What Is The Private Retirement Scheme (PRS), And How Does It Work?

Table of Contents

- What is a Private Retirement Scheme (PRS)?

- What’s the difference between PRS and EPF?

- What are the advantages and disadvantages of PRS?

- What funds can you invest in?

- Here’s how PRS funds have performed

- How to contribute to PRS

- PRS fees

- How to withdraw your PRS money

- How much can you save with the PRS tax relief?

- So…should you invest in PRS?

Want to buff up your retirement savings, or just trying to reduce your taxable income next year? Private Retirement Schemes can help you do both. Here’s what you need to know to get started.

What is a Private Retirement Scheme (PRS)?

PRS is a voluntary investment scheme to help you save for retirement. Under the scheme, you can invest in approved unit trust funds that are managed by PRS providers (Public Mutual, Kenanga, etc.).

The Private Pension Administrator Malaysia (PPA) serves as the central administrator of PRS. This means that it is responsible for managing your account and facilitating transactions.

What’s the difference between PRS and EPF?

PRS is sometimes compared to the Employees Provident Fund (EPF), as they are both investment schemes that help you save for retirement. But PRS is not meant to replace EPF. Instead, it’s a supplementary scheme to help you boost your savings.

Here’s how PRS and EPF compare:

| PRS | EPF | |

|---|---|---|

| Contribution | Voluntary | Mandatory for employees |

| Guaranteed returns | None | 2.5% |

| Account structure | Sub-Account A: 70% of contribution Sub-Account B: 30% of contribution | Akaun 1: 70% of contribution Akaun 2: 30% of contribution |

| Tax relief | Up to RM3,000 | Up to RM7,000 (public servant) or RM4,000 (non-public servant) |

| Withdrawal age | 55 | 55 |

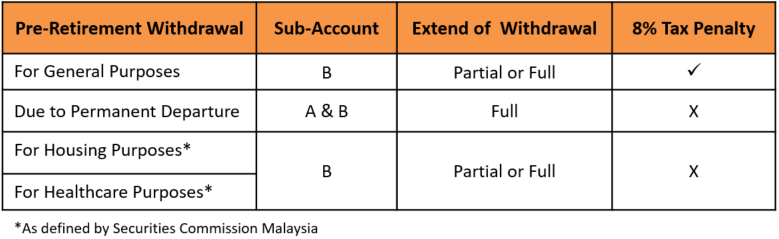

| Pre-retirement withdrawal | Maximum once a year from Sub-Account B unless permanently leaving the country; may incur 8% tax penalty | From account 2 for approved expenses |

| Fees | Sales charge up to 3%; annual management fees up to 5% | None |

| Shariah-compliant | Yes, but depends on unit trust fund selection | Yes, but depends if you opt for Simpanan Shariah |

What are the advantages and disadvantages of PRS?

Advantages:

- It’s like a second EPF. Contributing to PRS can help you get better prepared for retirement.

- Forced savings. If you’re under 55, PRS funds cannot be easily withdrawn. Withdrawals are generally only limited to a portion of your funds, and may be subject to an 8% tax, depending on the purpose of withdrawal. This may sound limiting, but it can help prevent you from dipping into your retirement savings unnecessarily.

- Low investing barrier. The minimum initial investment starts at only RM100 (may depend on your provider), which is an easy way to diversify your money through unit trust funds.

- Tax relief. You can claim tax relief of up to RM3,000 when you invest in PRS until 2025. Depending on your tax bracket, this could mean saving up to RM900 in tax.

Disadvantages:

- You could lose money. Your investment returns are not guaranteed. You could even lose money if your funds underperform.

- There are fees. You may need to pay an upfront sales charge of up to 3% and an annual management fee of up to 5%. These fees can seriously eat into your returns over many years.

What funds can you invest in?

Currently, there are 58 PRS-approved unit trust funds with eight different PRS providers. You can find a full list of the funds, their performance and fees here.

When you invest with each provider, you can choose to invest in the default core funds based on your age:

| Core funds | Age | Description |

|---|---|---|

| Growth Fund | Below 45 Years | ● Focuses on growing the portfolio ● High-risk ● Up to 70% invested in equities |

| Moderate Fund | 45 – 54 years old | ● Focuses on growing the portfolio while seeking consistent income ● Moderate risk ● Up to 60% invested in equities |

| Conservative Fund | 55 years old and above | ● Focuses on generating income and getting the portfolio ready for use in retirement ● Minimum risk ● Up to 20% invested in equities |

When you invest in these core funds, you can also opt into the Auto Glide Path, which automatically switches your funds from a higher risk asset allocation to a more conservative one as you approach retirement.

If you prefer to choose your own funds, you can invest in any of the non-core funds, but the risk and return profiles of these funds may not match your age group.

Here’s how PRS funds have performed

Here’s a snapshot of how PRS funds have performed in the past five years (May 1, 2016 to April 30, 2021).

