Here’s How You Can Pay Less On Your Loans Every Month

![]()

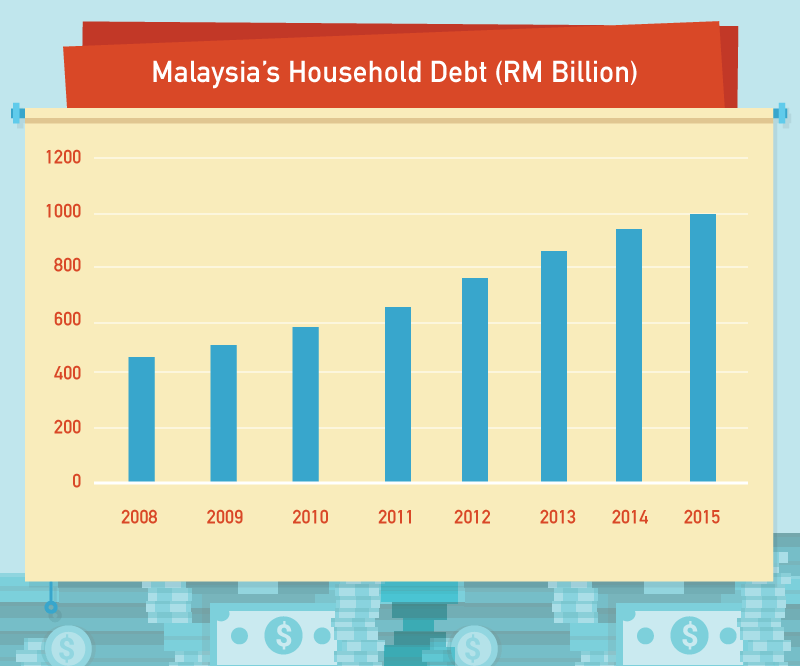

According to the Financial Stability and Payment Systems Report 2015 by Bank Negara Malaysia (BNM), Malaysia’s household debt-to-gross domestic product (GDP) ratio had increased by 2.3% to a whopping 89.1% last year. In fact, we have one of the highest debts in the region, alongside Thailand.

Household indebtedness has been on the rise in the past eight years. According to the latest data, it is at an frightening amount of RM1,010.8 billion!

Source: Bank Negara Malaysia

Malaysians find themselves borrowing extensively to fund their lifestyle that gets more expensive each year as the rising cost of living diminishes their purchasing power over the years.

Based on the same report by BNM, the biggest contributors to the high household debt in the country is residential properties, followed by personal financing, motor vehicles and non-residential properties.

Source: Bank Negara Malaysia

Unsustainable household debt and leveraged households can eventually choke consumer spending. As a result, consumer confidence will suffer. This can lead to stunted economic growth for the country.

What’s clear today is that Malaysian’s aren’t going to stop borrowing as the cost of living keeps going up. So while we can’t tell everyone to stop borrowing, what we can do is help you find ways to comfortably pay off your borrowings while also minimise your interest payments.

Tapping into your home equity

Bank Negara said that despite the elevated household indebtedness, the risks have eased due to the higher asset quality making up a huge chunk of the debt.

The value of properties in Malaysia has been increasing over the years, which means assets are growing in tandem with debts. The average house price in Malaysia has increased by 60% from 2010 to 2015.

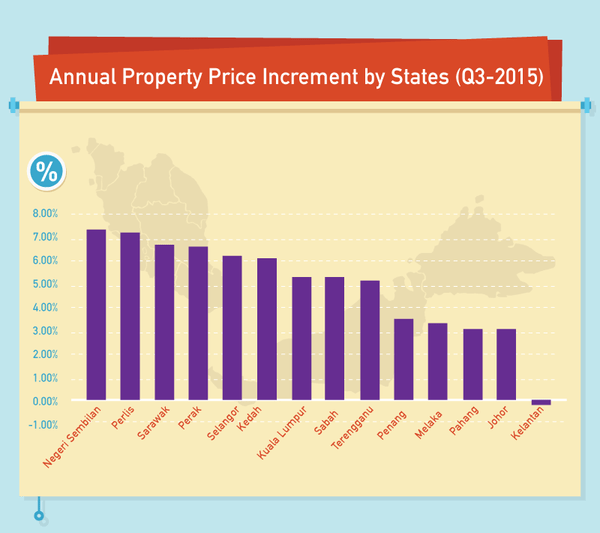

Source: Global Property Guide as of Q3-2015.

