Investment Guide: Are The Rewards Worth The Risk?

Table of Contents

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

When it comes to investing, every investor should first pay attention to the two R’s — Risk and Reward.

Investing is not without its risks. And usually, the higher the risk, the higher the potential return or rewards.

However, it is this very concept of risk and rewards that sometimes keeps people away from investing. However, with the rising cost of living, investing has now become a necessary tool to help keep pace with one’s financial goals.

Here are some questions you should ask yourself before taking on the risks involved in investing:

What’s the risk/reward ratio?

Investors use the risk/reward ratio to compare the expected returns of an investment to the amount of risk undertaken to capture these returns. Though ‘risk’ itself can’t quite be quantified since it is made up of many and sometimes intangible factors, the best you can do is to quantify the risk in the form of losses.

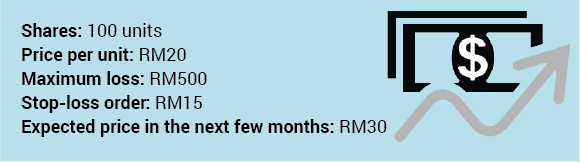

Here’s how to calculate the risk/reward ratio:

In this case, the investor is willing to risk RM5 per share to make an expected return of RM10 per share after closing her position. The ratio is RM5 over RM10 — 1:2 risk/reward ratio on this particular trade. Now that the real numbers can be seen and are quantifiable, you should be able to determine if a particular investment is really worth going for.

When should you start investing? Yesterday!

The average person dreams of becoming wealthy, or at the very least, have enough to live a secure and comfortable lifestyle all the way through their golden years. If one has a job, how would one work to achieve that? Work hard, earn more and spend nothing? The sad reality is it is not that easy or straightforward.

You need to fortify your money with the right investments and as early as possible.

Time is indeed money, and this will explain why:

Based on the above example, both Mr. A and Mr. B will be investing a total of RM15,000 – Mr. A’s investment will be spread over 15 years at RM1,000 a year, while Mr. B’s investment will be slightly higher every year, at RM1,500, over 10 years.

What would you stand to lose?

One potential loss that people sometimes fail to take into account is opportunity cost. For example, if RM5,000 were spent on a designer handbag, most people would be aware of the direct cost (of paying for the bag), but often disregard the indirect cost associated with the purchase.

Opportunity cost means the cost of foregoing another choice when the decision was made. As household incomes become more stretched to the limit, the principle of opportunity cost is quickly becoming an essential consideration when planning an investment budget.

For the sake of illustrating the opportunity cost in this example, let us assume the designer bag loses an estimated 10% of its value yearly.

Over three years, the value of the bag could have depreciated by RM1,355.

Most people understand the direct cost of their actions. However, the unseen costs could be something more important to take into consideration. Similarly with investing, being aware of opportunity costs is critical in order to make the best investment decision possible.

What can you potentially gain?

We all have financial goals that we want to achieve — whether in the next year, three years, or even 30 years.

Want to retire in the Caribbean without any worries? You need money for that. Putting aside some money in your savings account religiously can barely help you retire in a small village in Malaysia — let alone in the Caribbean!

Here are the differences between putting your money into a savings account versus an investment:

There is only one way to safely plan your financial goals – by establishing a solid investment portfolio.

By playing your cards right, you can potentially achieve most (if not all) of your financial goals.

The factors that will determine the success of your portfolio are:

The above factors are applicable for investment instruments that use the compounding interest calculation. However, for capital gain, your return or loss will be from the sale of your investment.

For example, if you bought 100 units of shares at RM20 per unit, and you decide to sell when the price is at RM25 per unit, you would have made a cool RM500. However, if you sell when the price drops to RM10 per unit, your loss would have amounted to RM1,000 .

If you have a low risk appetite, opt for a lower risk investment, with a lower projected rate of return. To compensate for this, consider increasing the amount and length of time invested.

Therefore, identify and decide on your own risk tolerance, then use it to construct an investment strategy.

There are many ways to minimise your investment risks, such as:

- Understanding how the investment product of your choice works and what are the risk factors involved.

- Doing your homework before investing. Find out about the fund or the company’s historical performance and understand the industry and market to be able to make an educated decision on your investment.

- Diversifying your investment by investing in different types of products and industries.

- Reviewing your portfolio periodically to ensure that it still matches your objectives and goals, and can adapt to the current market condition.

The world of investment is vast, and in this day and age, failing to carefully consider all your options will prevent you from achieving your financial goals.

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.

[sc:leadform-fa]