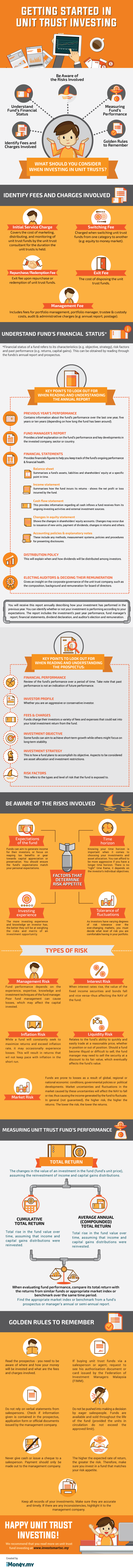

Getting Started In Unit Trust Investing [Infographic]

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

To most Malaysians, the term “unit trust investing” involves a few simple steps where one deposits money into a fund, and then patiently waits for an increase in value while forgetting about it. If only it were that simple, right? Well, the good news is unit trust investing is indeed not that difficult, and in this leaflet we are going to show you how to get started!

With hundreds of unit trust funds to choose from, how would you go about making an investment decision? As a general rule, always remember that unit trust funds work best as long-term investments. By understanding the nature of each fund and evaluating your own risk tolerance, you can select funds that provide either a regular income stream or capital growth, or a combination of both. By spreading your investment amongst different trust funds, you can create a unique unit trust portfolio that controls risks and generates potential returns. Now let’s get started!

Investors would also be affected by the 6% GST levied on the various investment products and services. Find out the affordability and viability of your investments post-GST!

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.