Should You Pay Off Your Loan Early If Given A Discount?

Table of Contents

- Hypothetical situation 1: Aaron owes RM20,000 to the Government. They’ll give him a 20% discount if he pays up immediately. If not, he has 10 years to pay at 0% interest.

- Hypothetical situation 2: Aaron owes RM40,000 to the Government. They’ll give him a 20% discount if he pays up this week. If not, he has 15 years to pay at 1% interest.

- Hypothetical situation 3: Aaron owes RM60,000 to the Government. They’ll give him a 20% discount if he pays up this week. If not, he has 20 years to pay at 1% interest.

Photo credit: Rexem at Deviantart

Photo credit: Rexem at Deviantart

If I gave you a discount to immediately pay off your loans this week, would you take it?

Is it better to take the discount today, or pay the amount over time instead?

One of my readers recently asked me a question about PTPTN (Government education) loan repayment. His question was about using credit cards to pay for the PTPTN loan — which unfortunately isn’t possible right now.

But when I was talking to him, he made me think about evaluating a discounted loan offer.

So this one is for you and me. In this wonderful land of only-in-Malaysia discounts, how do you know when to take a discount or not?

Hypothetical situation 1: Aaron owes RM20,000 to the Government. They’ll give him a 20% discount if he pays up immediately. If not, he has 10 years to pay at 0% interest.

This is the simplest of the three situations.

Let’s first assume that Aaron has RM16,000 in cash and that the Government gives out 0% interest loans (yeah, right!).

Should Aaron immediately grab the discount? On paper, the 20% discount looks attractive. It looks like it’s the only right decision.

But it’s an interesting question, because if Aaron doesn’t take the discount — he still has RM16,000 available. What could he use it for? Perhaps as downpayment for a brand new BMW? Or a new Rolex? Or if he’s financially savvy, he could invest the money instead — generating profits.

Should Aaron be able to generate enough profits over 10 years to make up for losing his 20% discount?

For the purposes of our calculation, let’s assume Aaron can earn 5% profits every year on his investments.

In Scenario A, Aaron immediately saves RM4,000, while in Scenario B, he has to pay RM4,000 more. Total payment here is RM20,000 over 10 years.

However, in Scenario B, Aaron also has a total earning from investment of RM4,906.53.

So at the end, Aaron still has RM906.53 left over in the bank.

Scenario B is obviously better than Scenario A. The initial investment of RM16,000 has made enough profit to cover the full loan amount of RM20,000, with a nice leftover in the bank.

The crucial element here is the interest rate of 5%. Can Aaron consistently get that? What if he only gets a very safe Fixed Deposit rate every year of 3.6%?

In Scenario C, we can see that Aaron loses. With lower returns, his investments have not made enough profit to cover the loan payments, with total earnings at only RM3,217.09. Compare that to the RM4,000 we would have saved in Scenario A, it would have been better to take the initial 20% discount.

The drop from 5% to 3.6% interest looks small, but over a period of time — it makes a significant difference.

Key learning: How much you expect to make on investments (interest rate) affects your financial decisions.

Hypothetical situation 2: Aaron owes RM40,000 to the Government. They’ll give him a 20% discount if he pays up this week. If not, he has 15 years to pay at 1% interest.

Here things get a little more challenging.

Not only is the loan amount bigger, now the Government is doing what banks do: charging interest.

What kind of interest? Let’s assume it’s fixed flat rate per annum interest. Which is similar to a typical car loan in Malaysia. (It’s my understanding that all PTPTN loanholders since June 2008 also have this kind of interest). Note that home loans are usually reducing balance loans — which is different from what we’re talking about here.

How will this new factor affect our evaluation?

Just like the first hypothetical situation, Aaron loses if the expected returns are only 3.6% in Scenario B. It would have been better to take the initial 20% discount. He only made RM8,856.09. Compare that to the RM14,000 he would have saved in Scenario A.

In both Scenario B and C, Aaron has had to pay RM14,000 more than in scenario A, making the total payment, RM46,000.

However, with 5% average return, he gets RM14,351.42 from his investment, and at the end, Aaron still has RM351 left over in the bank.

Scenario C beats Scenario A, even though Aaron has had to pay RM14,000 more!

Which doesn’t seem to make sense at first. How do you gain more money over 15 years, despite having to pay RM14,000 more?

