You Need To Know These 4 Takaful Coverage In Your Life’s Journey

Table of Contents

If you ask a single individual in their 20s what is his most important possession, his answer would likely differ greatly from someone in his mid-30s. Growing up does not only change our mentality and perspective, it also changes our priorities.

As we grow older our needs, responsibilities and lifestyle change, and so should our takaful cover.

This is the very reason why our takaful needs shift depending on the stage in life we are in. A young person may prioritise takaful endowment plan to help them save for their future, while a middle-aged person may veer towards a hefty family takaful protection plan to protect his dependents.

Not keeping our protection in sync with our life stage can leave our loved ones in the lurch. The ultimate reason for takaful is to protect what we value the most from life’s twists, turns and bumps. As what we value evolves through our life’s journey, it makes sense to also tweak our takaful coverage accordingly.

Whether you’re about to get married, expand your family or about to retire, protecting your assets and your dependents with the right amount of coverage is key.

Starting out in life

Most people make the mistake of foregoing takaful protection when they were young and single because they think that family takaful plans are best for those who have financial dependents. If you are in this category, it’s important for you to understand why takaful coverage is equally important in this stage of life.

There is a completely different reason why the young and single should get covered. When you are starting out in life, you will most likely bear a lot of commitments, such as an auto financing, a personal financing or even a home financing.

With debts under your name, you don’t want to pass on to any living relatives who might be responsible for the debt in case of an early death. Without a takaful plan, your aging parents may be straddled with your debts when you are gone.

Furthermore, if you lead an active lifestyle involving activities such as travelling or even futsal, you may encounter accidents that could lead to hospitalisation, or worse.

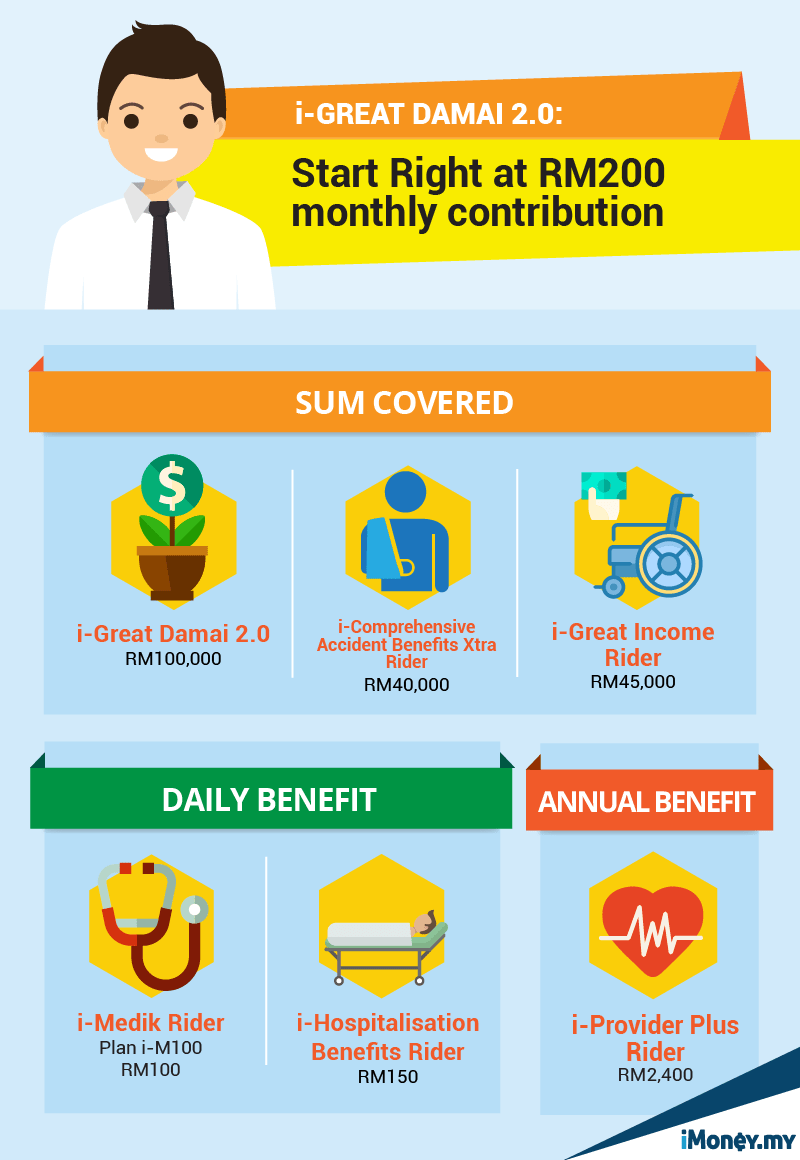

By contributing just RM200 a month, you will have access to an all-rounded protection through Great Eastern Takaful i-Great Damai 2.0:

* The package above is based on male, 24 years old and non-smoker.

