Top 5 Loyalty Cards You Should Have In Your Wallet

Table of Contents

More than 20 years ago, Tesco introduced the Club card in the UK, and in just one year, the supermarket saw the Club card holders spending 28% more at Tesco and 16% less at its competitor, Sainsbury’s.

Loyalty programmes are a boon to the consumer retail industry as they not only offer rewards to their regulars, which encourage them to keep shopping in the same store, these programmes also help the companies to mine tons of data about their customers.

Today, many companies, from supermarket to book stores, have a loyalty programme to retain their consumers in the increasingly competitive retail industry. You can find a card teasing amazing perks and discounts for just about any product imaginable.

If you find your wallet bulging at the seams because you have every loyalty card under the sun, it’s time to do a spring clean. Here are the top 5 loyalty cards that you should keep in your wallet!

BCARD

The BCARD was launched in 2010 and is Malaysia’s premier lifestyle and brand-focused reward programme.

The BCARD was launched in 2010 and is Malaysia’s premier lifestyle and brand-focused reward programme.

With a free lifetime membership, the BCARD uses a point mechanism, where members collect points from the purchases from participating merchants. On average, you can earn one BPoint for every RM1 spent. However, redemption will be 100 points for every RM1 redemption.

This is pretty standard for loyalty cards with the point collection mechanism. With BCARD, you will need to spend RM10,000 to get 10,000 BPoints. With 10,000 BPoints, you can redeem two RM50 Zalora vouchers. That’s 1% redemption.

It’s also easy to find BCARD merchants such as Chatime, Starbucks, Borders, Lazada, Caltex, UMobile, Zalora and Berjaya Hotels and Resorts, to name a few.

That makes this, if points are the name of the game here, a much better option than BonusLink. For those who want to boost their points accumulation, there are also on-going promotions that allow you to earn more BPoints, for example, earning up to 20x BPoints at Big Apple Restaurant and Broadway Lounge. This will help you earn your points much faster.

Other than the point mechanism, BCARD also offers discounts and other perks with selected merchants, such as a special rate for the Lost World of Tambun tickets. However, the promotions are quite limited, with only eight discounts at the time of writing.

| Membership fee | Free for life |

| Points accumulation | RM1 = 1 BPoints |

| Points expiration | 3 years |

| Points redemption | 1% (5,000 points = RM50 voucher) |

| Redemption | On-the-spot redemption at 400 participating outlets, and BCARD Online Redemption |

| Other privileges | Discounts at selected merchants (8 merchants) |

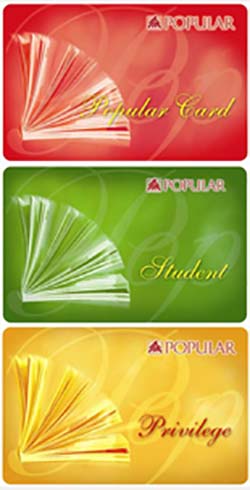

POPULAR Card

If you are a bookworm, the POPULAR card will certainly entice you with its 10% discount on items store wide. Cardholders are also entitled to 20% discounts on selected books under the POPULAR’s Choice category as well as recommended titles.

If you are a bookworm, the POPULAR card will certainly entice you with its 10% discount on items store wide. Cardholders are also entitled to 20% discounts on selected books under the POPULAR’s Choice category as well as recommended titles.

With 89 outlets nationwide, finding a POPULAR store should not be a problem. Most of them are located in major shopping malls and cities. In fact, it’s cheaper to sign up for this than a Kinokuniya Membership Card which provides a similar discount rate of 10% for books at RM38 yearly. Also unlike Kinokuniya, which only has one outlet in the country, you will never run into trouble locating a POPULAR store.

Besides books, the POPULAR Card provides discounts and privileges such as birthday coupons where you are entitled to discounted items at participating merchants. For example, its July promotion offers a wide range of perks from food and beverage outlets such as Juicework and BlackBall to edutainment and leisure centres such as the Lost World of Tambun and Sunway Lagoon. The downside is obviously you only get to enjoy these discounts and privileges for a month every year.

Other drawbacks to the POPULAR Card are discounts are only applicable to retail-price goods, ruling out magazines, stationaries, some categories of books and other net-priced items; there are no rebate points; replacement and renewals aren’t free.

| Membership fee | RM12 per annum |

| Benefits | 10% discount on items store wide 20% discounts on selected books under the POPULAR’s Choice category |

| Card expiration | 1 year |

| Other privileges | Discounts at selected merchants on birthday month |

AEON MEMBER Card

The AEON MEMBER Card is a points-based rewards card where you get one point for every RM1 spent. This card can be used for discounts and points collection at AEON stores and Pasar Raya MaxValu.

The AEON MEMBER Card is a points-based rewards card where you get one point for every RM1 spent. This card can be used for discounts and points collection at AEON stores and Pasar Raya MaxValu.

Membership costs RM12 a year. At the time of writing, a promotion is running where you get three years’ membership for the price of two years, at RM24. Compared to the Tesco Clubcard, the AEON MEMBER card demands a higher membership fee. Tesco’s is priced at RM10.60 and membership is for life, meaning no renewal fees.

Rebates will only be issued after cardholders spend RM500 at any AEON store over a period of six months. Also, AEON’s card doesn’t come with additional features such as the Touch ‘n Go functionality which is increasingly common among loyalty cards.

