Save For Retirement Today, Enjoy Financial Freedom Tomorrow

Table of Contents

If you have not started saving for retirement, you’re not alone. However, failure to do so will haunt you when it’s finally time to leave the workforce.

We all know what we should be doing, there’s advice everywhere when it comes to saving for retirement but actually putting it into practice is hard. Excuses? Now those are much easier.

We have other ongoing financial responsibilities that compete with our ability to set aside money for our retirement. With salaries that barely budge over the years, while the cost of living continues to climb in an accelerated speed, it may seem difficult to save for something as long-term as retirement. For those who do have enough, they don’t even plan for retirement. These are huge mistakes no matter where you’re at in these scenarios.

Statistics show that Malaysians do not have enough in their retirement nest to help see them through retirement. With Malaysia’s average life expectancy rate at 75 years, and the average Malaysian retirement age at 55 to 60 years according to World Bank (want to add), you will need your retirement fund to last you for at least 15 years. Based on EPF’s Annual Report 2014, 68% of Employees Provident Fund (EPF) members aged 54 years have less than RM50,000 in their EPF accounts, a sum which is expected to only last five years post-employment assuming there are no other means of income generation.

With the longer life expectancy rate coupled with the rising cost of living and inflation, Malaysians should be worried about not having enough for their golden years.

Gone are the days where you can just depend on your mandatory retirement savings scheme to ride out your retirement. According to statistics, money in Malaysia’s mandatory retirement savings schemes alone may not suffice due to the various withdrawals that you are allowed to make along the way. It is highly recommended that everyone actively sets aside a percentage of their monthly take home salary to be invested for their retirement.

Don’t know where to begin? Private Retirement Schemes (PRS) is a good place to start and here are some guiding points to help you:

1. Know your retirement needs

Retirement is expensive. As a rule of thumb, you will need to maintain at least 2/3 of your last-drawn income to keep up with your standard of living post-employment.

On top of your default mandatory retirement savings schemes contributions like Employees Provident Fund (EPF) or bank savings, you need an avenue to increase your retirement savings to cater for a comfortable post-retirement lifestyle. PRS is an ideal option as it offers additional avenues to boost your retirement savings. PRS complements your other retirement savings and alleviates the concentration risk from other investment platforms and may help to defend your retirement fund.

The later you start, the more you will have to contribute every month to make up for the shortfall. To achieve 2/3 retirement income, you will need to save 1/3 of your savings from as early as in your 20’s.

Identify how much you will need for a comfortable retirement based on your expected future income and expenses. Work backwards from there to find out how much you need to contribute, for how long, and what should the expected returns be.

2. Start investing as early as possible

To reap the most benefit from your investments, you need to start saving now. If you’re patient and disciplined, your money can work for you and make a real difference in your investments over time.

The key is the power of compounding, the snowball effect that happens when your earnings generate even more earnings. You receive interest not only on your original investments, but also on any interest, dividends, and capital gains that accumulate – so your money can grow faster and faster as the years roll on.

Retirement accounts aren’t just savings accounts – they’re actively invested, and therefore have the potential to make the most of this benefit. For compounding to work, you need to: Start now, invest regularly and be patient.

Current age: 30 years

Retirement age: 60 years

Life expectancy: 90 years

For an ideal case of 8%p.a. return on investments with 4%p.a. rate of inflation, one would have to invest RM483 monthly before they retire in order to supplement their retirement with RM1,500 monthly for the next 30 years. On a worse case basis of 4%p.a. return on investments with 6%p.a. rate of inflation, one would have to invest RM2,656 to supplement their retirement with the same amount of RM1,500 monthly.

3. Choose appropriate funds

Confused by all the offerings of different investment opportunities? You’re not alone. People generally tend to pick their investments based on the funds they hear about, not because they understand them.

Instead of looking at funds, you should look at spreading your investments across different assets depending on your risk tolerance. Depending on where you’re at in life, it may make more sense to have more aggressive asset classes like equities and as you age, move towards more stable, lower risk assets like bonds. A general rule of thumb is to subtract your age from 100 and invest that much in equity funds. For example, if you’re in your 20s with longer age horizon, about 80% of your investments should be in equities and 20% in fixed income.

