Get The Best Returns While Saving for Your Kid’s Education

You’ve heard of college costs, but when should you start saving up for your children’s tertiary education? The short answer: ASAP.

You’ve heard of college costs, but when should you start saving up for your children’s tertiary education? The short answer: ASAP.

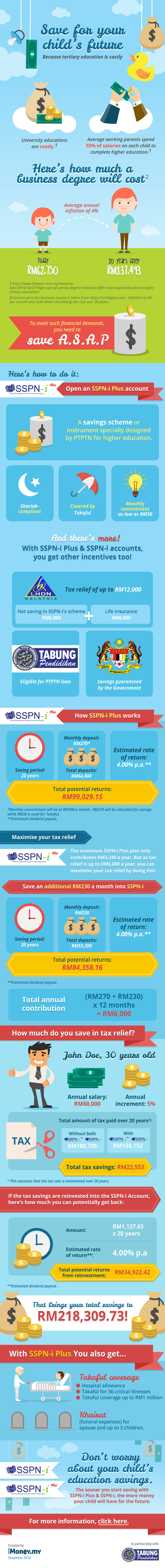

Malaysia is the fifth-most expensive country to get a university education and according to a survey, the average working parent spends 55% of his or her salary on each child to complete higher education. Clearly, sooner is better.

What you need to look for in an education savings plan is one that protects your money, guarantees returns, and confers additional tax benefits.

The SSPN-i Plus savings account delivers on all three points: deposits are protected by the government, an estimated 4.25% in returns per annum, and a tax relief of up RM12,000.

What’s more, the savings is backed by Takaful, meaning you the benefactor gets some form of protection while working towards a brighter future for your kid.

Getting started is easy: commit as little as RM50 a month. After all, what’s more important than seeing that smile on your child’s face on graduation day?