Why I Believe In Bitcoin

Table of Contents

When I bought my first bit of Bitcoin in September 2016, I never imagined the adventure I was starting on.

Since then, Bitcoin prices have gone up 3,400% (34x), dropped 84% from the peak, and recovered to USD 9,500 per bitcoin. In layman’s terms, when I first dipped my toes in, 1 bitcoin could buy one entry-level 32GB iPhone 6S. Today, 1 bitcoin buys 11 premium 256GB iPhone 11s.

On the career front, I believed so much in the promise of Bitcoin that I quit a job I really loved; and dived full-time into the cryptocurrency industry. My first few months were a baptism of fire — I was calling furious customers to explain why they couldn’t get their cash out immediately, pleading with them for time to solve issues with our then-bank.

But we persevered; eventually solving the banking problem, and fighting on until we relaunched full operations in October 2019 with governmental approval — almost two years later.

There’s this scene that sometimes replays in my mind: One day my CEO sat my boss and me down and said we had shown tremendous resilience in tough times. I looked at my boss and thought for a while. We had been so focused on daily tasks that we’d never once stepped back and doubted: “Is this all gonna fail? Have we taken the wrong path? Should we look for another job?”

Today, millions of people around the world continue to believe in Bitcoin, and the message continues to spread. Whereas once mainstream media would associate it with drugs and money laundering, today it’s largely covered by business news as a new investment asset. I guess you could say our faith has been rewarded.

But why? Why so much faith in this funny Internet money that nobody can see?

Allow me to get personal; allow me to share why. Almost four years on in my Bitcoin adventure, here’s why I believed in Bitcoin back then. And here’s why I believe in Bitcoin more than ever now.

Change is human nature

10 years ago, if you predicted that one day I would push some buttons on my phone, a random car would show up at my doorstep with a stranger driving, I’d get in confidently, and the stranger would take me exactly where I wanted without discussing the price — even a tech geek might have called you crazy.

Today, 65-year old aunties regularly use Grab.

Interesting how the world changes eh? We don’t necessarily like thinking about it, because change is painful. But everything we’re used to is actually being “disrupted” all the time. Change itself is human nature.

Think of some other things you use today that were once radical concepts themselves:

- Social Media, which disrupted newspapers (for getting news)

- Online Marketplaces like Lazada, which disrupted large shopping malls (for buying stuff)

- Instagram, which disrupted Facebook (for picture sharing)

Even money changes

Which brings me to money. Money might seem like a static concept that hasn’t changed in our lifetimes. But it’s not. Look through history, and you’ll see money has evolved with everything else — over decades, centuries and millennia. Long before we used today’s money, humans used barter to trade, then animal skins, then precious metals, and so on.

Here’s a more recent example: For most of us, mention “money” and we think about those nice-smelling pieces of paper in your wallet.

But I’ve just spent the last eight weeks isolated at home without using physical money for the first time in my life. I’ve paid for everything using online banking, e-wallets and credit cards. (I’m sure this isn’t how the government wanted to launch a “cashless” society, but guess the coronavirus just proved it’s possible.)

We already live in the age of digital money. And we know that everything changes. So what’s next?

“I do think there is something very strange about this world of fiat money and exactly about the way it ends.”

– Peter Thiel, early Facebook investor –

Money can be confusing

What’s the first rule of money?

“Don’t spend more than you earn,” say the responsible adults in the room.

But read the business news and you’ll know governments “break” this rule all the time, which is why most countries end up with budget deficits. Why and how? Are there different money rules for individuals, corporations and governments? Explore down the money rabbit hole, and you’ll start to question this.

Here’s my tip: If you wanna understand money (from a global-level perspective), first throw out everything you believe about money from a personal level.

Another tricky one: What determines the amount of money flowing within a country? If you said “the amount of gold/resources a country has,” you’d be in good company. In our personal accounts, the absolute amount of cash you can withdraw is proportionate to assets you have: savings, property, unit trusts, and so on. This makes sense.

But again, this doesn’t apply to countries and governments. The gold standard was ditched in the 1970s, and governments have been free to control their own monetary supply ever since. In other words, nowadays it isn’t gold that determines money. It’s governmental policy around money. Or if we’re being blunt: it’s politics.

At this point, you might think you’ve just stumbled upon the latest conspiracy theory website on the Internet, written by a good-looking but crazy fake news bro. You might be skeptical, because it goes against everything you believe in. But I assure you, everything above is true. If you’re still in doubt, please continue to do your own research — here’s an article by the UK Central Bank to start getting your mind blown.

But what does all this have to do with the money in my pocket?

The world isn’t running out of money; it has too much money

In the last financial crisis of 2008-2009, the US government was faced with a critical situation: due to insane risky practices in the previous decade, huge companies (including banks and insurance companies) were on the brink of going bankrupt. Experts feared the global economy would collapse; an unprecedented clusterf**k caused by human greed.

