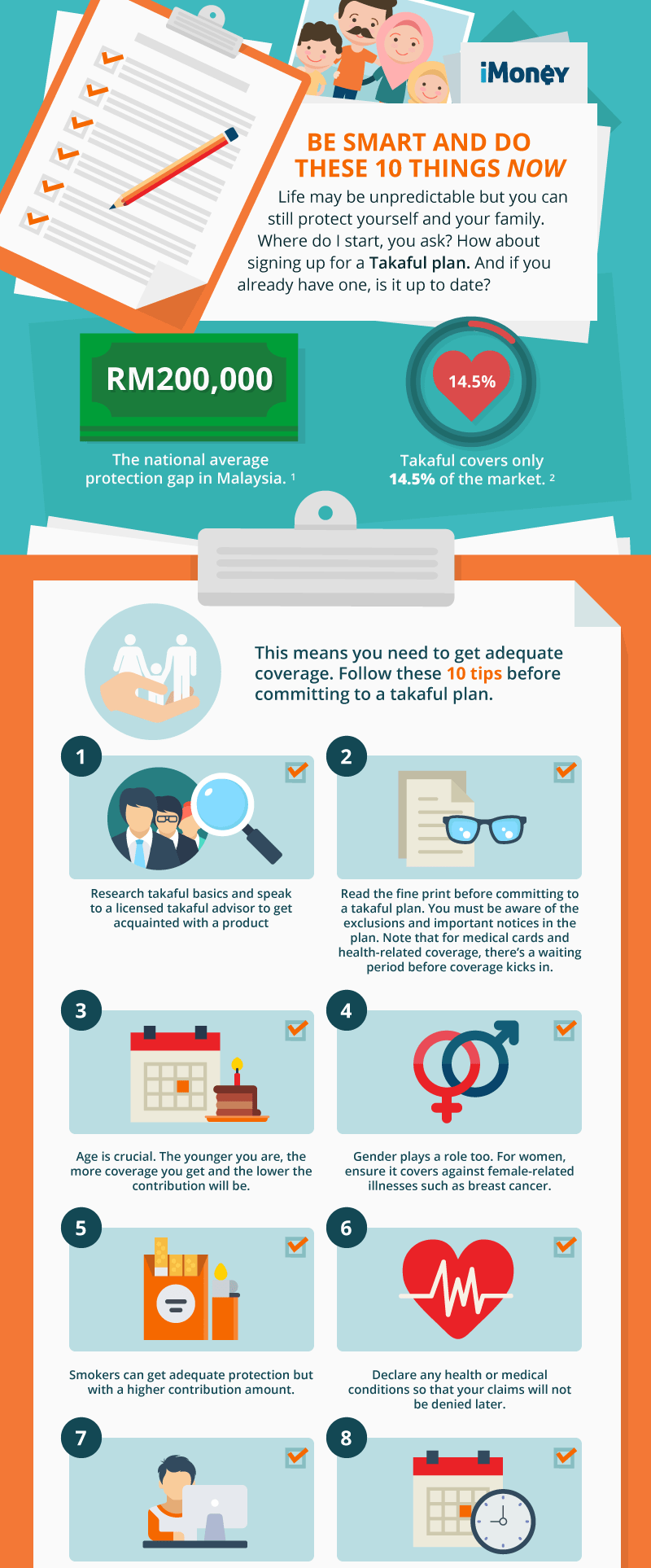

Your Top 10 Checklist To Get The Right Takaful Coverage

Malaysians are spoilt for choice when it comes to finding a takaful plan that the question now is finding the right one that suits your needs.

Signing up for a plan is the first step but before you put pen to paper, there are a few factors that would influence your coverage. Why should you pay attention to the details? Because you need your plan to be up to date.

It’s simple maths, really. Imagine if you are covered for RM500,000 today. Factor in inflation, and that may not be sufficient in 10 years’ time. Now, imagine if you were clueless about this at the date you are seeking to claim your takaful?

The good news is, to keep your plan relevant, you don’t need to do much. For starters, seek out the help of a takaful advisor. He or she could help you understand a product so that you will be shielded, especially during uncertainties.

Next, ensure you are transparent with your advisor so that you can work out a proper plan either for you or your family. The last thing you want to do is spring a surprise on your advisor, because what you don’t tell, you can’t claim.