Here’s another way to look at it: In Scenario C, Aaron invested his RM32,000 wisely. Over 15 years, that investment brought in enough money to cover all his debts and make him a small profit. Whereas in scenario A, Aaron said goodbye to his RM32,000 in Day One — meaning that he never had the opportunity to make any more money with it.

Key learning: Compound interest is amazing. It can create vast sums of money over time.

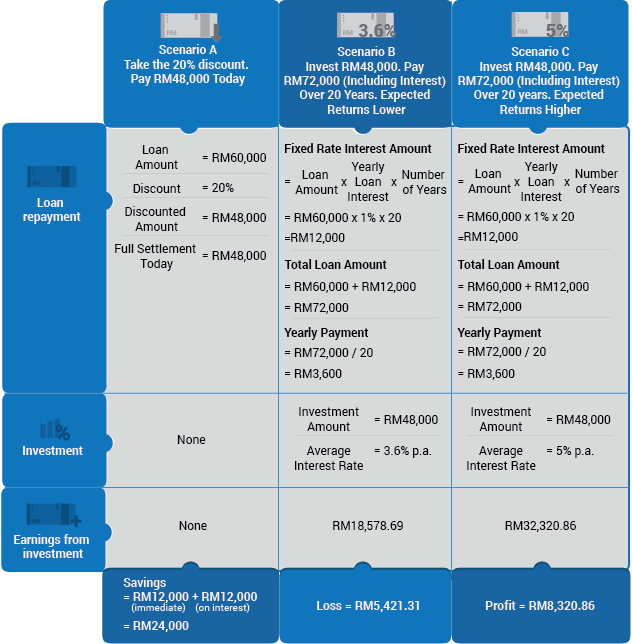

Hypothetical situation 3: Aaron owes RM60,000 to the Government. They’ll give him a 20% discount if he pays up this week. If not, he has 20 years to pay at 1% interest.

In our final hypothetical situation, we’ll look at what happens if both the time frame and amount are increased. Now that you’re probably tired of my obsession with cashflow tables, we’ll also discuss a quick and easy way to answer the first question I asked today.

Again, we see that Aaron loses in Scenario B, when the expected returns are only 3.6%. Total earnings is only RM18,578.69. Compare that to the RM24,000 we would have saved in Scenario A.

In both Scenario B and C, Aaron has had to pay RM24,000 more than in scenario A. Total payment here is RM72,000. But with 5% return, total earnings from investments is RM32,320.86. (Recall our second key learning — given enough time, compound interest can generate a lot of money).

So at the end, not only has Aaron paid off his loan, he’s made a nice profit of more than RM8,000!

(To understand the calculation for the investment returns, click here to view the Google spreadsheet I used to calculate all the examples above. You can use it to simulate your own scenarios, and to check my calculations. Hey, I’m human — let me know if I made a mistake somewhere.)

But what if you don’t? What if all these numbers make you dizzy, and all you really want is a simple way to know: Take the discount or not?

The answer lies within the concept of Present Value.

Key learning: Present Value — the value or worth of a sum of money in the future based on a specified rate of return.

The logic behind Present Value, or PV, is, it is always better to receive a sum of money now, compared to later, because by having the money now, you can invest the money and generate returns.

But how does this help you determine which option to take?

To evaluate your options, you can use Present Value of Annuity.

Compare the Present Value of the Annuity (Loan) to the Present Value of the Lump Sum Payment you have to make today. Then, choose the option with the lower Present Value.

For example, let’s go back to Hypothetical Situation 3:

Yearly payment = RM72,000 / 20 = RM3,600

Initial cash = RM48,000

Interest rate = 5%

And using the easy financial calculator found on Investopedia to help us:

The Present Value of the Loan (if I pay over 20 years) = RM44,863.96 (Meaning I’m paying RM44,863.96 of today’s dollars).

The Present Value of Payment (if I take the Government’s 20% discount) = RM48,000.

So I should choose the 20-year loan. Because I would be paying less.

And that, ladies and gentlemen — is how you determine whether you should take a discount or not.

Further reading: ReadyforZero, Math is Fun, Accounting Coach, Frick CPA

Aaron Tang is the founder of mr-stingy.com. He writes about optimising time, money, and relationships – to make the most out of life.