The Best Personal Loans In Malaysia For 2014

Table of Contents

Personal financing is a good financial facility to have, if taken up for the right reason. However, too many people taking it up can cause chaos in the country.

According to Bank Negara Malaysia (BNM) the personal financing segment is now moderating at 4.2% in the third quarter of 2014 as a result of its macro-prudential measures.

“We do not expect personal financing to increase even with the Goods and Services Tax implementation next year,” said Governor Tan Sri Dr Zeti Akhtar Aziz in a report on The Star.

However, even the downward trend in personal financing did not stop the banks from rolling out competitive personal loan packages, serving the needs of different segments. Here are some of the best personal loans in Malaysia we’ve seen in 2014:

Best personal loan for civil servants

The average salary for civil servants is generally lower compared to the average salary of private sector employees. That is why civil servants would likely look for a loan that primarily offers them easier entry requirements.

Agro Bank’s AgroCash-i

Interest rate: From 3.54%

Maximum loan amount: RM200,000

Maximum loan tenure: Up to 10 years

Approval duration: Up to 5 days

Minimum income requirement: Not less than RM1,000 for civil servants and not less than RM2,000 for GLC’s staff

Why it’s the winner:

AgroCash-i is the obvious winner of this category as it requires a lower income requirement at just RM1,000 for civil servants. This is inclusive of all fixed allowance. This package is the perfect lifesaver with low interest rate and high maximum loan amount of RM200,000 paired with a maximum loan repayment tenure of up to 10 years. AgroCash-i also allows borrowers to repay the loan through the Biro Perkhidmatan Angkasa – which means the monthly repayment will be automatically deducted from the borrowers’ salary. This will help ensure they repay their loan on time, and avoid late payment charges.

Drawback:

AgroCash-i has one of the slowest approval processes of up to 5 days. This is definitely not the loan to go for if you urgently need the money. Furthermore, if you are a contract staff, the bank will require a guarantor for the loan. The tricky part is, the guarantor must be a permanent or confirmed Government staff.

Best personal loan for debt consolidation

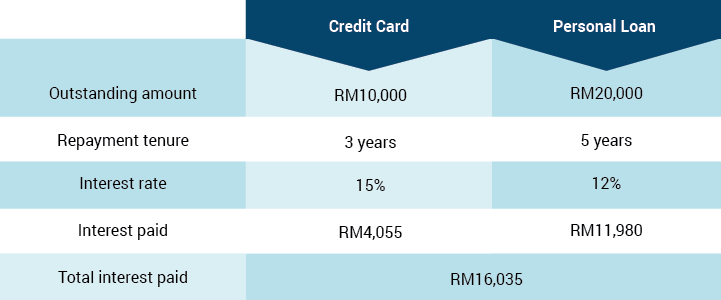

This loan would certainly be the winner for those sinking in credit card debt with high interest rates. A personal loan can be a good tool for debt consolidation, regardless of whether the package offers the feature or not. However, without the debt consolidation feature, some self-discipline will need to be exercised when the loan is disbursed. The key to getting the right personal loan to consolidate your debt is to choose one with low interest rate for short tenure.

Maybank Personal Loan

Interest rate: From 6.5% to 8%

Maximum loan amount: RM100,000

Maximum loan tenure: Up to 6 years

Approval duration: Within 2 business days

Minimum income requirement: At least RM2,500 gross salary a month

Why it’s a winner:

Maybank Personal Loan scheme offers a lower interest rate of up to 8% per annum – which is considerably lower than the interest rate charged by credit cards. It also offers the debt consolidation facility

Here’s how it will help:

If the borrower took a personal loan instead:

Loan amount: RM30,000

Interest rate: 7%

Loan tenure: 3 years

Monthly repayment: RM1,008

Total interest paid: RM6,288

By consolidating your debt using a lower interest personal loan, you not only save yourself a whole lot of hassle, you also save about RM9,747 in interest! Besides that, it offers a quick loan approval of up to 2 days only.

Drawback:

Maybank Personal Loan comes with an early settlement fee to discourage borrowers from making full settlement on the loan before its tenure complete. For example, if one wants to settle their remaining loan of RM5,000 before the initial end date, they will need to pay an extra RM200 in early settlement fee.

