Why Gold May Be The Safest Bet To Protect Your Investment Portfolio

Table of Contents

![]()

With the spectre of a trade war looming ahead and geopolitical risks still on the minds of markets, gold prices have climbed recently fuelled by risk off flows in response to higher volatility.

Is it time for investors to turn bullish on gold?

Here we talk about the potential risks and rewards, as well as a smarter way to get into gold investing that you might not have heard of.

First, let’s talk about the good

Hedge against investment risks

One of the most famous benefits of gold is that it is a hedge, meaning it is an investment that offset losses in another asset class. Investors flock to gold to hedge against the decline of a currency, usually the US dollar.

One of the most famous benefits of gold is that it is a hedge, meaning it is an investment that offset losses in another asset class. Investors flock to gold to hedge against the decline of a currency, usually the US dollar.

It is also a defence against inflation. For example, the price of gold more than doubled between 2002 and 2007, from US$347.20 to US$833.75 an ounce. That’s because the dollar’s value (as measured against the euro) fell 40% during that same period.

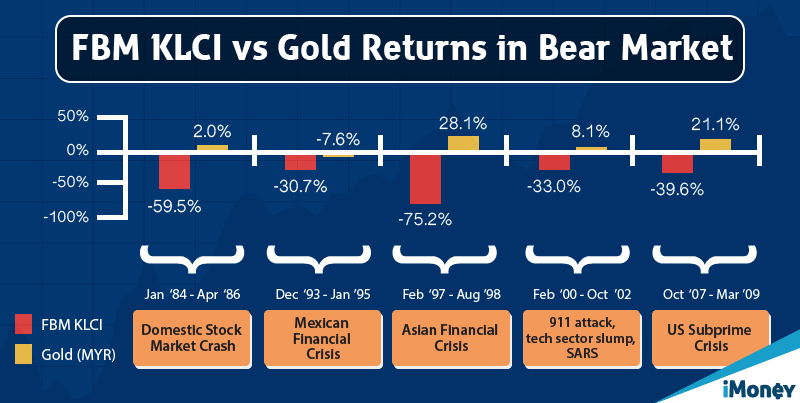

Also some researchers have found that gold hedges well against a potential stock market crash and is a safe haven against extreme market conditions, such as geopolitical flare-ups, and economic instability.

For example, many bought gold during the 2008 financial crisis and prices continued to skyrocket in response to the infamous Eurozone crisis.

There’s also diversification

That’s the goal of any investor and gold can play a part as an effective portfolio diversification tool. Contrary to what some might think, an ideal portfolio isn’t one that does not incur any losses at all. That would be impossible to achieve.

But, rather a diversified portfolio with a suitable blend and mix of asset-classes, coupled with an asset allocation strategy tailored to meet their investment objectives and risk-appetite comes pretty close to what can be called as ‘ideal’.

A more aggressive investor would often devote the bulk of their portfolios to stocks and fill out the remainder with fixed income, and possibly leaving some room for holdings such as real estate, REITs and commodities. Whilst this is a good start to building a diversified portfolio, investors must also consider how these asset-classes move in relation to each other which brings us to the next benefit of gold.

And low investment correlation

Metals, including gold, fit into a completely separate category from traditional stock-market investing. According to Investopedia, precious metals have been more volatile than the stock market but their ups and downs have occurred at opposite times.

For example, during the economic malaise of the late 1970s, which was marked by a stagnant stock market and runaway inflation, gold prices went higher than US$2,000 per ounce and silver tipped US$100 per ounce.

But during the late 1990s, during the stock-market boom, gold dropped below US$350 per ounce and silver to a paltry US$6 per ounce. Precious metals then experienced a resurgence between 2007 and 2011, when investors flocked back to gold due to its characteristics as a safe haven to seek shelter from a plummeting stock market and weakening US dollar.

Now, for the bad

It is illiquid

While gold is a wonderful long-term investment, it is not the best way to store your funds in the short-term.

For example, when you are buying physical gold, you are purchasing it from a dealer, meaning paying slightly over the market price of gold at that time.

The process is the same when you want to sell gold, and dealers usually pay a little less than the market price when they are buying your gold, because they consider it their commission.

A rush to sell that block of gold may lead you to putting with receiving less money for your investment than the going market rate. The only way to overcome this is to always diversify your investments.

But it remains clear that for short-term investments, liquidity will always be a problem.

And there’s no broker assistance

Usually, brokers do not fancy gold investments because they are not allowed to deal in physical gold.

