Malaysians Can Now Use LHDN’s e-Invoicing Portal, MyInvois

It has just been announced that the Inland Revenue Board’s (LHDN) MyInvois portal can now be accessed for e-invoicing.

The statement that was released by LHDN said that the availability of the MyInvois portal proves the agency’s commitment to ensuring the implementation of e-Invois runs smoothly, especially among Phase 1 taxpayers who are required to use it from 1 August.

Read More: LHDN’s e-Invoicing Implementation Timeline

e-Invoicing timeline

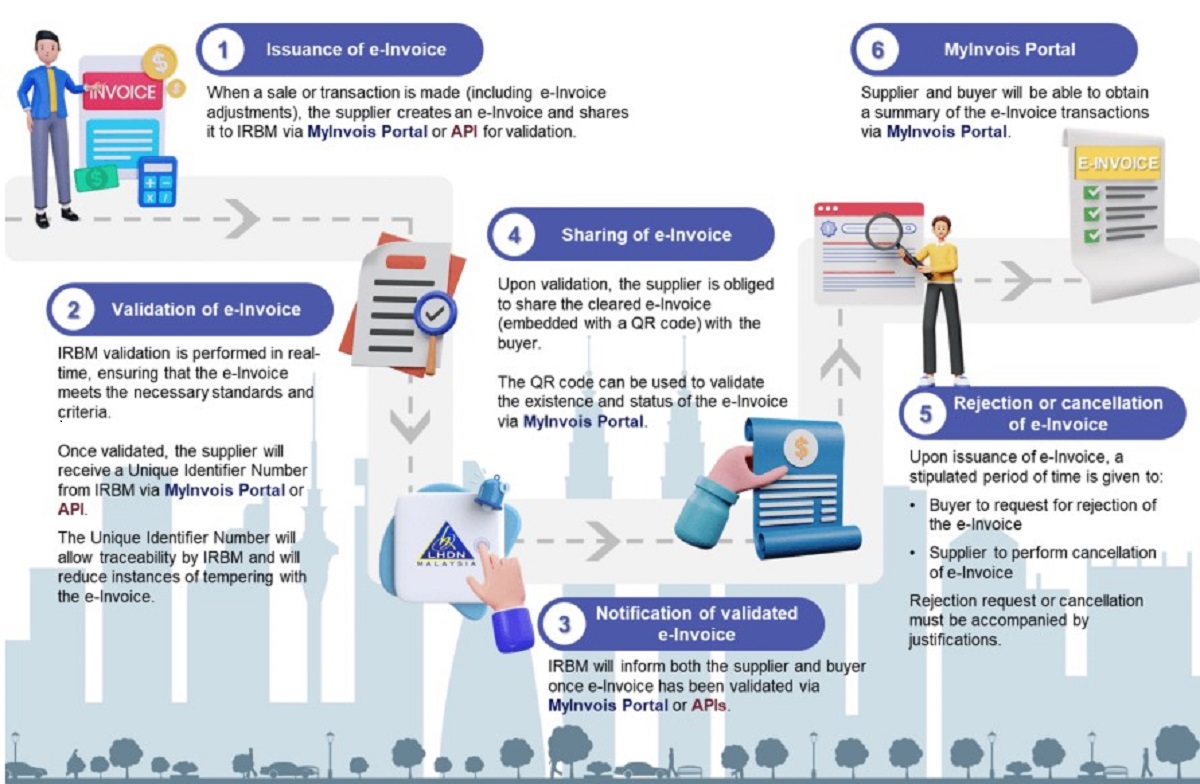

Through this latest development, taxpayers can submit eInvoices to the LHDN through two methods. Taxpayers can use their Application Programming Interface (API) Integration (for companies with their own software systems). Otherwise, they can directly use MyInvois portal which can be accessed for free at https://mytax.hasil.gov.my.

LHDN e-Invoicing guidelines

The statement also mentions that the eInvois General Guidelines (Version 3.0) and eInvois Specific Guidelines (Version 2.2) have been uploaded on the e-Invois microsite on the LHDN portal via the following link: https://www.hasil.gov.my/e-invoicing. These can be used as reference and guidance for taxpayers.

“Software Development Kit (SDK) Version 1.0 has also been updated with the latest function, which is digital signature verification,” said the statement.

Digitalise tax administration

Currently, the government has plans to implement the eInvoicing system in stages. The aim is to improve the efficiency of tax administration management in Malaysia.

This falls in line with the current 12th Malaysia Plan, where one of the main focuses is to strengthen digital service infrastructure and digitalise tax administration.

e-Invoicing will also enable near-real-time transaction verification and storage, catering for business-to-business (B2B), business-to-consumer (B2C) and business-to-government (B2G) transactions.