Guide To Using LHDN e-Filing To File Your Income Tax

So, how to file income tax? Taxpayers can start submitting their income tax return forms through the LHDN e-Filing system starting from March 1 of every year, unless otherwise announced by LHDN. This method of e-Filing your income tax is becoming popular among taxpayers for its simplicity and user-friendliness. For first-time users, the task can be quite daunting and complicated, which is why an e-Filing guide will be very useful for you.

Unlike the traditional income tax filing, where you have to print out the income tax form and fill it in manually, the e-Filing income tax form calculates your income tax for you automatically. So, questions like “How to calculate my income tax” will not stop you from getting your income tax returns.

Filing your tax through income tax e-Filing also gives you more time to file your taxes, as opposed to the traditional method of filing, where the deadline is usually on April 30.

If this is your first time filing your tax through e-Filing, don’t worry, we’ve got your back with this handy guide on e-Filing.

1. How to apply to file my income tax online for 2024?

If you have never filed your taxes before on e-Filing income tax Malaysia 2024, go to mytax.hasil.gov.my and click on the e-Daftar button. You will then be asked to fill in an online form and upload some verification documents. The form will need to be printed out and taken to your nearest LHDN branch – where you will be given a first-time login PIN.

2. Login to MyTax

Once you have your new PIN, navigate to the new MyTax website and login using the First Time Login option. You will then be asked to create a new password for your new online account (make sure it’s a secure one), which you can use to login to the LHDN’s income tax e-filing page.

3. Start e-filing

Click on the menu ezHasil services menu on the top-left-hand side of the screen. This should give you a list of all relevant ezHasil’s centralised tax services. The option you want to select is “e-filing”. Once the new page has loaded, click on the relevant income tax form for the year. This option may vary depending on what type of income tax you are filing, and you can refer to this table to help you figure out what to look for:

Submissions and deadlines

(e-E) | ||

carry on business | (e-BE) | |

on business | (e-B) | |

(e-P) | ||

(Knowledge Worker/ Expert Worker) | (e-BT) | (For those who do not carry on any business) June 30, 2024 (For those who carry on any business) |

(e-M) |

||

(Knowledge Worker) | (e-MT) |

4. Update your details

Now you’re ready to start filing your income tax! The first step is to review your personal details. You can change some of them if you need to, especially if you recently updated your passport or got married (or divorced).

5. Add more details

The second step is to review a few more details about yourself. You will also need to declare whether or not you sold any taxable assets, which would fall under the Real Property Gains Tax (RPGT) Act, at this step. You can also declare any tax incentives you have received at this step.

6. Provide your income details

Fill in the form with your income information according to the relevant categories.

You can then declare any donations or gifts that you have received. Refer to our tax deduction section to understand more about this deduction. Remember, you must ensure the organisation you donate to is approved by LHDN. If unsure, you can check the status of the charitable organisation on LHDN website.

Check if the total monthly tax deductions (MTD/PCB) displayed are correct. You can find this information in the EA Form provided by your company.

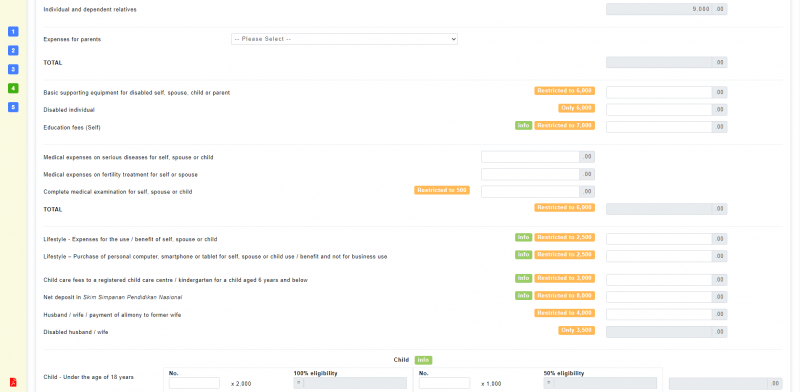

7. Tax relief

This is where you declare your purchases from last year that provide tax relief. Unlike previous years, the new e-filing form will actually provide you with additional information on each relief if you hover your cursor over the green ‘Info’ button. The maximum amount of relief you can claim under each category is also listed in an orange box for easy reference.

Regardless of what you claim, remember to retain the proof of purchase of that item for at least seven years.

8. Check your summary

Once you have filled up all the reliefs and rebates, the system will automatically calculate your taxes and you will know if you have balance or excess in income tax payment.

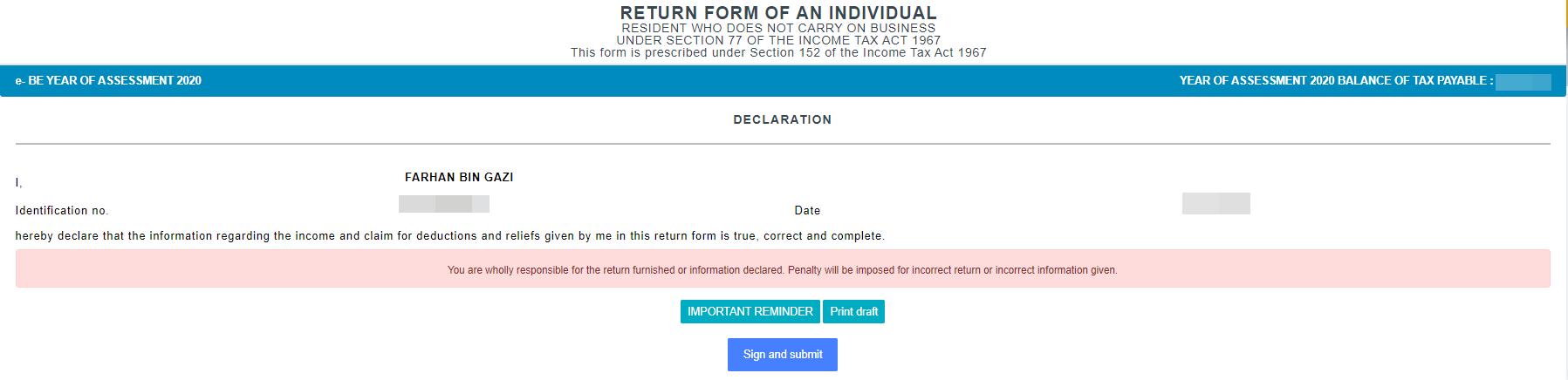

9. Declare, sign and send

The final step is to declare that all the information provided is true. This is done by simply clicking on the ‘Sign and submit’ button on the final page. Once you do, you will be asked to sign the submission by providing your identification number and MyTax password.

That’s all! It may seem intimidating to use e-Filing form at first, but it really is easy to do. Those who did not own a computer or have Internet access could head to the special computer counters at LHDN branches.

Now that you have filed for your income tax if you need to pay for tax, here’s what you need to know about how to pay income tax in Malaysia.