Based on the graph above, most residential properties in the country saw a hike in value in 2015. For example, the value of an average home in Selangor has increased by 6.20% per annum.

While homeowners are struggling to meet their mortgage payments and also keep up with the rising cost of living, many have overlooked the potential sources of extra cash from this growing equity.

But what is home equity? Home equity is determined by the loan-to-value (LTV) ratio of the home and the ratio requirements of the lender, such as the financial institution.

| Property price | RM450,000.00 |

| Annual increment of property value | 6.20% |

| Property value in Year 7 | RM685,621.00 |

| Total mortgage debt in Year 7 | RM414,082.00* |

| Loan-to-value ratio | 80% |

| Available equity | RM134,414.00 |

If the lender offers a line of credit for your home equity, this means RM134,414 will be available as overdraft for you at an agreed interest rate with the bank.

The smartest way to use your positive equity

Sounds like easy money? Making use of your home equity should be done prudently and only for a number of specific reasons.

A home loan overdraft facility allows you to borrow against the equity of your property at a pre-determined interest rate as well as repayment terms and conditions set by the bank.

Using your home equity should best be for things that can bring you returns or reduce your costs in the long run. One good example would be to consolidate your debts so you can save on interest, especially if they involve revolving and expensive credit facilities such as credit cards.

A home loan overdraft facility allows you to consolidate a few balances into a single credit facility, usually at a much lower interest rate. This doesn’t just simplify your life, it can potentially reduce your borrowing costs dramatically through a single lower interest rate and allowing you a longer tenure to pay off your loans. You also have the option to pay just the interest amount on the overdraft to give your finances more breathing room.

For example, if you have a few debts that you would like to consolidate into a cheaper loan, you can consider tapping into a home loan overdraft facility. Here’s how it works:

Total Debts

Interest Rate (p.a.) | Balance | Monthly Payment | |||

| Credit Card A | 11 months | ||||

| Credit Card B | 4 months | ||||

| Personal Loan A | |||||

| Personal Loan B | |||||

| Total | |||||

That’s a lot that you need to pay for each month! What if we told you that you could reduce your monthly repayment by 50% (or more)? Here’s an example of how debt consolidation could work in your favour using the Alliance Bank’s home loan overdraft facility at 6.88% per annum if we wanted to halve the monthly commitment:

| Total overdraft amount | RM100,000.00 |

| Interest rate | 6.88% p.a. |

| Repayment duration | 4 years 5 months |

| Monthly repayment | RM2,460.13 |

| Total interest incurred | RM30,386.67 |

So, what are the benefits and savings you stand to enjoy by consolidating your debts with an overdraft?

| Total repayment duration | 11 months | 5 months | 5 years and 6 months! |

| Total interest paid | |||

| Monthly repayment | |||

| Debt to income ratio* |

The best thing about consolidating your debts using a home loan overdraft facility is not just the interest savings, it’s the flexibility for you to adjust your repayment. On the months when money is tight, you can always reduce your repayment amount and stretch the repayment duration a little longer. You will not be able to do so if you consolidate your debt using a term loan, such as a personal loan, where you’ll end up incurring harsh fees for missing payments plus you’ll take hits to your credit rating.

Sometimes paying off debt seem to be an impossible mountain to climb. If you were to stick to the minimum payment each month, it would take six years and two months to settle one of the credit card bills in the example above. You can shorten your repayment period with an overdraft.

In the example above, the overdraft period is five years, but you can shorten that further by increasing your monthly repayment.

Letting the ball drop on your repayments can be a disaster. This is why debt consolidation is good for you as you will only need to deal with one lender, and make a single payment on one due date. This makes life so much simpler and easier.

Taking up a home loan overdraft like one offered by Alliance Bank comes with many perks beyond just the lower interest when you’re consolidating your debts:

Using your home equity to repay your debts will help you regain control of your finances. Doing so doesn’t just help you repay your debts at a cheaper cost and much faster repayment period, it also frees up your debt-to-service ratio (DSR). This improves your credit health, making it easier for you to apply for other credit facilities.

Sold on the idea of leveraging on your home equity to pay off your debt? A note of caution with using overdraft for debt consolidation: It takes discipline for it to work. If you are not prompt with your payment every month, you will run all your balances back up again and find yourself in worse shape than before.

Find out how much you can save by consolidating your debt using a home loan overdraft with this calculator.