Why Rent-to-own Scheme May Not Be For Everyone

Table of Contents

Property prices have risen to be 4.4x the median income, making the dream of owning a decent property quite out of reach for most Malaysians.

This automatically drives up upfront costs such as down payment and transactional costs like legal fees and stamp duty for the buyer.

Feeling the increasing financial squeeze due to the unrelenting housing market and high cost of living, the middle-income Malaysians are finding it hard to purchase their first home, or even upgrade their existing home.

If you are saying that the first step to home ownership is discipline and hard work, we are here to burst your bubble – it’s not as simple as that.

Let’s take one of the residential developments under HouzKEY, for instance. It is a 760-square-foot, two-bedroom unit which costs about RM448,000.

This means, if you are purchasing the unit via a traditional mortgage route, you will need to cough up RM44,840 just for the down payment and don’t forget the transactional costs, such as stamp duty, legal fees and more.

With the housing withdrawal facility available from the Employees Provident Fund (EPF), you may think it is easy to save for the upfront cost – but you may be sorely mistaken.

Using the EPF savings calculator, we determine how much a typical Malaysian would have in their Account 2 savings.

If your current salary is RM5,000 and you’ve been working since you were 22 years old with a starting salary of RM2,700, your estimated savings in Account 2 would be RM30,000 at age 35.

This is assuming a 5% annual salary increment and 6% average EPF dividend per annum. That only makes up 63% of your down payment.

Even if you were earning a decent salary, saving up such a large amount of money is difficult due to statutory deductions and the unforgivingly high costs of living.

If you saved 10% of your salary every month, it would take more than five years to save up just the 10% down payment of a RM448,400 property. Let’s take the mean salary of a middle-income household in Malaysia, which is RM6,502 per month:

Unfortunately, we don’t jump into the workforce with that kind of salary. If you start saving with a salary of RM2,700 a month, then it would probably take you much longer than five years to reach the target amount of RM44,840.

However, by the time you save up for the down payment, the property price would have skyrocketed to RM654, 279, which means you would need an extra RM20,588 just to meet the down payment.

Enter HouzKEY – a rent-to-own-scheme

Maybank introduces its RTO scheme to cater to this segment of the society – HouzKEY. HouzKEY allows the renter/buyer to rent a home for 12 months and after that, he/she has the option to purchase the home anytime at the pre-agreed price. While a rent-to-own (RTO) scheme may seem like a new concept for Malaysians, it has been implemented overseas. For example, Home Partners Of America, for those in the United States, is similar to HouzKEY – it’s a scheme that allows rental tenants to purchase a home within five years of renting.

Here are some of the benefits that HouzKEY offer:

-

Low entry cost

Instead of forking out a 10% down payment and additional transactional fees upfront like you would with a traditional mortgage, you only pay a three-month security deposit to secure a property with HouzKEY.

Moreover, the transactional costs (stamp duty, legal fees, etc.) are absorbed into the financing amount and will be part of your monthly repayment. Thus, the initial costs are much lower than the costs associated with a traditional mortgage.

-

Lock in pre-agreed price to enjoy appreciation of capital

After the 12 months rental period, you have the option to purchase the property at the pre-agreed price at any time. This means that even if the property price appreciates (which is typically the case), you get to purchase the property at the price that was agreed upon. In short, you get to enjoy the appreciation of capital without paying the hiked-up amount.

This fact is demonstrated in the graph below, which shows the property price appreciating significantly throughout the years, while HouzKEY’s purchase price for the same property remains affordable. Hence, when you decide to migrate to mortgage with the scheme, you can get more for less!

*Based on House Price Index (HPI) Compound Annual Growth Rate (CAGR) 6.30%

-

Pooling income with up to three guarantors

One of the problems people face with purchasing a property is their inability to get approval for the loan/financing amount that they require. With HouzKEY, they can enter the scheme by pooling in income with three other guarantors. Guarantors can be family members like a spouse, parents or siblings. The total income of all the guarantors will be considered when you apply for HouzKEY.

-

Exemption of MOT and stamp duty

Maybank will offer to convert the outstanding to Maybank mortgage seamlessly without any other further upfront cost required. Memorandum of transfer (MOT) and stamp duty on the Sales and Purchase Agreement (SPA) is also exempted at this leg.

HouzKEY versus conventional mortgage

(including transactional costs) | ||

**Calculated using this calculator. Transactional costs include SPA legal fees, stamp duty for MOT and stamp duty for loan. Stamp duty (transfer and loan) waived for the first RM300,000 and is only applicable for property not more than RM500,000 for first time home buyers only.

As shown in the table above, applicants only need to fork out a three-month refundable deposit (RM7,190.88) with HouzKEY, which is less than 2% of the property price, while those opting to go the traditional mortgage route will need to prepare about 14% of the property price for the upfront costs (RM51,916.80).

To help potential homebuyers get their feet into home ownership, HouzKEY makes the cost of entry much lower than purchasing a home through conventional mortgage and allows rent for up to 30 years.

Here are your options with HouzKEY:

Option 1: Migrate to mortgage any time after 12 months of renting

After 12 months of rental, migrate to mortgage at the pre-agreed price anytime.

Option 2: Cash out any time after 12 months of rental

The applicant can cash out after 12 months of rental by selling to a third party. First, they must file a request to the bank of their intention to sell before finding another purchaser for the unit. Any gains from the sale will belong to the customer.

The table below outlines how much you can get if you cash out after 5 years of rental.

The Real Property Gains Tax (RPGT) starts when the tenant signs the lease agreement. Hence, after the fifth year, the cash out amount is no longer taxable under RPGT.