If you are getting all your investment money managed by a broker or through a brokerage, it is troublesome to find a separate dealer for gold. In fact, you’ll need to do some legwork to find a reputable gold dealer.

Investing through a gold savings account

Because gold has been in vogue for some time, some have resorted to opening a gold investment account as a fast, convenient and easy way to invest in the commodity.

A minimum purchase is required and this varies from bank to bank. But it is an easy and convenient way to invest in gold: Investors can do this online by purchasing a minimum amount when the price of spot gold reaches their target amount.

Investors also can sell their positions when they feel it’s the right time or you need money to fund another type of investment.

However, the drawbacks are that you can never take physical possession of the gold, so a major financial collapse can wipe out your investments.

There’s also the stigma attached to this method of investing, where one would feel more secure if they were to purchase and hold on to physical gold as opposed to investing in “phantom or paper-backed gold”.

A year-on-year comparison of gold prices. This chart shows that prices have remained relatively stable, making it a good commodity to have in one’s portfolio. Chart by Bloomberg.

But there’s also gold exchange-traded funds

By combining the best of its attributes, gold exchange-traded funds provide investors a low-cost and efficient entry point to gain exposure to gold and its hedging characteristics, whilst also addressing the issue of liquidity and ease of transacting.

This option is also backed by physical gold as well as certificates that acknowledge the amount or share of gold you own through the fund. The main benefit here is that you can easily buy or sell shares over the counter since it is listed, making them highly liquid investments.

For example, the TradePlus Shariah Gold Tracker by Affin Hwang Asset Management is a commodity exchange-traded fund that provides investors a Shariah-compliant avenue to invest in physical gold without the hassle of storing or insuring gold bullion.

The fund aims to provide returns that closely track the performance of its referenced index, which is the LBMA Gold Price AM.

Information summary of the Fund:

| Name of Fund | TradePlus Shariah Gold Tracker |

|---|---|

| Investment Objective | To provide investors with investment results that closely track the performance of gold price |

| Benchmark | LBMA Gold Price AM |

| Asset Allocation | The Fund will invest a minimum of 95% of the Fund’s net asset value (NAV) in physical gold bars, with the remaining balance invested in Islamic money market instruments and/or Islamic deposits for liquidity purposes. |

| Annual management fee | 0.30% p.a. |

| Annual trustee fee | 0.06% p.a. (excluding custody fee and charges) of the NAV of the fund calculated and accrued daily using the fund’s base currency. |

| Annual custody fee | 0.20% p.a. of the value of the gold bars held with custodian, accrued daily and payable monthly using the fund’s base currency. |

| Quarterly license fee | 0.0075% of the Peak AUM, subject to minimum of US$250 and a maximum of US$10,000. |

| Brokerage fee | <1% brokerage fees apply (depending on brokerage firm), including clearing fees and stamp duties where applicable. |

Why this is the right time to go gold

Investments are volatile creatures. When economies slide due to slowing growth or geopolitical rifts, your investments usually take a beating.

Investments are volatile creatures. When economies slide due to slowing growth or geopolitical rifts, your investments usually take a beating.

A savvy investor knows that while this is out of his or her control, one way to minimise the risk is to diversify into asset classes that are inversely or less correlated, meaning you want a significant portion of your investments to move the opposite direction.

The best example here has to be gold. It acts as an insurance for your portfolio: you buy them in case things go south.

And an ETF tracking a gold index gives you a low-cost option to own some without the burden of trading an illiquid commodity.

Sure, it’s still not exempt from the general investment risks that exist with any managed fund, but it has been a world-beater in providing investors some protection when things go wrong.

Diversify your portfolio!

Go to TradePlus Shariah Gold Tracker by Affin Hwang Asset Management for more information.

Warning statement

A Prospectus is available for the TradePlus Shariah Gold Tracker, and investors have the right to request a copy of it.

Investors are advised to read and understand the contents of the Prospectus dated 28 November 2017 before investing. The Prospectus has been registered with the Securities Commission Malaysia, who takes no responsibility for its contents. A copy of the Prospectus can be obtained at Affin Hwang Asset Management Berhad’s sales offices.

As with any forms of financial products, the financial product mentioned herein carries with it various risks. Investors are advised to consider the general and specific risks involved as stipulated in its Prospectus before investing. There are also fees and charges involved when investing in the fund, and investors are advised to consider the fees and charges carefully before investing. The price of units and distribution payable, if any, may go down as well as up and past performance of the fund should not be taken as indicative of its future performance.