Meet The Best Friend Of Retirement Planning: Time

Table of Contents

We often hear the adage “the early bird catches the worm” and this is especially true for retirement planning. But, in this day and age, young adults who have just started work are faced with a multitude of commitments and challenges.

Most of the time, young working adults are distracted by the new opportunities in their working life. In addition, they are often faced with conflicting priorities on their lifestyle and the need to set aside savings for their future. As such, retirement planning may not be on their priority list. However, the reality is the moment you step into the working world, the clock starts ticking towards your eventual retirement.

Research has shown that young adults are aware of their eventual retirement as most of them are living with retired parents or know of retired relatives and friends. They actually are aware of the living standards and lifestyle these retirees are having and the issues they face. If they don’t like what they see from the lifestyle of their retired parents, relatives or friends, it is wise to take action now to secure a better retirement. In other words, young adults do not have to be retired to know and feel what the retirement issues will be if they do not plan for it now.

What’s the perk?

With heightened awareness on retirement and more incentive for saving for retirement, people are seeing the importance of having a fund on top of their EPF savings for retirement. In Budget 2014, the Prime Minister Datuk Seri Najib Tun Razak announced the PRS Youth Incentive for individuals between the age of 20 to 30 years old who contribute a minimum of RM1,000 within a year.

The scheme provides a RM500 one-off incentive from the government, to encourage youths to start saving for their retirement.

The incentive, which effectively started in 2014 for a period of five years, is also a timely boost to establishing the PRS as the voluntary third pillar of the country’s pension framework.

Young working adults who start PRS saving in their 20s for retirement are certainly at an advantage with 30 to 40 years of savings being compounded. The significant amount of funds saved and invested in PRS will help to address the concerns of adequacy, sufficiency and sustainability to replace their earned income during retirement years.

The math

To address the affordability issue, young adults can make it easy by starting to set aside 5% of their monthly pay into their PRS account. The RM1,000 contribution works out to only about RM85 a month. Think of it as setting aside just RM3 daily as future spending for dream retirement. With the RM500 incentive for youth, members also stand to increase their PRS savings from RM1,000 to RM1,500. In addition, the RM1,000 contribution is also eligible for tax relief.

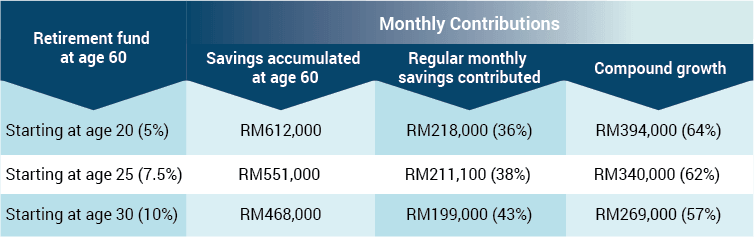

Based on PPA’s research, the earlier we start saving with PRS, the greater the benefits we will enjoy. Young adults who start saving in PRS between the age of 20 and 25 at the rate of 5% of monthly salary (assuming starting salary of RM2,000), they would be able to accumulate RM612,000 at retirement age of 60.

Of the amount accumulated, a whopping 64% actually comes from compounding growth (assuming average annualised return of 6%), while the remainder 36% is the capital from regular monthly savings contributed. However, those who delay their retirement saving by 10 years at 30, they will lose out a chunk of RM144,000 in accumulated savings at retirement. The longer they take to start their retirement saving, the magic of compounding growth will diminish and of course, they will also need to increase the rate of savings.

(*Note – Assuming starting pay at RM2,000; average annualised return of 6% and annual increment of 4%. The above compound growth returns are for illustration purpose only. Actual performances may differ.)

Young working adults have the advantage of having time on their side for saving and compounding the growth of their retirement fund. Firstly, the longer time horizon to retirement allows young adults to save more through regular monthly contributions.

Secondly, long-term investing of the retirement savings allows for compounding effect to accelerate retirement funds growth. As a rule of thumb, investing in a fund that consistently gives a 7% annual return will double the fund’s growth in 10 years.

Thirdly, long term investing allows the fund to ride out market volatility and to generate sustainable average returns over the retirement accumulation period.

It’s a no-brainer. So, what’s stopping you?

Use PPA’s retirement calculator to find out how much additional savings you need to make on top of your EPF.

For more questions on how PRS can help you address these retirement income issues, leave a comment below!

Dato’ Steve Ong is the chief executive officer of the Private Pension Administrator Malaysia (PPA). He is a seasoned professional with 30 years of experience in the financial services industry, with 21 years involvement with the life insurance business and nine years in the fund management industries. Prior to his move to PPA, he was the CEO of one of the country’s leading fund management companies, which he started and grown.