5 Hidden Costs In Selling Your Property

Table of Contents

Selling a home can be a headache – but it is a good problem to have. However, before you start counting the money you will make from the sale, there are a few hidden costs in selling your property.

Aside from considering whether to make repairs and renovations to the home before selling it, you should also consider the cost of selling that property.

Home repair/Renovation fees

The sole purpose of sprucing up your home before selling is to net more money from the sale. While sellers are often reluctant to spend time and money on a property that will soon be out of their hands, it has been proven time and again that sellers who properly repair their homes for sale often reap benefits of a quicker sale and at a higher value.

Fixing up your home for sale doesn’t have to cost a bomb, but you must know how to effectively allocate your resources for maximum results.

For example, a kitchen with broken tiles and a chipped countertop may look unappealing to prospective buyers. However, to completely remodel your kitchen before selling it does not quite make financial sense. A cosmetic facelift is a more realistic solution as it requires a minimal expense, and will help you achieve the desired effect. New paint, floor coverings and light fixtures have all been known to bring high returns for minimal costs.

Structural defects such as rusty pipes are a little trickier to fix. When facing such issues, you will need to assess if you will come out better if you fix the structural defects, or if you offer it at a lower price as is.

For instance, if the repairs cost RM15,000, but will likely result in a RM20,000 higher valuation sale price, you would want to do it. If the projected post-repair price is only RM10,000 higher, forget it.

Real estate agent commission

Perhaps the most important people to engage when putting your home up for sale are real estate agents.

A real estate agent will help you price and market your property, arrange for viewing and bookings, and negotiate with prospective buyers on your behalf. In return, they earn a commission of typically 2% – 3% of the property’s selling price, which is subject to 6% service tax.

Get the most out of your money by engaging the right property agent. Find out how you can do that here.

DIY-selling costs (optional)

You can potentially save up to thousands of Ringgits on processing fees if you choose to forgo an estate agent and forge on the DIY-selling route.

However, it is important that you do it right to get the best result. To do this, you need to first establish the value of your house. There are many companies around that provide property valuation services, though they will incur a cost.

[sc:sample_banner]

Below is a rough guide of the current valuation fees structure in Malaysia (actual charges may vary according to companies):

Valuation Fees Rate in Malaysia

| For first RM100,000 | 1/4% |

| Next residue up to RM2 mil | 1/5% |

| Next residue up to RM7 mil | 1/6% |

| Next residue up to RM15 mil | 1/8% |

| Next residue up to RM50 mil | 1/10% |

| Next residue up to RM200 mil | 1/15% |

So for example, if your house value is at RM500,000, the valuation fees calculation would come up to this:

| House value: RM500,000 First RM100,000 = RM100,000 x 0.25% = RM250 Residue = RM400,000 x 0.2% = RM800 Total valuation fees = RM250 + RM800 = RM1,050 |

|---|

Of course, there are no rules that say that you need to get your property formally valued. Although not the most accurate measure, you should be able to get a pretty good gauge of how much your house is worth by comparing how much other houses in your area are selling or have sold for.

Once you’ve done this, aim to get maximum exposure for your sale advertisement. One of the easiest way to do this is to put up your ad online, where the bulk of home searches are initiated today.

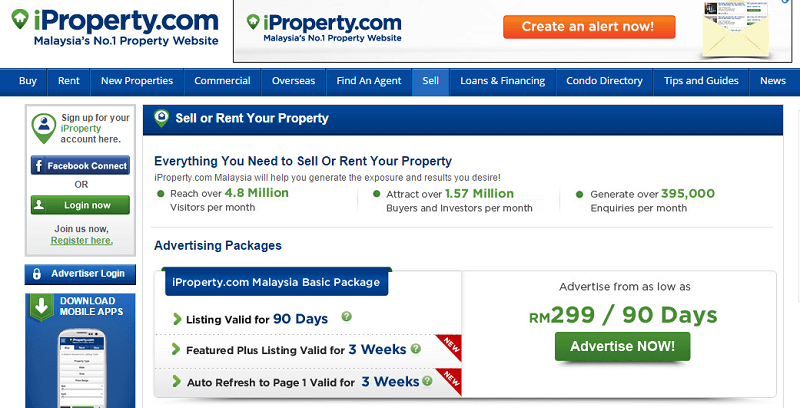

Some websites or social media platforms let you create ads instantly for free, while others require a fee. For example, it will cost you roughly RM299 to put up your ad on iProperty for three months.

Depending on your target demographic, paying for ad space on property-specific sites may help you reach your desired audience and achieve quality leads faster.

Of course, you can choose to skip this step entirely too, but doing so will likely result in you getting limited exposure and could delay the sales transaction of your property.

Legal fees

Once you have found a buyer, next comes the legal matters which will require the expertise of a lawyer. When you and the buyer have come to an agreement, the buyer will pay you a non-refundable deposit (also known as booking fee) amounting to 2% of the property’s selling price.

This is when a lawyer comes into the picture. The lawyer will be tasked with drafting the Letter of Offer and then the Sale and Purchase Agreement (SAP Agreement).

For the services rendered, the lawyer will charge you a legal fee which is calculated based on the property’s selling price. For example:

Using the example above, the total legal fees payable amounts to:

Real Property Gains Tax (RPGT)

This is where the bulk of the cost. Real Property Gains Tax (RPGT) is a tax imposed by the government when you dispose of a property within five years from the date of purchase. With that said, RPGT is not applicable if you have held the property six years or more.

RPGT is charged only on net gains, meaning the sum after deducting the original purchase price of the property, cost of renovations done to the property, and other costs such as legal cost. In other words the net gain you made from the sale.

With effect from Budget 2014, RPGT rates have increased to curb the activity of local and foreign property flippers. The new RPGT rates are as follows:

However, RPGT can be exempted for one unit of residential property per Malaysian citizen or permanent resident, or if the disposal of property is between parent and child, husband and wife, and grandparents and grandchildren.

The table below illustrates the net profit you will gain from the sale of your property after taking into account all the aforementioned costs.

For information on how RPGT affects property investors, go here.

While the calculations above show an estimate of the cost you can potentially incur in a sale of property in Malaysia, it is not exhaustive.

Not familiar with RPGT, DIBS and GST? This infographic will explain to you how RPGT, DIBS and GST can affect you and your property.

Buying and selling property in Penang? Find out about Penang’s new housing regulations here.

* This article was updated on August 7, 2015.