Essential Items Will Be Exempted From SST

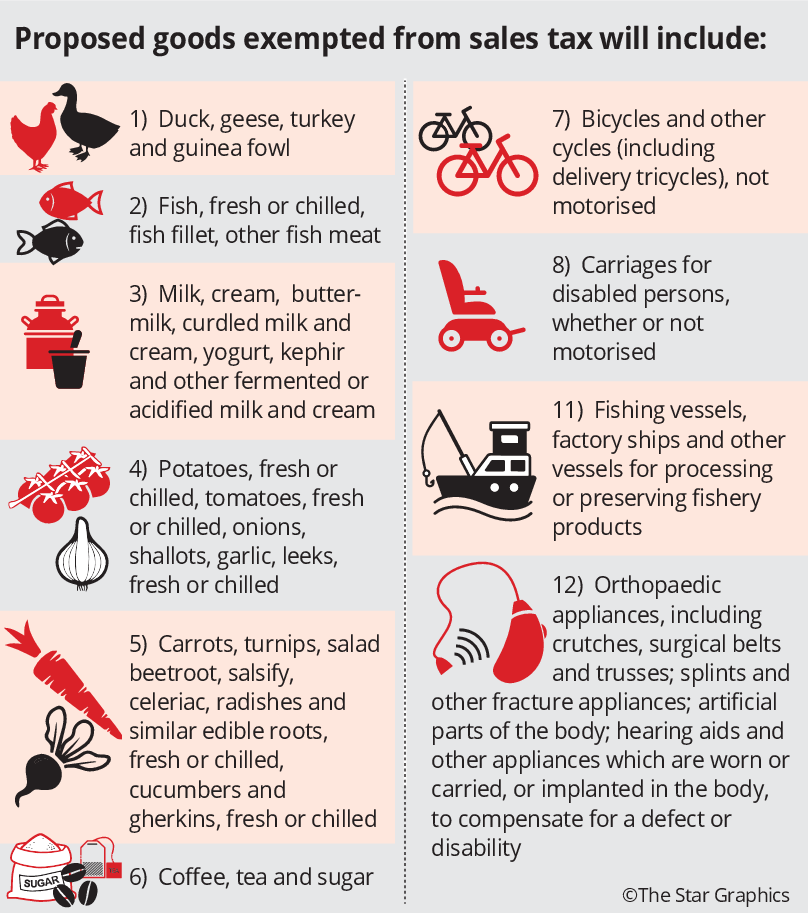

A list of consumer goods including poultry, fish, milk, vegetables and various types of sugar, has been proposed by the Customs Department to be exempted from the Sales and Service Tax (SST) when it is reintroduced.

The 292-page exemption list also includes bicycles and carriages for disabled persons as well as various types of orthopaedic appliances.

Exempted goods will not be subject to the proposed 5% to 10% sales tax under the SST.

Image from The Star

The SST will take effect on September 1 to replace the Goods and Services Tax (GST), which has been zero-rated since May 31.

Other than a list of exempted goods, the Department also proposed a list of services that will be subject to a 6% service tax under the SST, including hotels and homestay operators, as well as Pay-TV, telecommunication, insurance and takaful service providers.

Some of the services proposed to be subject to 6% service tax are:

- Hotels & homestay operators

- Pay-TV such as Astro

- Telecommunication operators

- Insurance and takaful service providers

- Principal or supplementary credit or charge card upon issuance at RM25 per card per annum

- Professional services such as legal, accounting, surveying, architectural, valuation and engineering

- Restaurant operators such as hawkers and food truck operators

Similar to GST, the SST will only be applicable to individuals and businesses that make more than RM500,000 annually.

Both lists will be submitted for tabling in Parliament.

Customs director-general Datuk Seri Subromaniam Tholasy said the SST would also take into account the B40 or bottom 40% households.

“There is some widening in the new SST compared with the old SST but not so much.

“At the same time, we also have revenue concern, so we have to strike a balance,” he said.

The coverage of the SST would be much narrower compared with the GST, where some 472,000 businesses were subjected to the GST while fewer than 100,000 would be affected by the SST, he said, adding that the SST is not expected to have the same impact (on consumers) as GST.

Subromaniam also said the SST was just one small component that affects prices of goods and services when asked whether prices of goods and services would increase.

Other factors such as fuel prices and the attitude of traders and businesses also played a role, he added.

“We hope businesses don’t take advantage of the SST by raising prices,” he said.

He said his department was working with the Finance Ministry and the Domestic Trade and Consumer Affairs Ministry to monitor the situation.

A nationwide engagement session on the SST would be rolled out with stakeholders starting Monday, said Subromaniam.

The list of proposed taxable services and exemptions for goods can be viewed in full at the Customs Department website at http://www.customs.gov.my

[Source]