- Eight funds out of 58 have no performance history during this period.

- Twenty-two funds have annualised returns higher than 6%.

- Three funds have negative annualised returns of between -0.99% and -5.67%.

- Non-Core funds have performed the best with average annualised returns of 8.24%, followed by Core Growth (7.93%), Core Moderate (6.3%) and Core Conservative (4.07%).

- These are the top performing funds, according to annualised returns:

| Fund | Category | Annualised return from 01/05/2016 to 30/04/2021 |

|---|---|---|

| Principal PRS Plus Asia Pac Ex Jpn Eq A | Non‐Core | 14.66% |

| Principal Islamic PRS Plus Asia Pac Ex Jpn Eq A | Non‐Core Shariah | 13.86% |

| Public Mutual PRS Islamic Strategic Equity | Non‐Core Shariah | 12.53% |

| AmPRS ‐ Islamic Equity D | Non‐Core Shariah | 11.69% |

| Public Mutual PRS Islamic Growth | Core Growth Shariah | 11.46% |

In short, investing in PRS could help you grow your savings at a rate comparable to or better than EPF, which produced dividends of 5% to 6.9% a year in the past five years. Most PRS funds have had positive returns during this period. But if you choose the wrong funds, you risk losing your money or growing it at paltry rates.

How to contribute to PRS

There are three ways to start contributing to PRS:

- You could sign up with the PRS providers listed here.

- You can also sign up through the PRS Online Enrolment Portal.

- Your employer may also contribute on your behalf – but that depends on your work benefits.

Initial contribution starts at RM100 only, but that may depend on your provider.

PRS fees

Like regular unit trust funds, these fees will apply:

- Sales charges: 0% to 3%. This is the upfront charge you’ll pay when you invest. For example, if you invest RM1,000, a 3% sales charge means that you’ll actually invest RM970, while RM30 goes to fees.

- Annual management fee: 1% to 5%. This is the annual fee you’ll have to pay to the professional fund manager. It’s subtracted from your fund value.

- Switching fee: You need to pay a switching fee if you want to transfer your money from one fund to another.

How to withdraw your PRS money

To withdraw your money, just contact your PRS provider or check your provider’s online portal. But the process can be tricky depending on your age:

a) Withdrawal at age 55 or above

You can make full or partial withdrawals without any penalties.

b) Withdrawal before age 55

Your PRS savings are split into two sub-accounts. When you contribute to a PRS, 70% goes into Sub-Account A, while 30% goes into Sub-Account B.

You can only withdraw your money from Sub-Account A if you intend to permanently depart Malaysia. Otherwise, you can only withdraw from Sub-Account B. If your withdrawal isn’t related to leaving the country or covering housing and healthcare-related expenses, you’ll need to pay a 8% tax penalty on your withdrawn amount.

You can only withdraw once per calendar year.

Source: PPA

How much can you save with the PRS tax relief?

A huge draw of contributing to PRS is its potential tax savings. You can claim tax relief of up to RM3,000 when you invest in PRS until 2025. Depending on your tax bracket, that could tax savings of up to RM900.

With the new individual income tax structure announced in Budget 2023, you will also save in tax payments if your income is within the RM35,000 to RM100,000 range.

| Chargeable income | Calculations (RM) | Rate % (until YA 2022) | New Rate % (YA 2023) |

| 0 - 5,000 | On the First 5,000 | 0 | 0 |

| 5,001 - 20,000 | On the first 5000 Next 15000 | 1 | 1 |

| 20,001 - 35,000 | On the first 20,000 Next 15,000 | 3 | 3 |

| 35,001 - 50,000 | On the first 35,000 Next 15,000 | 8 | 6 |

| 50,001 - 70,000 | On the first 50,000 Next 70,000 | 13 | 11 |

| 70,001 - 100,000 | On the first 70,000 Next 30,000 | 21 | 19 |

| 100,001 - 250,000 | On the first 100,000 Next 150,000 | 24 | 25 |

| 250,000 - 400,000 | On the first 250,000 Next 150,000 | 24.5 | 25 |

| 400,001 - 600,000 | On the first 400,000 Next 200,000 | 25 | 26 |

| 600,001 - 1,000,000 | On the first 600,000 Next 400,000 | 26 | 28 |

| 1,000,001 - 2,000,000 | On the first 1,000,000 Next 1,00,000 | 28 | 28 |

| Exceeding 2,000,000 | On the first 2,000,000 Next Ringgit | 30 | 30 |

If you add in the RM3000 maximum PRS contributions that you can claim tax relief (until YA 2025), you can potentially enjoy several hundred ringgit more in tax savings!

So…should you invest in PRS?

Most Malaysians aren’t saving enough for retirement. If you already have an emergency fund, and you’ve already paid off your high-interest debt, putting aside some money into PRS can help you improve your chances of retiring comfortably. Plus, paying less taxes while boosting your savings doesn’t hurt either.