Western Union: Strengthening Money Services

As years progress with better implementation of computerised systems, money services business transactions conducted through formal channels continue to grow. Understanding the money services business industry is an important area of focus in the central bank’s efforts to reduce vulnerabilities to money laundering.

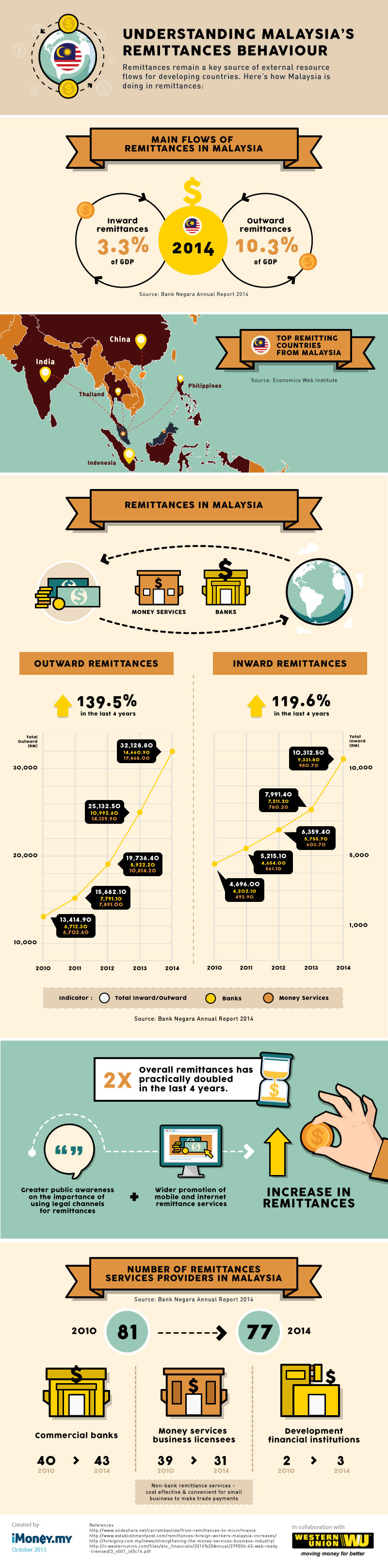

A more competitive environment in the remittance industry has also contributed towards enhancing services to consumers in terms of lower cost, faster speed and more extensive channels for remittance transactions. Malaysia is taking effective measures to make legal, reliable and convenient money transfers more accessible and convenient for all its citizens including foreign workers and expatriates.

Western Union, one of the key players in global payment services, has been providing individuals and businesses with fast, reliable and convenient ways to send and receive money around the globe. In 2012, 147 million consumers representing 73 million senders and 83 million receivers worldwide have used Western Union to make remittances. Key countries that receive remittances from Malaysia include Indonesia, India, Philippines, Bangladesh, Vietnam, Nepal, China, Myanmar, Thailand, Cambodia and Sri Lanka.

Western Union allows money transfer primarily through retail, bank and mobile money transfer. Retail transfer service is also available and accessible in rural areas of the East Peninsular and East Malaysia. Remittances made via Western Union can be transferred from a bank account via online banking, mobile or ATM services to a retailer or direct-to-bank services. These services are offered by selected retail agents for remittances to Indonesia, China and India.