Investment Guide: Taking “Stock” Of GST

Table of Contents

This article is sponsored by Securities Commission Malaysia, under its InvestSmart initiative.

The GST has replaced the current Sales and Service Tax as part of the Malaysian Government’s tax reform initiative to enhance the capability, effectiveness and transparency of tax administration and management. Fixed at a standard rate of 6%, the GST is levied on goods and services across the various stages of production and distribution, from the manufacturer right down to the consumer. Investment products and services are a form of goods and services and are thus subject to GST treatment. The illustration of how GST will be applied to you as an investor follows.

Share-trading, unit trust and REITs investors

Collective investment schemes such as unit trust funds and real estate investment trusts (REITS) are managed by fund managers who provide various management services for the investor. For unit trusts, fee-based services such as the sale or transfer of units as well as trustee services, would incur GST. As for REITS, charges on property, lease and marketing management services are subject to GST. Brokerage commissions or clearing fees are also subject to GST at a standard rate. In share trading, services offered by banks such as arranging, structuring and underwriting equity issuances, the placement and trading of shares, and advisory, custody and nominee services are subject to GST.

As a consequence, the cost of owning a share or fund would rise. This also means that your shares or funds will need to produce higher yields in order to make up for all the charges and fees paid, as well as GST expenses.

To illustrate, let’s assume that the management fee of an investment management firm is 1.8%. Having invested RM100,000 on any one product, you will be paying RM1,800 annually on management fees alone. Adding the 6% GST to the picture, you will now need to pay RM1,908 instead.

Statutory Managed Funds

Statutory Managed Funds

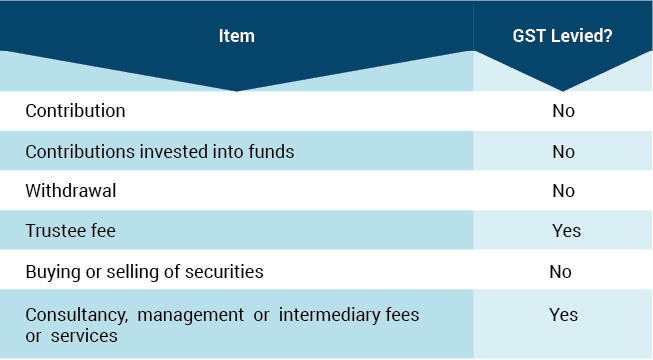

Those who invest their money in the EPF would be subject to GST due primarily to the fund management services provided.

The same applies for private sector managed funds such as retirement plans offered by banks, investment and insurance companies.

Investors are always urged to understand all investment costs and charges applicable before deciding to invest their hard-earned money. There is a need to ensure that investments will yield sufficient returns, even after deducting the necessary fees and charges. With the implementation of GST on the horizon, this becomes even more important as investors will be paying more in terms of costs and charges, thus reducing actual profits.

Being aware of the extra fees and charges you incur for each investment allows you to manage your total transaction costs and maximise return on investment. Knowing the applicability of GST on your investments will enable you to make informed investment decisions for a brighter financial future.

© Securities Commission Malaysia (SC). Considerable care has been taken to ensure that the information contained here is accurate at the date of publication. However no representation or warranty, express or implied, is made to its accuracy or completeness. The SC therefore accepts no liability for any loss arising, whether direct or indirect, caused by the use of any part of the information provided. The information provided is for educational purposes only and should not be regarded as an offer or a solicitation of an offer for investment or used as a substitute for legal or other professional advice. For enquiries regarding sharing, republishing or redistributing this content please write to: admin@investsmartsc.my.