Option 3: Continue paying rental with 2% step up per annum after 5 years

If you intend to continue renting instead of purchasing, you would have to pay an extra 2% annually as the flat rates are not applicable past five years.

This is not a recommended option, as it is much better to move to mortgage. Maybank can help the migration to mortgage facility.

If you choose to rent for long-term, it will mirror the traditional rental where rental rate will increase over time. However, if your intention is to own a home, it is better to move to mortgage as soon as you are ready.

Additionally, you can rent up to a maximum tenure of 30 years and purchase the house from Maybank at a nominal fee of RM1.

Option 4: Walk away after 5 years without any obligation

If you decide that home ownership is not your cup of tea, you can walk away from the scheme after five years with no obligation. However, we would recommend option 2, so you can walk away and still gain some monetary value.

If you decide to cash out within the first 5 years, the gains you receive will be subjected to the Real Property Gains Tax (RPGT), which starts from day one after the lease agreement is signed with the bank.

With four options to choose from, HouzKEY is a flexible and affordable way to own your first home, or even to upgrade to a better home. Read on to find out how you can get on board.

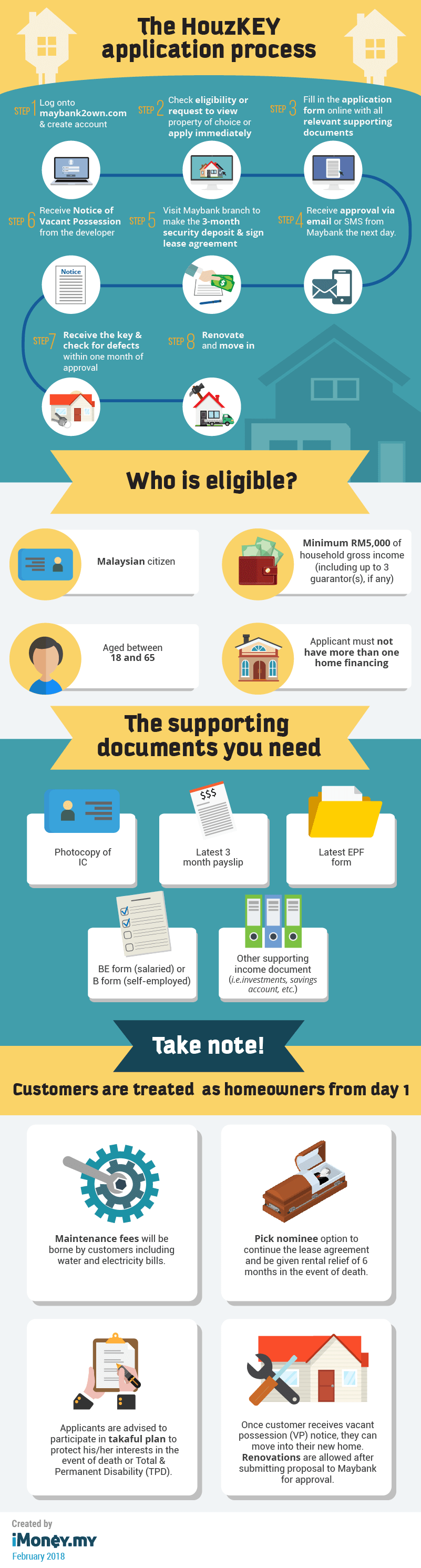

How to apply for HouzKEY

HouzKEY uses an online system, so, you skip the long ques at the bank and submit everything through their website.

So, is HouzKEY for you?

As with most financial products, there is no one-size-fits-all. We need to identify our goals and choose the best product that will help us realise them.

Here’s a guide to help you decide if HouzKEY is your key to home ownership.

HouzKEY is NOT for you if…

1. You want to rent short-term and you only want to rent

HouzKEY is – as we’ve harped on above – a homeownership scheme and would only be financially beneficial to you if you were to purchase the home in the short-to medium-term. With the rental range mirroring a mortgage instalment rather than a market rental range as we lock-in today’s property price, it won’t make sense for you to rent without the goal of eventually purchasing the home.

Although HouzKEY offers the flexibility for you to not purchase, it will save you more money if you identify your end-goal before going into the scheme.

2. You own two or more home financing

If you own more than two properties, this is not a scheme for you as HouzKEY’s main goal is to promote inclusiveness to help those struggling to enter homeownership and secure their first home.

However, HouzKEY is THE KEY to homeownership if…

1. You don’t have enough savings for upfront costs

If you are struggling to cope with the high costs of a traditional mortgage, you can avoid the stress of saving up the 10% down payment and instead, just pay a three-month security deposit with HouzKEY.

2. You have enough for the upfront costs but want to decrease cash outflow

Even if you do have enough in your EPF savings or other investment funds such as ASNB, you might be thinking twice about withdrawing a large amount from these accounts to meet the upfront costs of a traditional mortgage. There is an option for you to not sacrifice your savings by putting it all into a home purchase, instead, your money can better serve you as a rainy day fund and you are able to explore other forms of investment opportunities.

3. You need guarantors to support your application

If you are worried your salary may not make the cut with a traditional loan, you can pool your income with three guarantors through HouzKEY to strengthen your application.

4. You are not looking to rent long-term

If you are looking to purchase a home in the near future but would like to rent first, you can opt for this scheme as HouzKEY will lock in the pre-agreed price and you can migrate to mortgage as soon as the first year has passed under HouzKEY.

5. You want to lock in property price and hedge against inflation

With HouzKEY, you can avoid paying an inflated price as by the time you wish to migrate to mortgage, the price of the property would have remained affordable for the average income earner.

Ready for your homeownership journey?

Just log on to Maybank2Own.com to make your application today!