Why Takaful Protection Is Especially Important During This Pandemic

Table of Contents

If you are dependent on your employer’s health insurance or Takaful, perhaps it’s time for a reality check.

What happens if you lose your job, get a serious illness that forces you to stop working or have a family member that requires long-term care?

If you urgently need medical treatment in a private hospital, can you afford the bills out of your own pocket? If the answer is No, it’s time to take a closer look at your health needs as well as those of your immediate family.

The medical care cost in Malaysia has been rising at an alarming rate of more than 100% from 1997 to 2016 and in fact, it now ranks the second highest in Asia. With COVID-19 upon us, there may be unforeseen risks that we must consider.

Rising Covid-19 cases bring health and financial risks

A survey conducted by the Ministry of Health (MOH) Malaysia revealed that more than 80% of Malaysians had to use their own income for health services while 35.8% of them resorted to using their savings.

What more if you lose your job due to the pandemic and along with it, your medical coverage? The unemployment rate in Malaysia as of August this year is the highest it has been in 20 years. As a consequence of the pandemic, the number of unemployed Malaysians was at over 740,000 earlier in August according to the Department of Statistics.

If you have been depending on your job’s health coverage all these while, it’s time to figure out how to manage medical costs if you lose your job, can no longer work due to illness or if you retire. Either way, you will need a backup plan.

Medical protection provides peace of mind

You may think you can still cover the cost of going to the doctor or even the cost of a blood test or x-ray scan, which will set you back several hundred ringgit. But what if you get hospitalised, require surgery or repeated visits to the hospital for a critical illness?

A survey by the Debt Management and Counselling Agency (AKPK) revealed that less than six out of ten people can afford RM2,500 in medical expenses. All it takes is one unplanned medical emergency that could turn your finances upside down.

In these uncertain times, it is especially important to ensure your financial and medical bases are well covered with the two being closely interlinked.

Maximise your investment and health protection with Sun Life Malaysia

As a life insurance and family takaful provider, Sun Life Malaysia has been advocating the need to plan early for health and financial protection, and more so during this challenging period, to safeguard you and your loved ones.

An insurance/Takaful plan with medical benefits is useful here, as it acts as a safety net while also providing a financial buffer should you ever run into a medical emergency. You will also have peace of mind knowing that your family is well taken care of, should the worst happen.

You can also consider adding on a medical rider. Medical riders add extra benefits on top of your existing Takaful plan, such as coverage for hospital room and board, surgery & operating theatre fees, consultations for illnesses, and more. So on top of ensuring your finances are well-looked after, you now have a fall-back plan in case you run into health or medical issues.

To protect your loved ones and invest for the future concurrently, Sun Prime Link-i is an innovative investment-linked Takaful plan that checks all the boxes. The plan also comes with a new and affordable medical rider, Prime Medi Care Plus-i, which gives you financial security and healthcare protection at one go.

- Customisable coverage, contribution amount, and type of protection for yourself or your family

- Protection up to 99 years old

- Death benefit and total and permanent disability (TPD) coverage

- Selection of various Shariah-compliant investment-linked funds based on your risk level

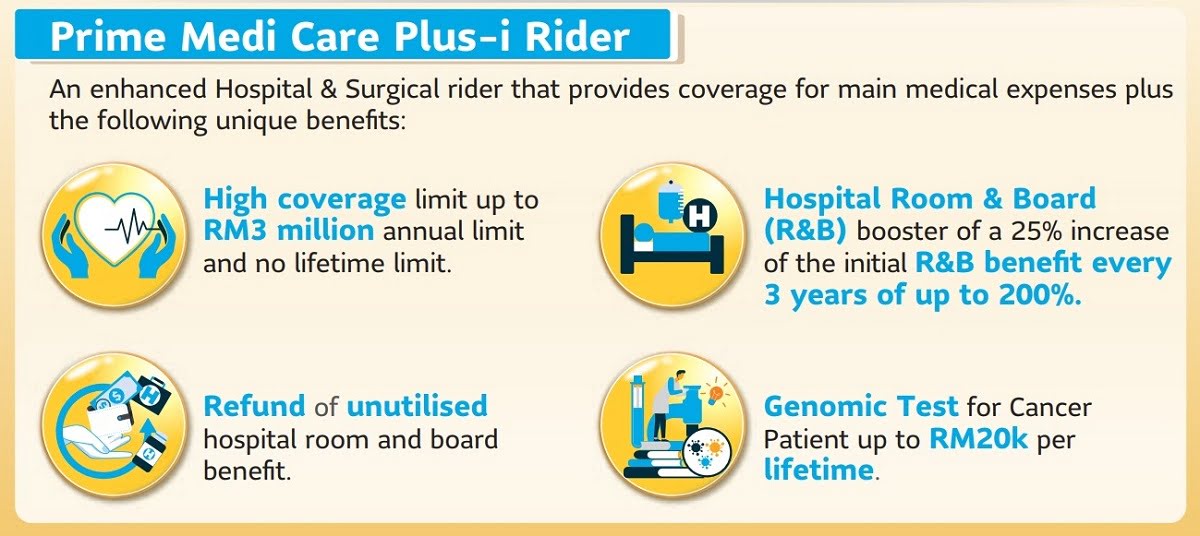

- Choose from various riders to match your medical, critical illness, accident, and disability protection needs. This includes the new Prime Medi Care Plus-i rider, an affordable way to protect your family financially from sudden medical expenses due to hospitalisation, surgical and out-patient treatment costs.

The rider benefits include:

- Refund of unutilised Hospital Room & Board (R&B) amount

- 25% increase in R&B benefit every 3 years provided no claim is made and the maximum hospital R&B benefit is 200% of the initial benefit

- High coverage limit at up to RM3 million annual limit with no lifetime limit

- Genomic test for cancer patients of up to RM20,000 per lifetime for a special test that can provide insights for suitable treatments for some cancer types

Sign up for the Sun Prime Link-i plan with Prime Medi Care Plus-i Rider today to enjoy rebate up to RM500* by clicking here!

*Terms and conditions apply.

Riders are an affordable way to include additional benefits to your Takaful plan to ensure all your needs are met. With the on-going uncertainties, Sun Prime Link-i and the new medical rider will ensure you help your loved ones sustain their standard of living and be financially protected in the event of medical emergencies. Speak to a Sun Life Malaysia advisor here for more info on this and other suitable plans from their dynamic portfolio.

Nominate your beneficiary

This year has created uncertainties and unexpected challenges leaving many of us wishing we could have been more prepared. It has also undoubtedly put forth the need for you to nominate your beneficiaries so your family is not left in a financially precarious position.

“In this climate, it is important that you name your beneficiaries to ensure that your assets and money are distributed according to your wishes. Such matters must not be delayed to ensure their future wellbeing are taken care of in the event of any worst-case scenario.”

– Raymond Lew, CEO & President / Country Head of Sun Life Malaysia

With Sun Life Malaysia’s new e-hibah nomination feature, available with all Takaful plans, you can ensure a peaceful transition of your wealth and even Takaful plan payout to your chosen beneficiaries upon passing. All of this at your convenience using the SunAccess Client Portal anytime, anywhere.

Heed the valuable lessons from this pandemic and protect yourself for the unexpected today. With the purpose of helping Malaysians achieve lifetime financial security and live healthier lives, Sun Life Malaysia can help you minimise the impact of any unfortunate situations and ensure you will enjoy protected and brighter days ahead.

Looking for lifelong financial security and protection for your family? Take the first step with Sun Life Malaysia today.