A Little Flexibility Goes A Long Way In Managing Your Loans

Table of Contents

Loans are becoming a necessity to move forward financially in today’s economy. Taking on loans is not necessarily a bad financial move if you excel in managing them.

However, if your phone is ringing off the hook and your postbox is filled to the brim with bills asking you to pay up – then it’s definitely time to relook at your loans, and strategise on how to pay them off.

Most people would likely turn to debt consolidation plans. However, most of these consolidation plans come with a structured and rigid payment plan. If you are unable to commit to the payment plan, you will be brought back to square one.

For example, if you consolidate your debts or loans using a personal loan, here’s how your payment structure would be like:

| Credit card A: RM12,000 Credit card B: RM14,000 Personal loan: RM30,000 Total debts: RM56,000 | Loan amount: RM56,000 Interest rate: 7.90% per annum Loan tenure: 5 years Monthly repayment: RM 1,302 |

Most conventional debt consolidation plans require you to pay a fixed amount every month for a set period. In this example, you will have to consistently pay RM 1,302 every month for five years.

This may be able to help save some interest compared to not consolidating your loans. However, it may not work for everyone, and seeing it through to the end isn’t always an easy feat.

The cost of failing to pay your monthly installments

What happens if you are unable to adhere to the payment schedule of a conventional consolidation plan? Sometimes, life circumstances may derail our financial plan, which includes paying off our loans.

For example, an unexpected car breakdown, or a busted refrigerator at home would require additional big expenses that you may not be prepared for. These ad hoc expenses could affect your ability to service your loan, and if that happens, you could potentially miss a payment, or be late in your payment.

Both scenarios have their negative consequences. Late payment would, of course, result in interest charges or late penalty payment. Missed payment(s) on the other hand would result in your credit rating taking a hit. This means it may be harder for you to get another credit facility in the future.

With the steep living cost today, not many people are able to stick to a debt consolidation plan and in case of financial emergencies.

So, what do you actually need to do to ensure your loan repayment continues without a hitch until you are completely debt-free?

Manage your loans with a home loan overdraft

A home loan overdraft allows you to borrow money from an account that is linked to your housing loan. This takes place under a predetermined interest rate as well as repayment terms and conditions which have been set by the bank.

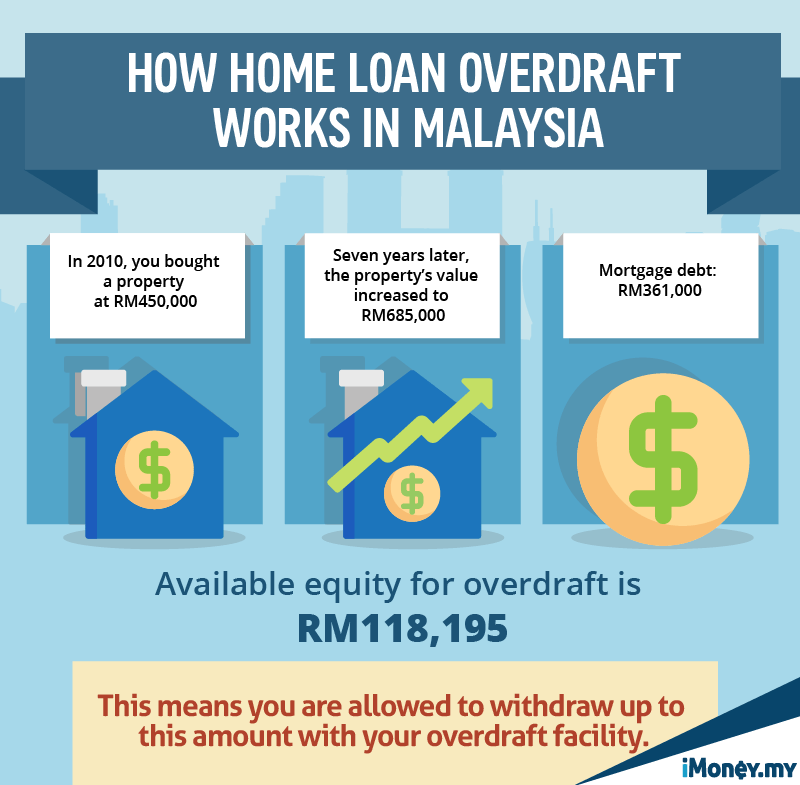

When you utilize the overdraft facility in a home loan, you are essentially borrowing against the equity of your property.

You can find out more about home loan overdraft here.

Make your loan repayments fit your budget

The best part about an overdraft is you don’t have to stick to paying a fixed amount every month. On months that you may be tighter financially, you can reduce your repayment amount. Similarly, on months where you have a bit more disposable cash, you can choose to increase your repayment amount.

Your repayment duration will adjust accordingly when you adjust your repayment – capped at the number of years left in your mortgage.

The Alliance Bank’s Alliance One Account allows you this flexibility when you consolidate your loans using this financing solution. The amount and repayment can be adjusted based on your income and property value.

For example, if you are withdrawing RM56,000 from your overdraft facility using the Alliance Bank’s Alliance One Account at 6.88% per annum, here’s how much you need to pay:

| Total overdraft amount | RM56,000.00 |

| Interest rate | 6.88% p.a. |

| Minimum monthly repayment | (RM56,000 x 6.88%)/ 12 months = RM321.00 |

Although you are allowed to spread your repayment over the tenure of your mortgage, you might want to speed up clearing off your loans by increasing your monthly repayment. Here’s how:

| Total overdraft amount | RM56,000.00 |

| Interest rate | 6.88% p.a. |

| Repayment duration | 5 years |

| Monthly repayment | RM1,105.70 |

By paying more on your monthly repayment, you are effectively reducing your repayment duration and interest charges in the long-run.

The beauty of this facility is you don’t have to stick to one or the other. You can choose to pay just RM321 on months that you need the additional cash for your expenses. However, when you are financially more stable and capable, you can increase your repayment for the overdraft.

An overdraft facility, being a revolving long-term credit facility, is not subject to any repayment as long as the amount used is within the credit limit – in this case, it is tied to your home equity. Compared to a personal loan, an overdraft is more flexible as it only charges interest on the outstanding amount, and not the withdrawn amount.

The ideal solution to manage your cash flow

Other than flexibility to the facility, there are many other reasons an overdraft facility makes sense for your loan consolidation. It is a fast and convenient option to gain access to fund(s) without having to apply for a loan. It also allows you to unlock the equity of a not-yet-fully-paid property to reduce your debts.

As cost rises, cash flow would inevitably become tighter. Instead of committing to a high loan repayment every month, you can seek for flexibility needed to pay your loans. Failing to commit to a loan consolidation plan will affect your credit rating or CCRIS report.

An overdraft facility offers you the balance of repaying your loan and the flexibility to manage your finances month to month.

However, it also requires more discipline. Without a structured payment schedule, borrowers have to ensure they are paying off their overdraft as best as they can to save on interest in the long run.

As with any financial decisions, it is best done once you have considered all the factors and costs involved. If you do have a mortgage with high equity, perhaps it is time to tap into it to give your finances a boost.

Interested to know more? Find out how much you can save when you consolidate your loans using this calculator, or read more about home loan overdraft.