With this Start Right package, a young person who is starting out in life will be looking for a lower basic coverage and medical coverage, due to the lower risk of falling sick and death. However, due to a more active lifestyle, personal accident plan is important for a young individual. The ability to generate income should also be protected with riders that replace his/her income in the event of disability.

You are able to stretch your takaful contribution to cover all your protection needs. By getting your takaful protection earlier in life, you would likely get a lower contribution rate, and also enjoy better chances of underwriting acceptance.

The contribution you pay will go to your takaful plan and your investment to grow your cash value, and create a financial safety net that will last your entire lifetime.

Becoming the breadwinner

The next natural life stage is starting a family. Getting married and expanding your family are all huge milestones in life, and as with any milestone, things will change – from your financial goals to your assets and priorities.

This is especially true if your spouse does not work and the household depends solely on your income. Your inability to generate an income, whether due to an illness, disability or death, would send your loved one(s) into financial despair.

Transitioning from being single to a family man will definitely require higher protection. It’s not just due to your expanding family with more dependents, it can also be due to your career, which may require you to travel more and take on more responsibilities.

A single emergency could wipe out your family’s savings, especially with the increasing medical cost. With the Prime Care package, the i-Great Damai 2.0 provides higher coverage according to the needs of one who has a family to consider:

* The package above is based on male, 37 years old and non-smoker.

The Prime Care package is designed to protect you and your young family from unfortunate accidents or illnesses, so you could focus on recovering.

With the skyrocketing medical inflation, it’s important for a family to protect their finances from huge financial emergencies such as critical illnesses or any medical treatments. This plan will ensure financial protection should you be diagnosed with a sickness, so your family will not be straddled with debts just to pay for your treatment.

Being a superwoman

And in almost every family, the pillar of strength lies in the mother. And today’s modern women often juggle a multiplicity of different roles at work and at home. Mothers strive to maintain all her roles, which include nurturing and to providing for her loved ones, yet they often neglect to plan for what might happen to them if the unforeseen occurs.

But think about this – as a mother, daughter, sister and wife, the last thing you want is to leave your family stranded in a difficult financial situation should disaster strike.

If you are trying to build your own dream empire, then you need to think of protecting it too without being dependent on others.

* The package above is based on female, 30 years old and non-smoker.

With women taking on a more active role in the workplace, and also taking care of their family’s welfare, it is crucial for them to protect themselves financially. Being a natural-born nurturer, when they are down from sickness, the last thing they want to do is to worry or trouble their family members with financial stress.

With specific medical coverage, which include early stage of female diseases such as Carcinoma in Situ of female vital organs (breast, uterus, ovary, fallopian tube, vulva, vagina and cervix uteri), breast mastectomy and others, an independent woman will be able to enjoy the peace of mind and concentrate on providing for her family.

Fulfilling your spiritual journey

One of the biggest life goals that Muslims have is performing the pilgrimage. Muslims are encouraged to perform the Hajj as early as possible, because being younger would make it easier to travel long-distance and be able to perform the rituals required in the best possible manner.

However, the preparations for pilgrimage is not done overnight. There are a few financial factors one needs to take note of. It costs a lot of money from the flight ticket, to the accommodation, transportation and food.

Pilgrims are encouraged to perform the Hajj when they are financially and physically ready, as such, Muslims have to start planning for their pilgrimage fund as early as possible.

The Great Eastern Takaful i-Great Damai 2.0 offers a package just for those who are planning for their pilgrimage. For a 40-year-old, the Hajj Ready package offers the right coverage and also platform to assist growth of savings via the investment portion.

* The package above is based on male, 40 years old and non-smoker.

Hajj Ready comes with a specifically designed Hajj benefit which provides double indemnity during the pilgrimage topped with accidental rider for complete peace of mind.

As with all i-Great Damai packages, it also comes with the option of Badal Hajj service should death or Total & Permanent Disability (TPD) occurs. This benefit ensures that your Hajj obligation is fulfilled by an able body or an organisation in the event of your passing or should you suffer from TPD before having the opportunity to perform Hajj.

Other than Hajj, Muslims are also encouraged to give to charity, and this should continue even after death through waqaf.

i-Great Damai 2.0 also provides another optional service called waqaf service, which channels an agreed amount by the Person Covered from the death benefit to a waqaf body appointed by the Takaful Operator and approved by the Shariah Committee.

This will give you the peace of mind in ensuring that your obligation will be fulfilled no matter what happens.

Wherever you are in life, without the right takaful coverage, you run the risk of a possible financial setback. The trick is to understand your takaful needs and find the right takaful product to bridge that gap.

Speak to a Takaful Advisor today and get a quotation for a takaful plan that fits your needs. You can also find out more about i-Great Damai 2.0 here.

Disclaimer: The above is used for illustration purposes only and the contribution amount may vary depending on the underwriting requirements of the Takaful Operator. Terms and conditions apply. The package above is merely an example and the riders shown are optional.