Here Are The Five Successful Applicants For Digital Bank Licences In Malaysia

Bank Negara Malaysia (BNM) has just announced that five applicants have been successful in obtaining digital bank licences as approved by the Minister of Finance Malaysia.

The following applicants are to be licensed under the Financial Services Act 2013 (FSA):

- a consortium of Boost Holdings Sdn. Bhd. and RHB Bank Berhad;

- a consortium led by GXS Bank Pte. Ltd. and Kuok Brothers Sdn. Bhd; and

- a consortium led by Sea Limited and YTL Digital Capital Sdn Bhd.

The following applicants are to be licensed under the Islamic Financial Services Act 2013 (IFSA):

- a consortium of AEON Financial Service Co., Ltd., AEON Credit Service (M) Berhad and MoneyLion Inc.; and

- a consortium led by KAF Investment Bank Sdn. Bhd.

These successful applicants will be required to contribute to increase financial inclusion by offering goods and services that will help close market gaps in underserved segments.

Of the five consortiums, three are majority-owned by Malaysians. These include Boost Holdings and RHB Bank Berhad, Sea Limited and YTL Digital Capital Sdn. Bhd. and KAF Investment Bank Sdn. Bhd.

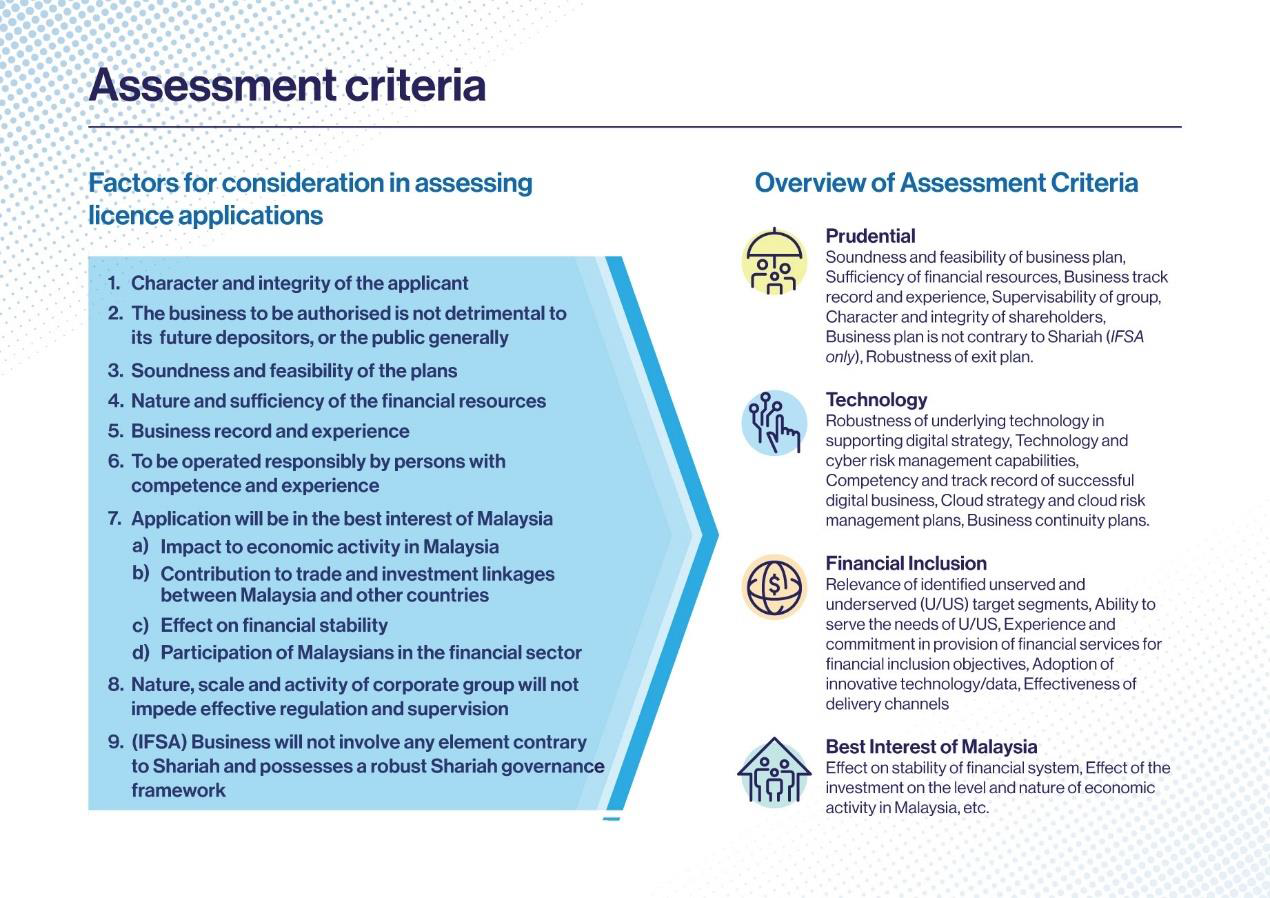

All 29 applicants were thoroughly screened and assessed with respect to section 10 (1) of FSA, and IFSA which require BNM to consider all the factors in Schedule 5 of the Acts and other relevant policy requirements. Applicants were assessed based on a wide range of criteria, along with their individual merits. The list of assessment criteria is as follows:

Source: Bank Negara Malaysia

According to BNM, each applicant underwent four levels of assessment, supported by a cross-functional technical team, a review team and internal independent observers from BNM’s risk and legal departments. The final recommendations to the Minister were deliberated and endorsed by BNM’s Management Committee.

“Digital banks are expected to further advance financial inclusion. By adopting digital technology more widely for everyday transactions, we can significantly increase opportunities for our society to participate in the economy – by overcoming geographical barriers, reducing transaction costs and promoting better financial management,” said Bank Negara Malaysia Governor Tan Sri Nor Shamsiah.

“Digital banks can help individuals and businesses gain better access to more personalised solutions backed by data analytics. As businesses move online, digital banking also provides a safer and a more convenient way to transact,” she added.

Before beginning their operations, the successful applicants will be subjected to a period of operational readiness which will be validated by BNM via an audit. This process is expected to take between 12 to 24 months.

In line with the 5 strategic thrusts stated in the Financial Sector Blueprint 2022-2026, BNM will continue to work with the financial and fintech industries and relevant stakeholders to continuously enhance access to financial services throughout the country and across all segments of society.