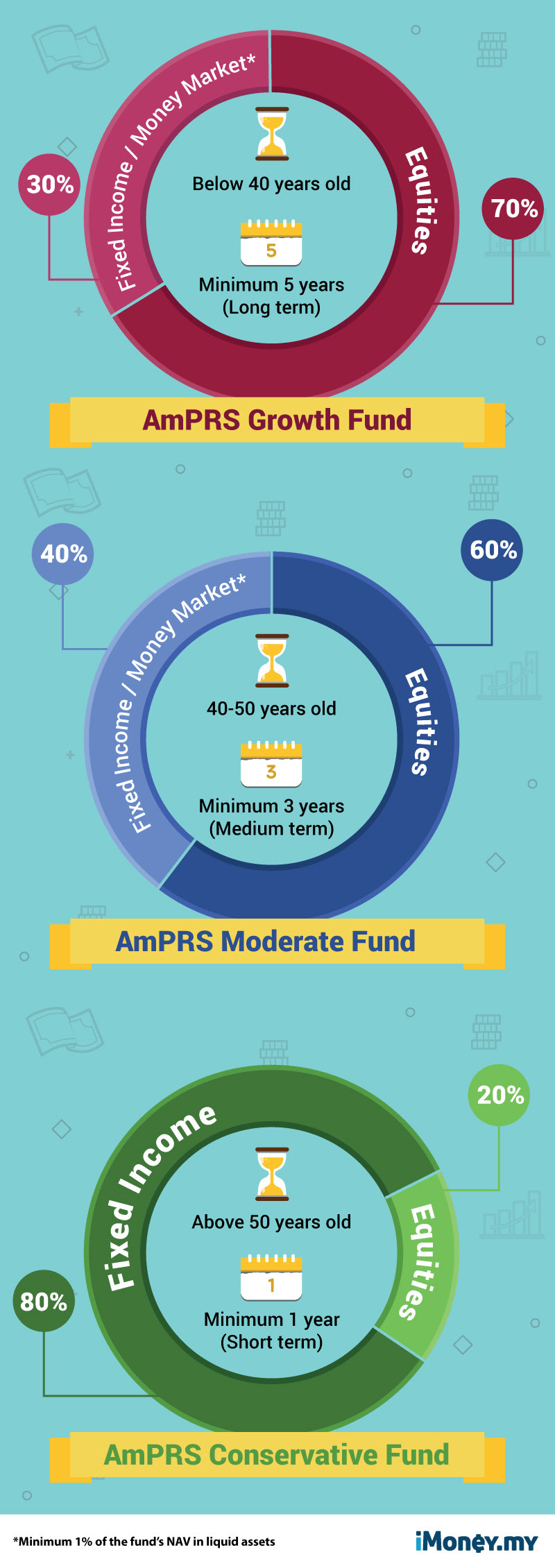

Here’s a guide on how you can change your strategy depending investment age, asset allocation arrangement and time horizon limitations. Keeping your investment strategy up to date along with your age and risk tolerance is vital to potentially provide you with competitive returns by the time you retire.

Core Funds (Conventional)

4. Rebalance as and when needed

Once you make your fund selections, you can coast along… for a while. You must always keep track of your investments and make adjustments when you need. Some of the biggest reasons that people don’t realise their investment goals is because they fail to adjust their portfolios according to the market movement or their present risk appetites.

Look at your investments at least every quarter, and rebalance it every year. Reduce your winning investments to an appropriate proportion of your overall portfolio. Start worrying about the proportions of your investments earlier by assessing your future income needs, and you’ll have a much better chance of enjoying a happy retirement.

For example, with the fluctuating Ringgit, you may need to review your investments to ensure you will still achieve your goals according to plan by having more exposure through investment instruments which provides you with global opportunities. At the same time, if your income has changed and you need to be more conservative with your investments, make those changes!

When it comes to PRS, you need to make sure that you actually have a good range of funds you can move your investments around in the first place. Not much point in wanting to make a change and then realising you don’t have the right avenues to do so. Keep an eye out for PRS solutions that have a wide range of available funds.

Avoid unpleasant surprises when retirement comes around

PRS is one of the best solutions on the market to help supplement retirement planning. However, many lack the flexibility required for investors as strategies need to change as life progresses. AmInvest PRS offers just that. Investors are able to build their own retirement investment portfolios and customise where and when necessary throughout their life-cycle on the road to living their retirement dreams.

The key being that it offers a wide range of non-core PRS offerings, allowing you to customize and adjust your retirement portfolio to suit your exact needs. Their unique PRS offerings provides you with a real estate Asia Pacific fund and a number of bond funds.

To reap the rewards of a well invested retirement portfolio for a financially secure retirement, it is vital that every individual takes charge of their own retirement planning, as early on as possible. Investing gives you control over how you will spend your golden years.