Many members sign up just for the AEON Members Day and AEON Members Privilege Day, as these events really give the card an edge where members are entitled to crazy discounts.

Also members get to enjoy discounts and privileges with participating merchants. There are a few categories to choose from such as food and beverage, specialty, edutainment and resorts, to name a few. For example, the 2015/2016 catalogue offers members special rates for selected hotels in Penang and Malacca.

The caveat here is that all promotions have to be redeemed within a specific timeframe, so for the latest catalogue members can only redeem the offers from July 1, 2015 to June 30, 2016.

| Membership fee | RM12 per annum |

| Points accumulation | RM1 = 1 point |

| Points redemption | About 0.66% (150 points = RM1) |

| Benefits | Rebates worth up to 5% at any AEON General Merchandise Store Free parking for the first 2 hours Special price for selected items Invitation to AEON Members Day and AEON Members Privilege Day |

| Points expiration | Points will be converted to vouchers every 6 months |

| Other privileges | Discounts at selected merchants |

Petron Miles Card

The Petron Miles Card is more than just a loyalty card for fuel, it also comes with some great privileges for its members. The card offers one point for every RM1 spent on fuel. You can also earn points when you renew your car insurance with AIG.

The Petron Miles Card is more than just a loyalty card for fuel, it also comes with some great privileges for its members. The card offers one point for every RM1 spent on fuel. You can also earn points when you renew your car insurance with AIG.

The points can be redeemed for fuel and convenience store purchases. There are also special deals and discounts at Petron’s partners. For example, you can redeem 500 PLUS points for tolls with 500 Petron Miles points.

However, the downside is, you will need to spend RM950 (950 points) to redeem RM10 worth of gas. That’s similar to the BHPetrol eCard where you need RM550 (550 points) to get RM5 worth of fuel – about a 1% rebate. Only with Petron, you’ll need to spend more.

Petron also has a much smaller network of fuel outlets nationwide. It pales in comparison to, say, Petronas with its armada of 1,000 Kedai Mesra outlets throughout the country – which is why some prefer to carry the Petronas Mesra Card with them.

The Petron Miles also has its upsides: an extensive list of privilege and discounts; no expiry date on the card and points; and point-redemption comes in various forms, from fuel to air miles.

| Membership fee | Free if fuel purchase is made within 12 months |

| Points accumulation | RM1 on fuel = 1 point |

| Points redemption | About 1% (950 points = RM10) |

| Number of outlets | 560 Petron service stations |

| Points expiration | No expiry date |

| Other privileges | Discounts at selected merchants |

Watsons VIP Card

This 2-in-1 card not only confers you the benefits of being a member of the Watsons chain, it also comes with the Touch ‘n Go functionality. You earn one point for every RM1 spent, five points when using the Watsons VIP and two points when purchasing Watsons brand products.

This 2-in-1 card not only confers you the benefits of being a member of the Watsons chain, it also comes with the Touch ‘n Go functionality. You earn one point for every RM1 spent, five points when using the Watsons VIP and two points when purchasing Watsons brand products.

You can redeem the points for items on offer or be entitled to seasonal discounts for a wide range of products. Also the VIP Card comes with dining privileges where you can get discounts at selected restaurants.

As for the dining privileges, you have an array of restaurants to choose from. As a Watsons member, you are offered discounts and as well as complimentary dishes. Participating merchants include San Francisco Coffee, Crab Factory and Milkcow, to name a few. But the drawback is these offers have an expiry date, so you can only enjoy the benefits during the promotional period. On top of that, you may also capitalise on the Touch ‘n Go benefits.

The points expiration is a little more complicated than other loyalty cards as they expiry every two Decembers. For example, points earned in October 2015 will expire on December 31, 2016, while points earned in February 2016 will expire on December 31, 2017. This will make it a hassle to keep track of your points and redemption, but you can also link your card to an online account to monitor your points and also the privileges available.

| Membership fee | RM18 one-off |

| Upgrade to VIP | RM6 one-off |

| Points accumulation | Regular member: RM1 = 1 point VIP member: RM1 = 5 points Watsons brand products: RM1 = 2 points |

| Points redemption | 0.5% (200 points = RM1) |

| Number of outlets | 350 Watsons stores |

| Points expiration | Points earn between January – June, expire in the next December 31. Points earned between July – December, expire in the second December 31. |

| Other privileges | Discounts from 31 dining and lifestyle merchants |

What we have above is a list of loyalty cards that you can use across various lifestyle needs. Some of these cards are free while others require you to pay a membership fee, but they do provide you with discounts and privileges.

When it comes to making your pickings, it is sensible to choose brands with items you buy fairly frequently. This helps you maximise savings and usage of your rewards card. So it’s always best to evaluate where you do your shopping if you intend on reaping the benefits of a loyalty programme.

If you are really into collecting points, BCARD is likely your best bet as its redemption is 100%. You spend RM100, you get back RM100! It also has an extensive list of participating merchants for redemption and it’s absolutely free. However, it still has a lot of room for improvement for privileges and discounts at partner merchants.

Watsons has one of the best when it comes to getting discounts, especially for dining outlets. This is perfect for those who like a little savings in their dining expenses.

To reap more, you can pair your loyalty card with the right credit card that offers high cash back. This will help you manage your expenses even better.