Best personal loan for business expansion

When it comes down to a personal loan for business expansion, businessmen don’t just look for low interest rates (though it is still a big factor), they would also look for a loan that offers a high margin of financing and long loan tenure. The best personal loan package that offers all of these in 2014 is:

Bank Rakyat Personal Financing-i Aslah Swasta

Interest rate: From 4.88% to 9.07%

Maximum loan amount: RM150,000

Maximum loan tenure: Up to 10 years

Approval duration: Up to 5 business days

Minimum income requirement: At least RM2,000 gross salary a month

Why it’s a winner:

Bank Rakyat Personal Financing-i Public is a sure winner of this category as it offers a high amount of financing of up to RM150,000 despite the low monthly income requirement of only RM2,000. This shows a financing margin of up to 25 times of the borrower’s monthly gross salary. Besides that, this is one of the few packages that offers the longest loan repayment tenure of up to 10 years. Despite the high loan amount, it does not require a guarantor or any advance payment. It also does not penalise you for late payment.

Drawback:

Although the Takaful coverage benefit is optional, the borrower is charged a higher interest rate when they go without it. The long approval duration may be a hassle for some too. If you do need the money quick, this may not be your best option.

Best personal loan for emergencies

Sometimes unexpected things happen and we may be ill-prepared for it. Fortunately, we can turn to quick personal financing to bail us out financially if the need arises. The first criterion to look out for is the short approval duration.

Citibank Ready Credit (Pay Lite)

Interest rate: From 7.74% to 7.79%

Maximum loan amount: RM120,000

Maximum loan tenure: Up to 4 years

Approval duration: Up to 1 hour

Minimum income requirement: At least RM2,000 gross monthly salary

Why it’s a winner:

Citibank Ready Credit (Pay Lite) is definitely a winner in terms of express loan approval, as it only takes only up to one hour to get approval. With a considerably high maximum financing amount of RM120,000 for a tenure of four years at a fixed interest rate of up to 7.79% per annum, this is the best personal loan package for those in need of cash urgently. The minimum income requirement is equally low at a minimum of RM2,000 monthly.

Drawback:

Before you decide to take up the loan, make sure you are able to commit to making repayment promptly as 1% late payment charges will be imposed. Late payment charges will increase your total outstanding loan amount.

Best personal loan that rewards you

Mach I.O.U Personal Loan offers the highest loan amount compared to the rest of the lot, and also offers incentive to encourage timely repayments.

Mach I.O.U Personal Loan

Interest rate: 12%

Maximum loan amount: RM250,000

Maximum loan tenure: Up to 5 years

Approval duration: Up to 1 hour for loan amount of RM50,000 and below

Minimum income requirement: At least RM2,000 gross monthly salary

Reward: 20% cash back on your interest charges when you pay on time

Why it’s a winner:

Mach I.O.U Personal Loan offers the highest loan amount among the rest, with a maximum financing of up to RM250,000. The best reward comes with the incentive for prompt repayments, where the borrower will receive 20% cash back in terms of lower interest payment each month. It’s the only personal loan scheme that rewards you for being committed to your loan repayment. To make the deal even sweeter, if the borrower intends to settle the loan earlier than scheduled, he or she can do so by notifying the bank in writing three months in advance to be exempted from being charged the early settlement fees. For a loan amount of up to RM50,000, it only takes up to 1 hour for approval.

Drawback:

The biggest issue we have with this loan is the high interest rate of 12%, which means the borrower’s monthly commitment payment will equally be high too. To drive the monthly repayment even higher, this scheme only offers a maximum of five years tenure, despite the high loan amount.

If you are shopping for a personal loan, interest rate comparison is only one of the factors to look out for. It is definitely not the be all, end all of a loan package. There are other factors you should look out for to find the perfect personal loan that suits your need. Having the perfect personal loan match can benefit you in the long run. Getting one is perhaps easy, but it is solely your responsibility to ensure it is affordable and can be repaid in a timely manner to avoid getting yourself into a financial mess.

With the uncertain economic times ahead of us, we can expect more competitive and great personal loan packages in 2015. This year has been a great year for personal loan, but next year may be even better!