The US government acted decisively: bailing out several companies which were “too big to fail” by loaning them emergency money. In its effort to save the economy, the Federal Reserve (central bank of the USA) also pumped huge quantities of money into the financial system via a process called Quantitative Easing. In layman terms, some would call it “printing money from thin air.”

Over the next few years, almost 4 trillion USD of “new money” was added to the US monetary supply — which grew more than five-fold.

(I’m not great at explaining the crisis above, but for more, catch The Big Short on Netflix. It’s my favorite money movie of all time, and even features Margot Robbie teaching a finance lesson from a bathtub.)

Okay… back to reality. Printing money was supposed to be temporary. It was supposed to help us fix the Great Recession then scaled back. But while it was once an unconventional idea, central banks started warming up to it.

It’s 2020 now, with economies all around the world sick from the coronavirus. Central banks are scrambling — and the money printing has started once again.

Quiz time: What happens when the supply of something goes up by a huge amount but demand remains the same? Right, thank your economics 101 teacher: the value goes down.

My money loses value?

Of course it does. You already feel it in this thing called inflation. Every year, the cash in your wallet loses 2-3% of its value.

One of the biggest criticisms against previous Quantitative Easing plans was it would lead to huge devaluation of the US dollar. Devalue a currency too much and you end up with hyperinflation: like Zimbabwe in 2008-2009, where a loaf of bread cost 550 million Z-dollars at one time.

But don’t take my word for it. Ray Dalio, head of the world’s largest hedge fund recently published a breathtaking article titled “The Changing Value of Money.”

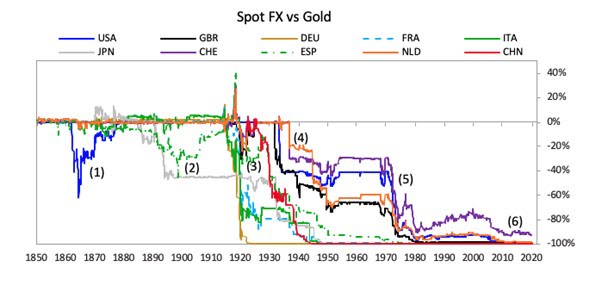

Mr. Dalio presents that relative to gold, most major currencies (including USD, GBR and JPY) have continued to lose their value over time, especially during crises like major wars and recessions. Here’s an interesting chart for you, showing more than 90% devaluations in all major currencies:

Source: Ray Dalio LinkedIn

“So if my money is losing value against the US dollar, which in turn is continuing to lose value against gold, what do I do? Do I wind back the clock and convert everything I own into gold?”

Well, probably not everything. Gold is valuable because people have demanded it for thousands of years, and it’s hard to get. But it’s also difficult to store and move: When was the last time you bought anything using a nugget of gold?

Wouldn’t it be amazing if there was something valuable like gold, but we could send to each other easily like an e-wallet?

What if there was digital gold?

Like gold, Bitcoin is hard to get hold of. But it has an additional quality that even gold doesn’t: the supply of Bitcoin is fixed, predictable, and has a maximum limit: only 21 million bitcoins will ever be created.

In a world where unlimited money printing can happen, this should capture your attention.

Here’s Paul Jones, billionaire investor who predicted the 1987 “Black Monday” stock market crash:

“It is literally the only large tradeable asset in the world that has a known fixed maximum supply.”

“Owning Bitcoin is a great way to defend oneself against the Great Monetary Inflation,”

Throw in Bitcoin’s advantages in portability and storage — you can store, send and receive Bitcoin simply using apps on your phone — and you have the closest thing to digital gold; only better.

Will Bitcoin continue to rise in price and make me a lot of money?

I hope so; and if we’re being honest — so does everyone else who’s invested. My personal price target is >USD 100,000 per bitcoin before I’d consider selling.

But there’s a bigger reason to park some money in Bitcoin. Like Peter Thiel, Ray Dalio, and Paul Jones, I don’t think the way our global monetary system is heading is sustainable. Historically, this has always led to some kind of major disruption, like a war.

Of course, nobody can predict exactly what happens. But I think it’s prudent to park some money in an alternative asset, which is the least-connected asset to everything else happening in the world of governments and money.

In other words, Bitcoin is my hedge against a crisis in the existing financial world. It’s insurance.

Part of me hopes I’m wrong. Part of me hopes for things to stay the same, even though I know change always happens. If Bitcoin remains at 10,000 USD for eternity in exchange for a stable, peaceful world where people continue to have enough to eat and lead comfortable lives, I would gladly take it.

But what if our fears come true?

Read More: Bitcoin: The Story Of The Future

Everything above is based on my personal experience. It’s not investment advice. Always make sure you do your own research before investing in Bitcoin or anything else.

Additional note: In his day job, he is also Luno Malaysia’s Country Manager. Luno is a licensed digital asset exchange in Malaysia.